3 FINTECH NEWS STORIES

#1: Prism Prioritizing Partnerships

What happened?

Equifax and Prism Data have partnered up:

Equifax has teamed up with Prism Data, the company behind CashScore®, to facilitate cash flow underwriting evaluations, allowing customers to preview the potential of bank transaction data.

The Prism platform transforms bank transaction data from various sources —including major data aggregators as well as deposit data from core banking systems—into insights and scores lenders can use to make better credit decisions. The platform also provides access to thousands of trended attributes covering income, spending, expenses, obligations and more, including information about gig work, rental payments, buy-now-pay-later usage, and other financial activity.

So what?

Prism has adopted a very FICO-like strategy as it tries to establish primacy in the growing world of cash flow underwriting — partnerships, partnerships, and more partnerships.

Rather than trying to own the end-to-end cash flow underwriting workflow or convince lenders that they should be thinking of cash flow data as a replacement for traditional credit data, Prism has prioritized working with the players that are already in the market. This includes data aggregators like Plaid (which Prism announced a partnership with a few months ago) and now Equifax.

The details on this newest partnership are a bit scarce, but from what I can tell, Prism has teamed up with Equifax to enable lenders to better evaluate and test the effectiveness of cash flow data, attributes, and scores.

This could be a big deal because backtesting — evaluating a new model or attribute against historical performance data — is extremely difficult in cash flow underwriting. It’s an entirely new dataset for most lenders and the infrastructure and analytic providers in the space don’t have the same depth of across-the-cycle performance data that the bureaus and FICO have.

By partnering, Equifax and Prism can, in theory, meld together Prism’s scoring model and library of attributes with Equifax’s data and analytics platform (specifically that platform’s keying and linking capabilities) to help lenders get more comfortable with cash flow data and analytics and how they can and should be incorporated into their underwriting processes.

#2: Financial Health-focused Collections

What happened?

C&R Software is acquiring SpringFour:

SpringFour … said it would become part of C&R Software, a firm that provides debt recovery and collections software to banks, utilities, telecom, healthcare, government and fintechs. SpringFour, which partners with banks, credit unions, lenders, nonprofits and more to help them deliver vetted financial resources to their customers at no cost, will remain a standalone brand

C&R and SpringFour expect that C&R’s extensive client base will mean more distribution opportunities for SpringFour’s services, which include four delivery methods that its clients can use to refer employment, food savings and other financial health resources to their end users.

So what?

I’ve always liked SpringFour, which essentially acts as an app store for financial health resources that banks, credit unions, nonprofits, and employers can direct consumers to in order to improve those consumers’ financial outcomes.

It’s a great product, but I imagine it was tough to run as a standalone business. SpringFour counts some big banks as clients, including Capital One Financial, BMO Financial Group, M&T Bank, Fifth Third Bancorp, and KeyCorp. However, financial health will never be a top investment area for those institutions, even if such investments can make other parts of the banks’ operations (such as collections and recovery) more effective.

Now C&R Software, which was acquired by FICO in 2012 and sold off by FICO in 2021 for reasons I still don’t understand, is adding a robust set of financial health capabilities to its collections and recovery product suite.

I absolutely love this for C&R.

Success in collections is traditionally defined in terms of efficiency. Lenders will withhold treatments and other collections resources from cases that they think will self-cure, and they will assess the resources that they do apply by measuring how fast they do their jobs.

This efficiency-first mindset can be effective, but it’s not the only model that works.

Engaging with customers earlier, before they have slipped into severe delinquency, can be just as effective in keeping default rates low (and more effective in keeping net promoter scores high). SpringFour gives C&R Software’s clients more tools to engage their customers earlier in the debt management lifecycle.

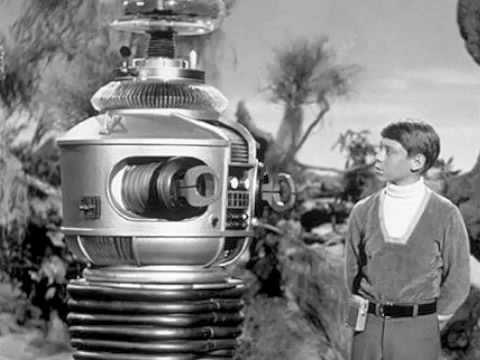

#3: Danger, Will Robinson!

What happened?

Mercury is launching working capital loans for e-commerce companies:

Introducing Mercury Working Capital: loans built for ambitious e-commerce businesses.

Whether you’re looking to boost inventory, advertising, or more, it’s time to unlock funding that doesn’t hold you back.

So what?

I feel like it would be a good use of my time to build a robot and program it to warn fintech entrepreneurs when they unwittingly wander into dangerous areas where other similarly naive entrepreneurs have been hurt before.

Working capital loans for e-commerce business would definitely be one of those areas where I would shout, “Danger, Will Robinson!”

You don’t have to have worked in fintech for a long time to have seen this TV show a few times by now. In the 2010s, it was online small business lending by companies like Kabbage and OnDeck Capital. More recently, we’ve had more sector-specific versions like Pipe and Ampla (both of which focused on e-commerce, ironically). None of them have worked.

The reason why is simple — in small business lending, you only want to lend to companies that you understand at a deep, almost intuitive level (e.g., vertical specialization) and that you have an unfair advantage in underwriting and servicing (e.g., B2B SaaS companies that process payments for their small business customers have first-party data to underwrite with and the ability to directly collect repayments from payment inflows).

Mercury doesn’t specialize in e-commerce. To the extent that it has any sector-specific expertise, that sector is venture-backed startups. And it doesn’t process payments for its customers, so it has no obvious unfair advantages in underwriting or servicing.

I’m worried about this one.

2 FINTECH CONTENT RECOMMENDATIONS

#1: Banks Aren’t Over-Regulated, They Are Over-Supervised (by Raj Date, Open Banker) 📚

A very thought-provoking piece by Raj Date. Among the many parts I enjoyed, it has one of the greatest openings you’ll ever read.

Open Banker is a new publication focused on financial services policy, and it’s very much worth subscribing to if you haven’t already. And be sure to keep an eye out for future editions. I have it on good authority that there’s some 🔥 content coming soon.

#2: Where the F(BO) Is the Money? (by Troutman Pepper) 📚

When Alex and the folks at Troutman Pepper write about BaaS (or any bank/fintech topic), I make sure to pay attention.

Read this and keep an eye out for parts 2 & 3 coming soon.

1 QUESTION TO PONDER

Who would be the best person to interview about the impact of generative AI on customer service, especially within a financial services context?

I’d ideally prefer a practitioner who is implementing AI for customer service (or testing it) rather than a vendor, but happy to consider a vendor if they can talk a good, non-sales-y game.