3 Fintech News Stories

#1: Who You Gonna Call?

What happened?

It has been a dramatic week for the CFPB.

First, President Trump fired Rohit Chopra and designated Secretary of the Treasury Scott Bessent as the Acting Director of the CFPB. After taking the reins, Secretary Bessent told everyone at the CFPB to take a break:

In an internal email shared with NPR, staff members were instructed to immediately cease much of the bureau’s work, “unless expressly approved by the Acting Director or required by law”. That includes a halt on issuing or approving proposed or final rules or guidance, and suspending the effective dates of all final rules that have been issued but have not yet become effective.

Staff members were also instructed not to commence or settle enforcement actions, nor to issue any public communications of any type, including research papers.

A few days later, a few of the kiddos working with Elon Musk’s DOGE initiative showed up at the CFPB:

Three DOGE team members—Christopher Young, Nikhil Rajpal, and Gavin Kliger—arrived at the CFPB’s Washington office, the CFPB employees union NTEU 335 said in a Friday statement.

Musk posted “CFPB RIP” with a gravestone emoji on X late Friday afternoon.

The three DOGE emissaries arrived at CFPB headquarters on Friday morning for a meeting with senior agency staff, according to a source with knowledge of the situation who was granted anonymity to protect against retaliation.

The DOGE members “are authorized to gain access as though they are a detailee assigned to us or one of our own employees,” CFPB Chief Operating Officer Adam Martinez said in a late Thursday email to senior agency staff obtained by Bloomberg Law.

Then Russell Vought, the newly confirmed Director of the Office of Management and Budget, announced that he had taken over from Bessent as the Acting Director. He doubled down on Bessent’s instruction to halt all work (including supervisory and enforcement work), stopped the flow of new funding to the CFPB, and shuttered the CFPB’s headquarters:

Employees at the Consumer Financial Protection Bureau were abruptly informed Sunday afternoon that the watchdog agency’s Washington, DC, headquarters will be closed this week.

In an email obtained by CNN, Adam Martinez, the CFPB’s chief operating officer, instructed all employees and contractors in Washington to “work remotely unless instructed otherwise from our Acting Director or his designee.”

No reason was stated for the sudden closure.

So what?

To quote Jake Peralta, cool cool cool cool cool cool cool cool cool cool cool cool cool cool cool cool cool cool cool cool.

The challenge for those of us who think the CFPB is a good thing that should exist (as I do) is that there is a lot that the Trump Administration can do to functionally shut down the CFPB, even if it would require Congress to completely get rid of it. Here’s my bank nerd friend Evan Weinberger, who has been doing some great reporting on all this drama:

Musk and his team are insulated from legal pushback over slashing the CFPB’s funding and eliminating its staff because of the agency’s unique leadership and funding structure.

The 2010 Dodd-Frank Act created the CFPB and gave its single director wide latitude to shape the agency. Only a handful of positions beyond the director, such as the CFPB’s deputy director, are mandated under the law.

The CFPB is funded independently through the Federal Reserve, but the CFPB director has the power to determine how much money the agency needs. That means a CFPB director could zero out the agency’s budget entirely.

Obviously, Elon Musk is thrilled with the direction this is going. He is in the process of transforming Twitter into the financial services super app he always wanted PayPal to become, and I’m guessing that super app will be the subject of at least a few consumer complaints.

Some fintech VCs and founders are also happy, but it’s extremely difficult for me to square their arguments for why the CFPB should be deleted/defanged with the obvious conflicts of interest they have in pushing for a less regulated financial services ecosystem.

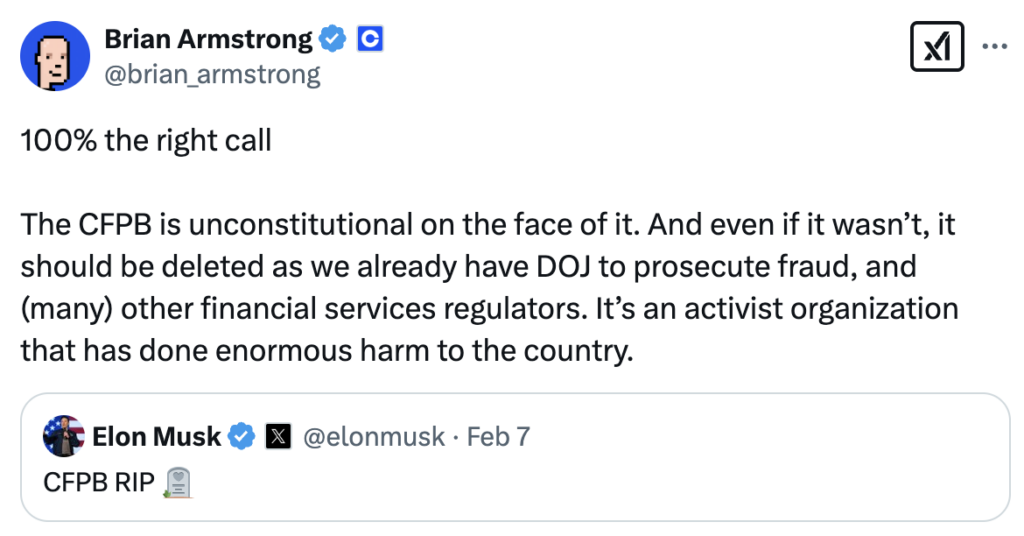

A good example is Coinbase. Here’s the CEO:

(Editor’s Note — Mr. Armstrong’s Constitutional law analysis here is flawed, as the U.S. Supreme Court recently affirmed the legality of the CFPB’s funding structure. Credit to Twitter Community Notes for pointing this out!)

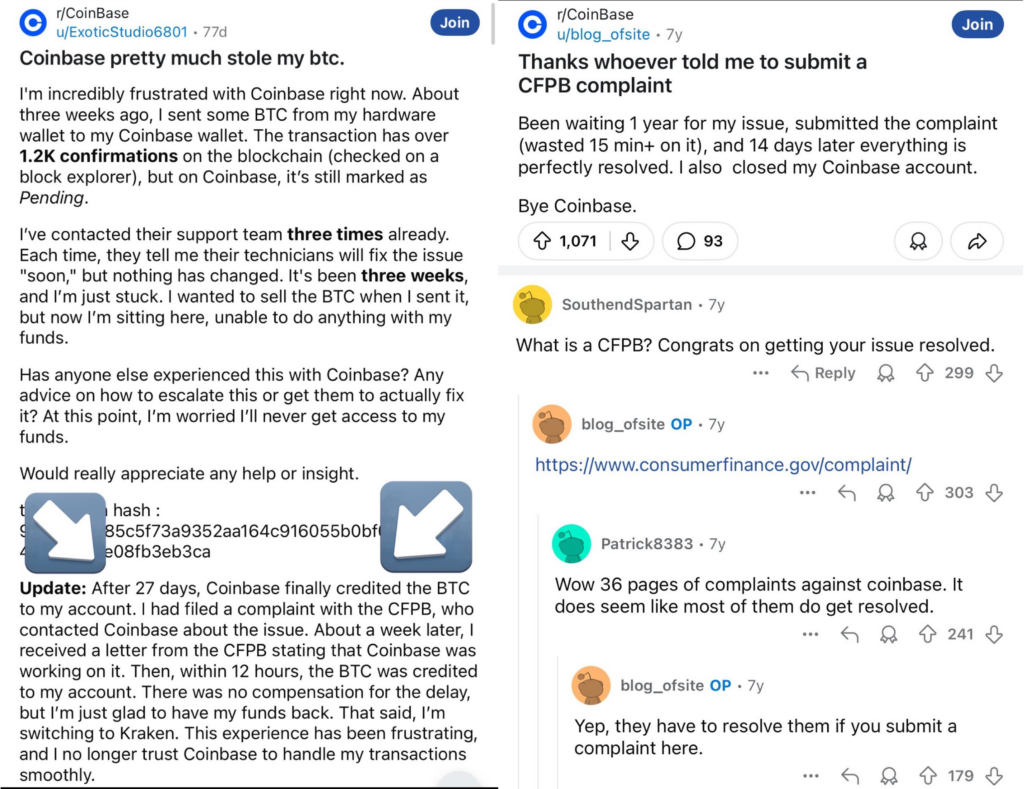

And here are multiple Coinbase customers praising the CFPB for helping them resolve issues they were having with Coinbase:

You can criticize how Rohit Chopra ran the CFPB (I did plenty of times over the last four years), but we absolutely should not be destroying it. Giving consumers someone to call (if there’s something strange in their neighborhood) is essential for building and maintaining trust in financial services.

#2: FICO + Affirm

What happened?

Affirm teamed up with FICO to study the impact of furnishing BNPL loans to the credit bureaus:

FICO conducted the 12-month study in partnership with Affirm, the payment network that empowers consumers and helps merchants drive growth. The research compared the FICO Scores of more than 500,000 consumers who opened at least one new Affirm BNPL loan against a benchmark population of consumers without an Affirm BNPL loan. FICO simulated the inclusion of these Affirm loans into consumers’ credit reports, and then examined the potential impact to resulting credit scores of those consumers.

The goal of the research was focused on outlining the potential benefits or impacts that BNPL lending products could have on FICO Scores. It was also intended to help inform both responsible furnishing of BNPL loans to the credit bureaus, as well as an appropriate and empirically supported treatment of this data within the FICO Score. Through this first-of-its-kind study with Affirm, FICO developed a proprietary treatment to harness the benefits offered by incorporation of BNPL data into consumers’ FICO Score calculation. The research showed that this treatment can improve model performance and lead to increased FICO Scores for some BNPL borrowers.

So what?

Frequent readers will know I really want the BNPL providers to furnish their data to the credit bureaus. Anything that moves the ball in that direction is good news to me. However, the devil with furnishing credit data is always in the details.

FICO says that it “simulated the inclusion of these Affirm loans into consumers’ credit reports.” How, exactly, did it do that? Here’s their explanation:

A unique consumer behavior associated with BNPL loans is the potential for a large number of these loans to be opened within a short period of time. To address this, FICO developed an innovative approach that includes aggregating separate BNPL loans together when calculating certain in-model variables. This novel treatment has proven effective at capturing predictive signal from the inclusion of BNPL data.

Put simply, FICO’s innovative approach is to combine a bunch of individual pay-in-4 BNPL loans into a single personal loan. My guess is that FICO’s preferred implementation for this approach would be for the credit bureaus to aggregate and store the BNPL data in that fashion. This would enable older versions of the FICO Score (which are well-accustomed to personal loans) to be compatible with it.

That would be good for FICO, but my concern is that it would be confusing for consumers, and it would introduce challenging complexities for the credit bureaus and lenders.

How does paying off one loan affect the overall age of the tradeline? How do you ensure that there isn’t any consumer confusion when they look at their report and see one $1,100 Affirm loan rather than the eight individual Affirm loans they remembered signing up for? Are you missing any valuable underwriting signals by not allowing lenders to model and build features against individual BNPL transactions?

Maybe FICO and Affirm have great answers to these questions, but I would want to see more information (including additional studies with the other big BNPL providers) before I signed off on this approach if I were a regulator, lender, or credit bureau.

#3: Embeddable Healthcare Payments

What happened?

Lynx, a healthcare-focused fintech infrastructure company, raised a $27M Series A:

Lynx’s vision is to make managing healthcare benefits as seamless as any other financial experience.

“Managing health insurance coverage and financial accounts like HSAs are often siloed experiences,” [co-founder and CEO Matt] Renfro said. “Lynx is really the only embedded fintech platform focused on healthcare, where you can see if your doctor is in-network right next to managing your HSA or even investing your HSA.”

For providers, a unified ecosystem translates into faster and more predictable reimbursements. Current healthcare billing systems are often riddled with inefficiencies, with delays in claim processing leading to cash flow constraints for medical practices.

For members, this means a more intuitive and seamless experience when managing healthcare expenses. Instead of navigating multiple platforms, dealing with opaque billing statements or struggling with reimbursement delays, they can access a single system that consolidates payment options, real-time benefits tracking and clear cost breakdowns.

So what?

Lynx is basically a BaaS middleware platform but for healthcare payments (HPaaS?)

Building payment products in healthcare is tricky because it requires simultaneous compliance with three different regulatory regimes (banking, healthcare, and taxes).

And building these products isn’t even the hardest part. Administering them is.

You have to ensure that the tax-advantaged spending accounts that you are offering are only being used for qualified medical expenses and that the money that is being invested in them complies with all of the requirements laid out by the IRS. This takes a lot of work, which makes the administration of these products slow and expensive.

Lynx simplifies the process of launching and administering healthcare payments products. And because their service is available through an API, it can be embedded within the digital apps and tools provided by financial institutions, health plan providers, and benefit administrators.

Lynx has also extended its ecosystem to integrate with more than 60,000 retailers (through integrations with companies like FIS), which allows it to process SKU-restricted payments in real-time:

“It’s not just about issuing a debit card,” Renfro said. “You need technology that can differentiate between candy and an over-the-counter medication at checkout. Our platform performs real-time adjudication down to the SKU level.”

This granular level of decision-making ensures that money is spent on approved healthcare expenses while preventing misuse. More importantly, it reduces friction for users who may not know which items qualify under their benefit plans.

Pretty cool.

2 Fintech Content Recommendations

#1: Debanking’s Dueling Narratives (by Jason Mikula, Fintech Business Weekly) 📚

Jason wrote a really comprehensive piece explaining the history of the debanking debate, stretching back to the original Obama-era Operation Choke Point.

It’s worth a careful read, given that this topic seems to be gaining speed and power, much like a hurricane that’s about to strike land.

#2: Under the Hood 🛠 – The Building Blocks of SME Lending (by Jas Shah, Fintech R&R) 📚

If you haven’t been reading this newsletter, you should. If you haven’t checked out this “Under the Hood” series, you should start there. They’re great.

This one on small business lending was particularly interesting to me, given my own frequent writing on the subject!

1 Question to Ponder

What would be the most significant consequence of the (functional) death of the CFPB (assuming Elon can make it happen)?