First, an observation.

While there have been a lot of great fintech lending companies that have been built in the last couple of decades – from peer-to-peer lending to BNPL – there has been a notable lack of lending products being launched by fintech companies that didn’t start out in lending. This is, speaking as a very sophisticated fintech analyst, quite weird! We’re years into the rebundling phase of fintech, and yet, most B2C neobanks don’t offer credit cards or personal loans (outside of very limited overdraft protection-type products), and most B2B neobanks don’t do a significant amount of lending (outside of corporate credit or charge cards).

Second, a prediction.

In spite of rising interest rates and growing concerns about consumer and business credit quality in this weird economy of ours, I believe that, directionally, all fintech product roadmaps are going to be bending towards lending over the next 10 years. For both B2C and B2B fintech companies, lending is going to be the next frontier.

Why?

Because it’s where the money is.

And fintech companies’ investors, be they public or private market investors, are pushing on their portfolio companies to generate more money, as Nik Milanovic at The Fintech Fund told TechCrunch last year:

The 2020-2021 market rewarded growth rates with little regard for other metrics, but path to profitability is once again in the spotlight due to the valuation downturn, so companies will likely counterbalance the pursuit of growth with unit economics more than in the past two years.

And if you take a quick glance around, you’ll spot plenty of examples of B2C and B2B companies in and adjacent to fintech that are embarking (or are already well into) the lending journey.

Chime is quietly accumulating state lending licenses:

Sometime late last April, Chime, the largest US neobank by number of users, made a minor tweak to the disclosures on its site that would’ve gone unnoticed by all but the most eagle-eyed observer — it added the following to the footer of its website: “Chime Capital, LLC, Nationwide Multistate Licensing System (“NMLS”) ID 2316451.”

it’s a reasonable (if speculative) conclusion that these licenses suggest Chime is gearing up to offer additional credit products to its users.

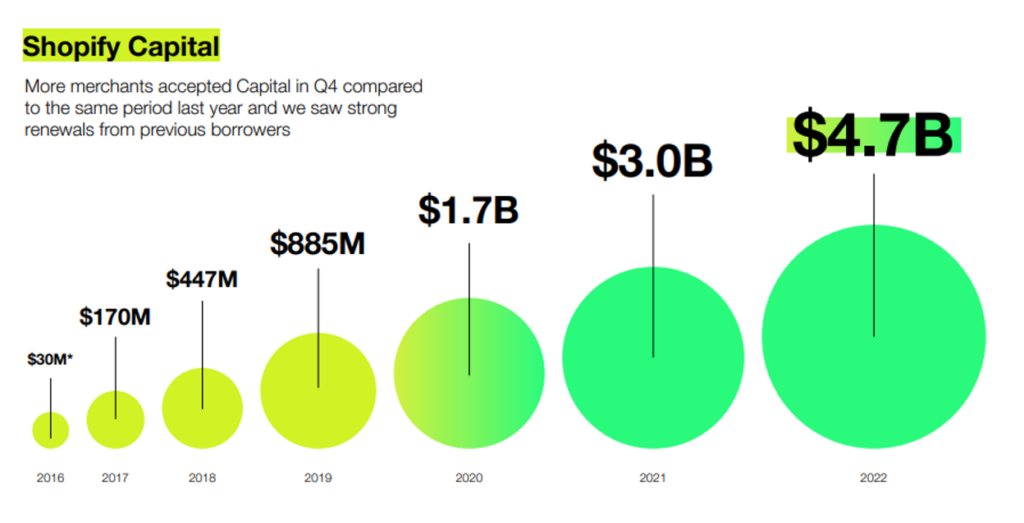

Shopify is talking up its lending product in its earnings presentation:

And even Apple (not a company that is struggling with profitability) is proceeding with its BNPL plans:

When Apple reported its most recent quarterly earnings, Tim Cook told CNBC that the service would be “launching soon.” In addition, Bloomberg’s Mark Gurman is reporting that Apple is beta testing the service with its retail employees. That’s an important step, and is something Apple did with Apple Card a few months before launching it to the public.

It was assumed Apple would partner with Goldman Sachs, which is already the bank that issues the Apple Card. In this case, Bloomberg says the company set up its own entity to handle the lending. That could certainly be a reason for the delay, but it also makes sense. Apple would certainly want to be sure it had answers to questions like “What percentage of Apple Pay customers are likely to use Apple Pay Later?” or “What happens if customers miss a payment?”

Sign up for Fintech Takes, your one-stop-shop for navigating the fintech universe.

Over 41,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

So, broadly speaking, I think we can say that fintech is moving into its lending phase.

Next question – what will that look like? What will it look like when fintech, as an industry, moves fully into lending?

The Kickstarter Problem

To answer this question, we need to gaze into fintech’s past and consider how we overcame “the Kickstarter problem.”

The Kickstarter problem is the gap that exists, in the age of the internet, between prospective customers’ enthusiasm for a product concept and the ability of an entrepreneur to actually deliver a fully functional version of that product at scale. As the name suggests, this problem is most evident in the world of crowdfunding, where aspiring inventors, entrepreneurs, and artists can pitch products and raise funds from early supporters to develop them.

Numerous studies have quantified this challenge. One such study found that design and technology products on Kickstarter miss their ship dates 75% of the time. This makes sense if you think about it. It’s much easier to dream up an idea for a new espresso machine or watch (and garner support for it online) than it is to successfully navigate the gauntlet of design, engineering, and manufacturing hurdles necessary to produce millions of these products for impatient customers. Or as the creators of the ZPM Espresso machine, a Kickstarter-backed product that raised $370,000 and never shipped a working product in three years, said:

To say we’ve learned a lot about engineering, design, manufacturing, marketing and customer service is…well…an understatement so extreme as to be laughable.

This Kickstarter problem exists in fintech, too … and it’s much, much worse.

After all, Kickstarter mostly confines itself to artistic projects (the vast majority of the 13 categories of projects that Kickstarter supports on its platform are artistic ones like film and dance). Those are certainly challenging areas to create something new in (creating anything new is really hard), but I would argue that they’re easier to deliver on at scale than a new piece of hardware and much easier than a new, highly regulated financial product.

A good example is debit cards and digital banking.

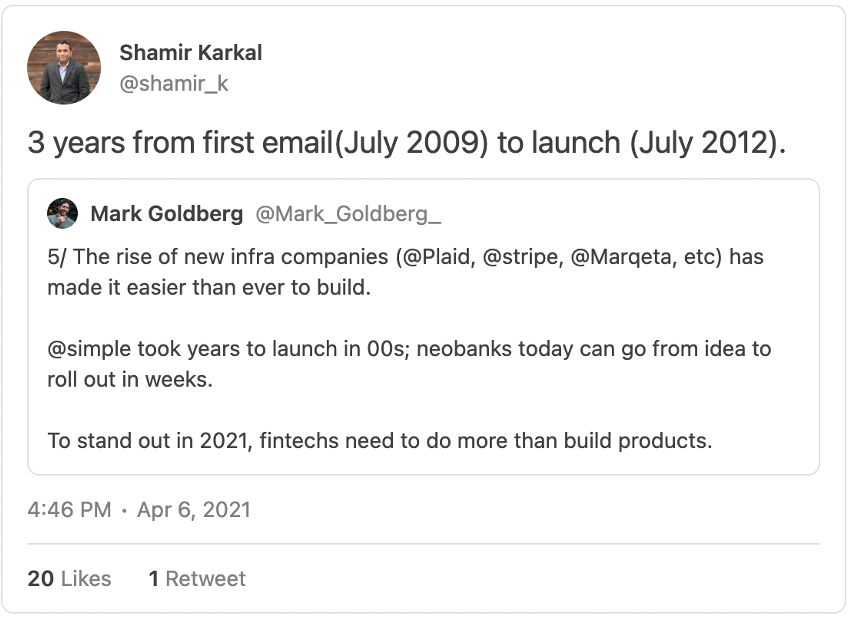

When the idea of a “neobank” first started to catch on in the U.S. at the end of the 2000s, the level of enthusiasm for it among consumers was readily apparent. I remember hearing Shamir Karkal (co-founder of Simple) telling a story during a conference panel about putting up an incredibly simple landing page to get customers signed up for a waitlist, a landing page that didn’t really say much beyond “you deserve better banking,” and being pleasantly surprised to see massive numbers of consumers signing up.

The enthusiasm was there. However, delivering a debit card and digital bank account without being a licensed bank took a while:

Three years. And countless long nights. But they (and other early neobank pioneers) got it done, and in so doing, they helped to catalyze a wave of fintech infrastructure innovation that would make it easier for more neobanks to follow them.

This wave started, in earnest, in 2014 when The Bancorp (an early prepaid card issuer and sponsor bank for the fintech industry) got in trouble with regulators:

That summer, the Federal Deposit Insurance Corp. slapped the bank with a consent order over weaknesses in its Bank Secrecy Act and anti-money laundering compliance program. Until it resolved those deficiencies, the bank couldn’t establish “any new prepaid card program or issue any new prepaid card product, or establish any new distribution channel for existing prepaid card products.”

The news of the consent order sent the bank’s stock plunging more than 29% after it came out, according to a press report at the time. Bank analysts wrote that they expected the company to spend millions of dollars resolving it, and that it would be a tedious process. “In our experience, a 12- to 18-month time frame to resolve this issue would not be out of the question,” wrote analysts at one investment bank.

That time frame would prove to be wildly optimistic.

The consent order wasn’t terminated until 2020, but The Bancorp (and a few other early BaaS bank pioneers) getting kicked in the teeth helped establish some general ground rules for other BaaS banks who would follow them, which eventually led to the thriving BaaS ecosystem that we have today.

Also in 2014, a struggling fintech company called Marqeta made a fateful product pivot:

With Marqeta’s API, companies that wanted to issue debit cards could authorize transactions themselves and set the criteria for accepting them. “We move the system of record or ledger to our customer,” Gardner says. And companies no longer needed to separately solicit relationships with a card network (like Visa), a bank, a transaction processor and a plastic card manufacturer. Marqeta had built those partnerships and wrapped them up in one package.

They essentially took the hard parts of launching a debit card and made all of them available for developers within a single API. This proved to be a beneficial innovation for companies across multiple industries, but especially for this emerging segment of digital banks:

Marqeta expects to double revenue again this year. Dahan says its clients are evenly spread across a handful of industries, which include lending, delivery, e-commerce, travel and one he thinks is the most promising: digital banking. In addition to Square, which has 15 million monthly users for its Cash app and is looking more and more like a bank, Marqeta is working with (as yet unnamed) digital-first “challenger banks” in Europe.

We overcame the Kickstarter problem in debit cards and digital banking by building infrastructure that made it easy for the second and third generations of aspiring neobank founders to manufacture and launch new products in a fraction of the time and with a fraction of the effort it took first-generation neobank founders to do it.

And the result is the embarrassment of neobank riches that we have today.

Unfortunately, lending will not be so easy to unlock.

Lending is Hard

There is a very good reason why most neobanks don’t offer even the standard lending products that customers expect from their primary financial institution, despite an overpowering desire on the part of those neobanks to solidify their status as that primary FI.

Lending is orders of magnitude more difficult than banking.

Take credit cards as an example.

If you want to launch a credit card, you’ll need a BaaS bank to partner with and an issuer-processor like Marqeta to help you get your cards into your customers’ hands. However, you also need to deal with some new and exciting regulations (ECOA and TILA and FCRA, oh my!), simultaneously manage funding risk (where are you getting the money to lend out?) and credit risk (how are you ensuring the money gets repaid?), and try your hand at debt collection … among many other requirements.

It’s not for the faint of heart!

And here’s the thing – fintech companies don’t just want to tack on standard lending products. They don’t want to manufacture the same products that banks have been manufacturing for decades. They want to build fundamentally new products and experiences for customers.

However, much like in the early days of neobanking, there is a significant gap in the infrastructure needed to unlock mass-market manufacturing innovation in lending.

Why Can’t Transformers Change Into Any Shape?

My five-year-old son loves transformers – the toy franchise populated by sentient robots like Bumblebee and Optimus Prime, who can transform into vehicles. And he recently asked me, “why can certain transformers only transform into certain types of vehicles?”

As with most little kid questions, this one was weird and unexpected and actually kind of challenging to answer!

It turns out, after doing extensive research, that the alternate forms that transformers can take are relatively fixed based on the overall size and classification of the transformer in question. In other words, heavy transformers with massive frames (like Optimus Prime) can generally only transform into big vehicles like trucks, buses, and tanks. For the same basic reason, only certain transformers can turn into planes or helicopters. You have to be a flying class of transformer in order to be able to take the form of a vehicle that can fly.

Put simply, transformers are “robots in disguise.” They can look different on the surface, but they can’t meaningfully change their basic nature.

This is the same problem that we have in lending – we can make cosmetic changes; we can change the experience, but the basic nature of the underlying products remains the same.

For example, over the last 30 years, we’ve made significant improvements to the experience of acquiring a loan. From the invention of risk-based pricing back in the 1990s to the more recent digitization of the account opening process, we have made customers’ experiences faster and more personalized. However, the experience of having a loan – spending funds, making payments, and dealing with any problems or questions – hasn’t really changed at all.

And that’s because the systems that govern that post-origination experience – the loan servicing systems – haven’t allowed the experience to change.

A Quick Primer on Loan Servicing

Before we go any further, we should spend a few minutes explaining what loan servicing is and how it works.

Loan servicing is the process of administering the full, post-origination lifespan of a loan, from the day the account is created to the day that it is closed and the balance is fully repaid. A loan servicing system handles everything within that lifespan – sending customer statements, collecting payments, calculating balances, fees, and interest, facilitating the fulfillment of customer service tasks (from answering simple questions to managing disputes), creating reports and furnishing data to the credit bureaus, and doing it all while ensuring compliance with all applicable regulations.

Put simply, a loan servicing system acts as the single source of truth for each loan in a lender’s portfolio and as the engine that drives all of the actions taken in regard to those loans. Any company that needs to account for their customers making repayments needs a loan servicing system.

And what’s interesting is that loan servicing is one of those things that feels like it should be easier to manage than it actually is. After all, a loan servicing system is just a database that keeps track of a few numbers, right? How hard can that be?

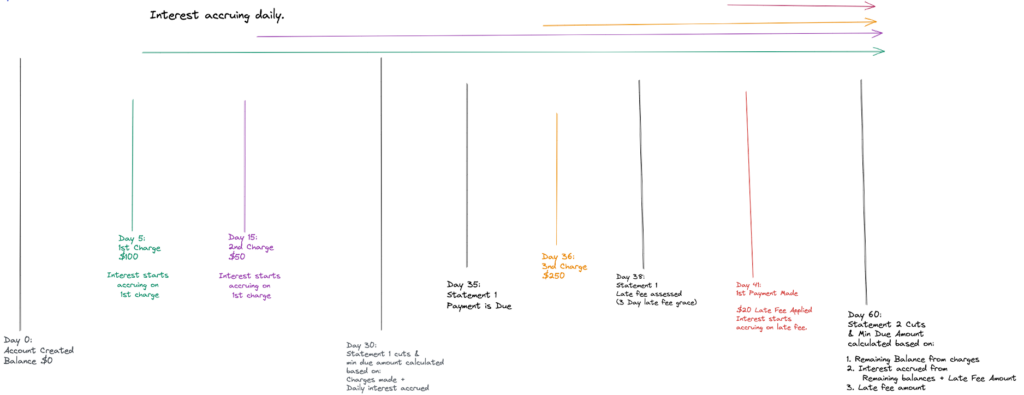

Really hard! Take a simple example – a general-purpose credit card.

Keep in mind this picture is only showing two payment cycles with a grand total of three transactions and one missed payment. You can imagine how much more complex it gets when the transaction velocity increases and the payment cycles continue to compound.

Adding to the challenge, loan servicing is a low-fault-tolerance activity. You simply cannot screw up when we’re talking about keeping track of how much money customers owe you. If you do screw up, this happens:

The Consumer Financial Protection Bureau (CFPB) is ordering Wells Fargo Bank to pay more than $2 billion in redress to consumers and a $1.7 billion civil penalty for legal violations across several of its largest product lines. The bank’s illegal conduct led to billions of dollars in financial harm to its customers and, for thousands of customers, the loss of their vehicles and homes. Consumers were illegally assessed fees and interest charges on auto and mortgage loans, had their cars wrongly repossessed, and had payments to auto and mortgage loans misapplied by the bank.

Bottom line – loan servicing is a complex, constantly changing stateful processing problem, in which the financial, reputational, and legal costs of making even tiny errors are enormous. This is why loan management systems have, historically, been designed to prioritize reliability and stability over everything else, as this blog post from Canopy explains:

Until the mid-20th century, loan management systems were basically teams of knowledge workers — accountants and others who prepared ledgers and processed payments. The dawn of mainframe computers and the adoption of COBOL (Common Business-Oriented Language) by banks and financial institutions led to the first digital loan management and servicing systems. To this day, COBOL is used for transactions the world over from processing paychecks to cash register sales.

Although primitive by today’s standards, COBOL was revolutionary in its time. It was one of the first accessible and universal programming languages. Earlier coding languages were cryptic and obscure. They were also usually written for a particular operating system and use case. In contrast, entry-level programmers could be trained to use COBOL within months and master it within a year or two.

Banks and financial services continue to use COBOL because it’s functional and it works. It’s a well-understood language describing programs that have been refined, debugged, and perfected over decades, and are widely considered reliable and stable.

The trade-off for this reliability and stability is flexibility. Change is the enemy of COBOL, as the Canopy blog post points out:

Banks can’t risk changing their COBOL-based loan management systems without compromising their integrity. Imagine a Jenga tower — you can only pull out and replace so many blocks before the whole thing comes crashing down.

This is why manufacturing innovative new lending products, or even product features, is so challenging.

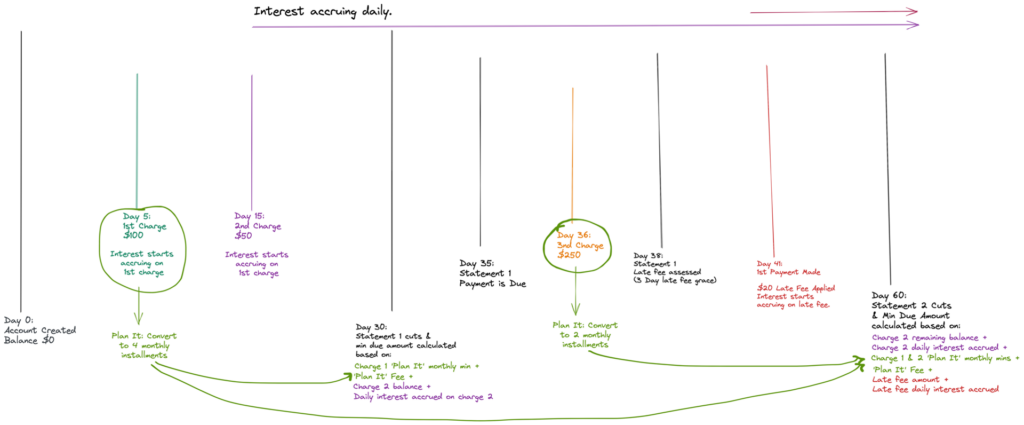

Take, for example, American Express’s “Pay It Plan It” feature, which allows cardholders to convert larger purchases (over $100) into interest-free installment loans that automatically add the monthly payment for those loans to the card’s minimum payment at the end of each month. It’s a neat feature, but let’s be clear – it’s a feature. It’s not like American Express invented an entirely new loan product category here. And yet, look how much complexity it introduces into the credit card loan servicing process:

Imagine how much money and time American Express spent behind the scenes, wrestling with an ancient loan servicing system and writing significant new amounts of new custom code to enable this feature.

This is why we haven’t seen mass-market manufacturing innovation in lending. It’s simply too complex and expensive to do unless you’re a megabank or a fintech lending company building in a zero-interest-rate environment with limitless piles of VC cash (*cough* BNPL *cough cough*).

But what if we could lower the costs of manufacturing innovation in lending?

Lowering the Cost of Product Innovation

To lower the cost of product innovation in lending, we need to start at the center. We need a much more flexible and robust loan servicing system.

So first things first, what does such a system look like?

Well, it has a few different attributes:

- Agnostic data structure. When you strip it all down, loan servicing systems are built on two types of data – time data (when was a payment made? when is interest calculated? etc.) and loan data (repayment structure, interest calculation method, etc.) The more agnostic the underlying data structure of the system is (meaning that the data fields aren’t specific to a product type or use case), the more flexible it can be in accommodating novel product concepts.

- Real-time by default. Legacy loan servicing systems weren’t designed to surface data in real time. They are batch-processing engines. That’s why when you call up your credit card issuer in the middle of the month and ask them exactly how much money you owe on your account, they usually can’t tell you. They can tell you what your last statement balance and minimum payment amount were, but until the current pay cycle ends, they don’t know. The legacy system they are using wasn’t designed to answer that question. A more robust loan servicing system, built in this century, should be real-time, by default.

- Event-driven. You also want a loan servicing system that is event-driven, which is to say that it can be easily configured to trigger any action in any of the myriad of systems that are dependent on it (CRM, collections, portfolio management, etc.) based on any change in state in the underlying data.

- API-first. And building on that last point, the system should also be able to be called, via a standard API, by any other system that the company is using in order to supply necessary time or loan data (like if a customer service agent needs to be able to tell a customer exactly how much money they owe at that moment).

- Compliance IP. Finally, as we’ve discussed, loan servicing is a task that is, for very good reasons, subject to a lot of regulatory compliance requirements. Giving companies greater flexibility to design novel lending products is not something that should be done without proper guardrails in place, lest those novel products end up as new versions of the same predatory products that we’ve been trying to stamp out of our industry for decades. The best loan servicing systems are built on intellectual property that helps companies understand how to ensure their lending product concepts are compliant.

Second, and more importantly, if we had such a system in place, what could we do with it?

There are three big areas of opportunity:

1.) Create a better borrower experience. Most loan products today are, from an experience standpoint, like a bad gym – incredibly easy to sign up for, but once you walk in the doors, there is no help or guidance on what to do, and half the equipment is broken and unusable.

In financial services, we’ve invested a ton into making the account opening experience a joy, but we’ve done virtually nothing to make the experience of having a loan (which is the vast majority of the overall lending experience) more valuable. You have a question about your account? You better hope you’re asking it in the right way at the right time. You want to repay your loan at a velocity or in an amount that we didn’t anticipate? Yeah, sorry, no.

A more flexible and robust loan servicing system removes the constraints that create these suboptimal customer experiences, which empowers companies to invest in making those experiences better and more personalized.

2.) Foster a more interconnected ecosystem. Fintech lending is a team sport. You can’t do it alone. Sponsor banks, debt facilities providers, and secondary market loan buyers are all necessary partners in a successful fintech lending program.

However, it’s very difficult, using legacy loan servicing systems, to build innovative lending products that cut across traditional product constructs. For example, let’s say you wanted to launch a hybrid credit card/BNPL product similar to American Express. In that instance, one thing you might want to do would be to securitize and sell the different types of receivables (the revolving balance and the installment loans) separately to different debt buyers based on their distinct risk profiles. A legacy loan servicing system wouldn’t provide the necessarily-granular data structure and event triggers necessary to do this, but a more modern system would.

A flexible and robust loan servicing system could play a similar role to what the new BaaS platforms like Unit do – providing a centralized, API-first ledger that could seamlessly connect the fintech lender to a network of different sponsor banks, debt facilities providers, and secondary market loan buyers.

3.) Build adaptable lending products. The final opportunity that can be unlocked by a more robust and flexible approach to loan servicing is the ability to create more adaptable lending products that fit better within the shifting contexts of customers’ lives.

Take, for example, a small business owner that initially applies for and receives a low-limit business credit card. The card works well for the business owner at first, but eventually, she outgrows it and needs access to both a larger revolving credit line as well as an installment loan to pay for some needed equipment upgrades.

Today, what she would likely do is scramble to apply for an additional revolving credit product and installment loan from any lenders who were willing to meet her short-term needs. She wouldn’t want to get two additional loans, but it’s what she would have to do. Even if her current lender were sophisticated enough to continually underwrite her business as it grew and anticipate and approve her for more credit, it would still very likely require her to open new loan accounts (with their own unique terms and payment cycles) in order to access that additional liquidity because the underlying loan servicing system wouldn’t be able to support anything else.

Tomorrow, empowered by more advanced infrastructure, the original lender might be able to offer an adaptable small business credit product, which could be continuously underwritten to offer additional liquidity, using the structure and terms preferred by the customer, and all rolled up together into a single convenient monthly payment.

It’s no longer loan products as transformers. It’s loan products as T-1000 Terminators.

This last opportunity – to create more adaptable lending products – is especially intriguing given that we are on the precipice of another massive shift in the lending industry. Not a change in the way we manufacture lending products, but a change in the way we distribute them.

Embedded Lending

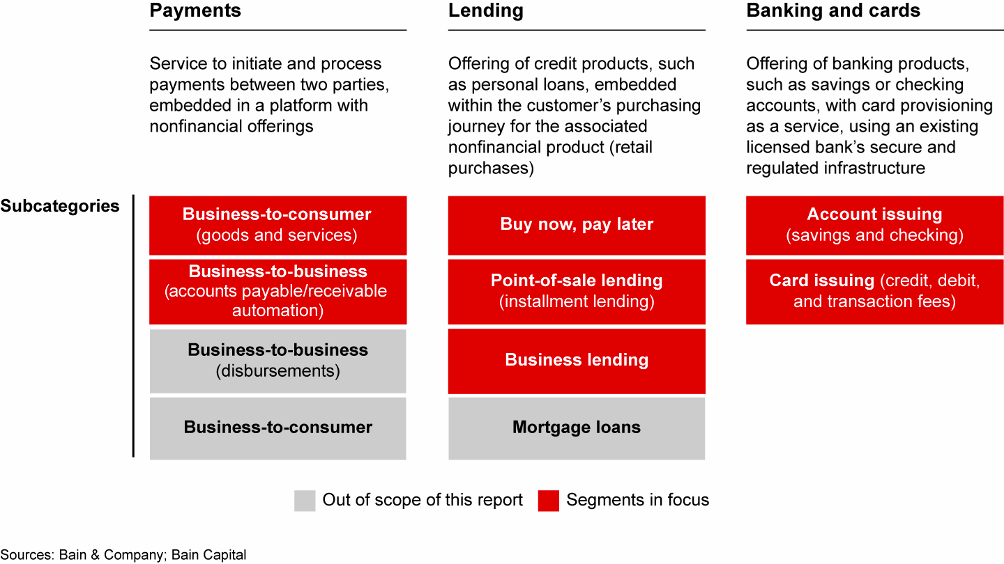

Careful readers of this newsletter will know that I’m a bit more skeptical than the average fintech observer on the promise and potential of embedded finance. Those with more optimism see a world in which embedding financial products – across payments, lending, and banking – within e-commerce and other software platforms as a proposition that will account for $7 trillion of financial transaction volume in the U.S. by 2026.

My personal take is that the promise of embedded finance, while it is uniformly interesting in theory, will prove to be much less consistently realized in the real world.

Not every financial product is going to make sense in an embedded context, as I recently pointed out in regard to bank accounts:

Bank accounts aren’t enablers of some other non-financial goal or activity. They aren’t utilities to be abstracted away until the end customer can’t even see them anymore. Customers want to see their bank accounts! They want to know how much money they have today. They want to know how much money they will have a week from today. They want to know if someone is stealing their money.

Lending, on the other hand, is the perfect product category for embedded finance.

Loans are enablers. They don’t have a purpose in and of themselves. They only exist to get consumers and businesses what they want (a house, a new oven for your bakery, etc.) As such, anything that financial services providers can do to reduce the effort that a customer has to go through to get a loan will be immensely valuable to that customer because it shortens the time until that customer gets their hands on the thing they actually want.

This isn’t a theory. We know this is true. Consumers and businesses will gravitate to the most convenient lending option time and again. Sears and other large retailers demonstrated this in the 1980s with store credit cards. RouteOne and Dealertrack demonstrated this in the early 2000s with indirect auto lending (which is now the dominant distribution channel for auto loans in the U.S.) Commerce platforms like Amazon, Square, and PayPal demonstrated this in the 2010s with embedded small-business lending. And most recently, fintech lenders like Klarna and Affirm demonstrated this with the rapid growth of BNPL.

This isn’t a new idea.

What is new is the size of the opportunity space. Software is everywhere now. It is the connective tissue between a vast array of B2C and B2B interactions. And it’s easy to integrate financial services into.

What this means, in practice, is that we have an uncountably large number of new, embedded distribution opportunities for B2C and B2B loan products. Optimizing these opportunities will require the ability to morph lending products to fit perfectly within the different contexts into which we’re embedding them.

About Sponsored Deep Dives

Sponsored Deep Dives are essays sponsored by a very-carefully-curated list of companies (selected by me), in which I write about topics that are of mutual interest to me, the sponsoring company, and (most importantly) you, the audience. If you have any questions or feedback on these sponsored deep dives, please DM me on Twitter or LinkedIn.

Today’s Sponsored Deep Dive was brought to you by Canopy.

About Canopy

Canopy Servicing offers the most flexible infrastructure to build and launch next-gen credit, debit, and lending products. Its API-first architecture ensures any brand can embed financial products, bring those products to market quickly, and support borrowers with world-class service in a highly secure and compliant way. With Canopy’s real-time platform, you can track the balances and transactions for each customer of your products and generate accurate statements for banks, credit bureaus, and regulators.