In an episode of the Fintech Takes podcast, Frank Rotman (Chief Investment Officer at QED Investors) observed that the stock market has become a game disconnected from reality:

When you buy a stock, you are buying ownership in the future cash flows of that business. Companies publicly report their financial performance once a quarter, but stocks are traded every nanosecond.

There’s now a game being played in the public markets, with stock ticker symbols and prices as the pieces and the scoreboard for the game. … You can see this in the data. The duration of the average hold for a stock has dropped precipitously in the last few decades.

What Frank is describing here, broadly, is financialization – the evolution of financial services from an enabler of economic activity to an economic activity in and of itself.

Financialization, as a trend, isn’t new. Economists and academics first started noticing it in the U.S. in the 1980s. It has, however, accelerated significantly thanks to the internet. Today, you don’t need a Bloomberg Terminal or a stock broker to day trade. You just need Robinhood and Reddit.

And the internet hasn’t just made traditional financial activities more accessible. It has caused the activities themselves to evolve, to become more pure.

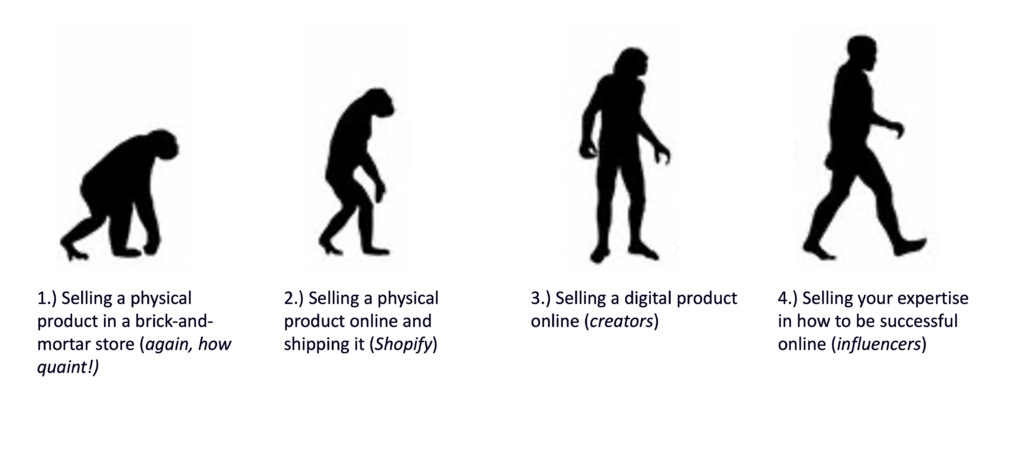

In the case of buying and selling stocks, that evolution looks something like this:

I think a similar evolution is taking place in the world of entrepreneurship.

The Evolution of Entrepreneurship

The internet has obviously made traditional forms of entrepreneurship more accessible. Whether it’s Square enabling more in-person commerce through its mobile card reader or Shopify arming the e-commerce rebels, it’s inarguable that it’s easier to start and grow a business today than it has ever been.

However, as with financial services, the internet has also driven an evolution in the nature of entrepreneurship:

The first two are obvious, and what most people probably think of when they think about the internet’s impact on entrepreneurship. The second two are a little newer and more confusing.

What, you may be asking, is the difference between creators and influencers?

The Difference Between Creators and Influencers

Creators are entrepreneurs who produce and sell digital products online.

That’s obviously a very broad definition, but it’s also a logical progression if you think about it.

Take music as an example. You start with a physical product (records) sold through a physical store (record stores). Then you move briefly to a physical product sold through a digital store (Amazon) before you realize you can dispense with the physical product and just sell the digital version through a digital store (Spotify).

That last evolutionary step is a big deal, though, because it reduces the marginal costs of distribution (no brick-and-mortar stores or shipping) and manufacturing (no pressing and packaging vinyl records) to zero. This allows individuals to compete in industries where, traditionally, manufacturing and distribution costs were moats for large companies. This is how creators like MrBeast and Ben Thompson compete with behemoths like Disney and the New York Times.

Sign up for Fintech Takes, your one-stop-shop for navigating the fintech universe.

Over 41,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

Influencers are very different.

Influencers don’t sell products (digital or physical). They are the product.

The promise of influencers is that by following them, subscribing to their content, and buying the products they tell you to buy, you can instantly (and with no additional work) attain the same end state promised by entrepreneurship – success.

That’s why most influencers, regardless of their other skills or qualifications, tend to be some combination of rich, smart, healthy, and good-looking. In order for you to want to buy them, they need to personify the traits that we associate with success.

But, of course, simply following an influencer isn’t going to make someone successful. No more than investing in a random crypto asset would make them rich.

Influencers are for entrepreneurship what what shitcoins are for financial services – a game that has become disconnected from reality.

Why Does This Matter?

The reason this matters is that technology shapes generations.

In her excellent book – Generations – Jean Twenge convincingly argues that generational differences are shaped not by major world events (wars, pandemics, etc.), but rather by the inexorable forward march of technological progress.

While major global events tend to be cyclical, technological progress is exponential. Thus, the world that Gen Z (those born between 1997 and 2012) grew up in, while pockmarked by similar macro-scale events, is exponentially different than the world that the Greatest Generation (those born between 1900 and 1925) grew up in.

So, for instance, if you became an adult at the same time that commission-free stock and crypto trading became widely available, you might naturally wonder why your bank keeps trying to refer you to a brokerage service rather than simply offering fractional investing directly within its mobile app.

It wouldn’t seem strange to your parents, but it would seem deeply strange to you.

This is why the evolution of entrepreneurship fascinates me.

In the same way that the meme stock and crypto mania of 2021 forced banks and many fintech companies to question their wealth management products for younger customers, I think the continued growth of the influencer economy may start to force banks and fintech companies to rethink how they can and should support young, aspiring entrepreneurs.

For those looking to get a headstart on that rethinking, I’d suggest looking at a company called Whop.

Whop! (There It Is)

(Editor’s Note – I’m so sorry for that subtitle. Here I am trying to be cool and fit in with the kids, and I blow it with a bad Tag Team reference. Damn it!)

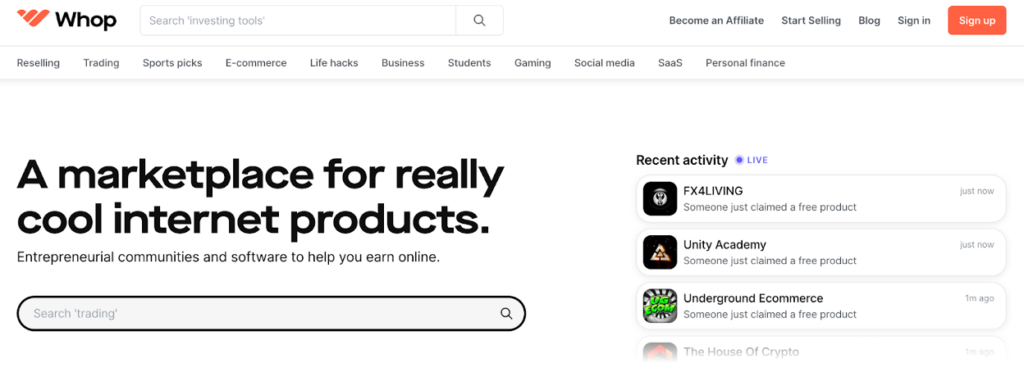

Whop is a marketplace for digital entrepreneurship communities.

Think of it kinda like like Shopify for the Gen Z internet economy.

Customers can browse through a wide selection of paid communities, courses, and tools – across various verticals – and easily purchase access to them through the Whop platform. Providers of these digital products (who I would mostly classify as influencers) can, like Shopify, get their “stores” up and running quickly and take advantage of a growing number of third-party apps available through the Whop app store. For every transaction, Whop charges a fee and a small percentage of the total sale (somewhere between 3% and 4.5%).

I have two takes on Whop.

First, the company, which was founded in 2021 and raised a $17 million Series A last year, is very impressive. According to a recent article in Fast Company:

Whop processed almost $300 million in payments [in 2023], and it’s grown revenue eight times year over year. One reliable estimate says they’re pulling in more than $4 million annually.

Even more impressive is the vision. The company’s Gen Z founders, who met when they were 13 in a Facebook group for people reselling sneakers, astutely observed that, despite the growth of social media as an awareness channel for influencers, no one (including the social media companies) had yet built the distribution infrastructure necessary to allow those influencers to fully monetize their influence.

That’s what Whop is building.

My second take on Whop is that, as a Millennial (with an especially old soul), I thoroughly and profoundly do not understand its appeal.

The products offered by influencers on the platform today include a community that will teach you how to make money from trading crypto, a consulting service to help you make sports gambling picks, a guide on how to become a TikTok influencer, and my favorite – an online course promising to teach you how to create an “infinite money glitch” and “embark on a mission to hack reality by unlocking financial and creative freedom strategically making money work for you.”

This all sounds, to me personally, like entrepreneurship that has become completely disconnected from reality.

What Will the Future Look Like?

I have absolutely no idea.

Most of the products on Whop today seem absurd (and often Ponzi scheme-ish) to me, but that’s also probably what someone from 1950 would say if you transported them to 2024 and showed them Robinhood. I don’t know. Maybe this pure distillation of the internet economy only seems strange because it’s new. Maybe it will grow to become a cornerstone of the economy, in the same way that complex financial products have, and banks and fintech companies will be forced to adapt to it.

Or perhaps this notion of entrepreneurship will de-evolve a bit as Gen Z gets older and certain economic realities set in (in much the same way that Robinhood has slowly turned away from meme stocks and leaned into boring corners of wealth management like retirement accounts). Maybe Whop will choose to tilt its future growth more towards creators selling actual products and away from influencers selling advice.

I don’t know what’s going to happen. All I know is that it will be worth paying attention to.