The focus of today’s essay is servicing.

In a lending context, servicing is everything that happens between a lender and a customer after that customer is onboarded and their account is created.

Obviously, that definition is very broad and covers a lot of very specific activities, everything from handling basic customer service inquiries to calculating interest and accepting payments to portfolio-level risk management.

However, an easy conceptual way to think about servicing is that it’s an exercise in managing a lender’s performance against the constantly changing financial conditions of their customers.

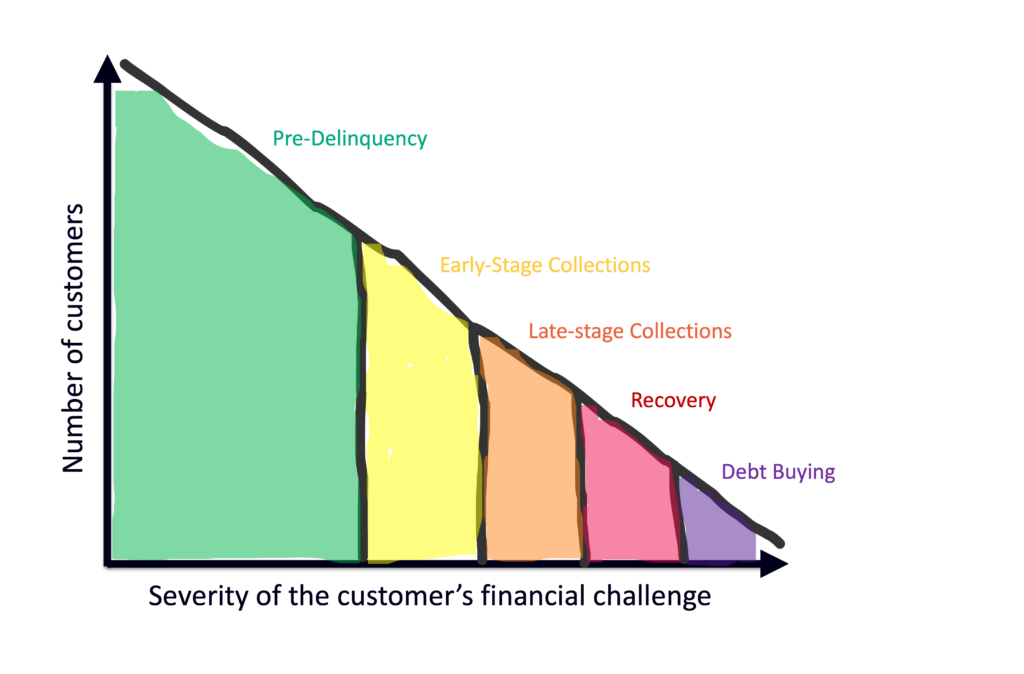

If a lender’s underwriting process is doing what it’s supposed to do, the number of its customers who are in relatively good financial condition (i.e. able to make their payments) should represent a supermajority of its total portfolio (these customers are, bizarrely, often categorized by lenders as ‘pre-delinquent’ … we’ll revisit this in a minute).

The remaining customers – those in some level of financial distress – are usually segmented out by the lender according to how far behind they are in making their payments and how the lender is approaching the task of collecting those delinquent payments.

Those that aren’t too late (roughly 30 to 60 days) go into the early-stage collections bucket. Those that are later (roughly 60 to 90 days) go into the late-stage collections bucket. After that (roughly 90 to 120 days), a lender will typically close the customer’s account and take the loss on their books. At this point, the lender will attempt (either directly or indirectly) to recover as much of the debt that they are legally owed as possible or sell the debt to a third-party debt buyer, who then attempt to collect on it themselves.

A couple of important notes about this ‘servicing lifecycle’.

First, lenders have traditionally thought of customers who haven’t fallen behind on their payments in similar terms to the cat in Erwin Schrödinger’s famous thought experiment – trapped in a state of quantum uncertainty, dead and alive simultaneously. It’s not until the customer misses a payment that lenders will open the box and see how bad the situation actually is.

(The fact that lenders often refer to this group as being in ‘pre-delinquency’ gives you some sense of how pessimistic most collections and recovery professionals are.)

Second, for customers who have fallen behind on their payments, lenders typically approach the collections and recovery process with an operational efficiency mindset. The tactics that they choose for each stage of the servicing lifecycle are selected in order to maximize their return on each incremental dollar invested.

In early-stage collections, where the odds are still decent that customers will be able to catch up on their payments, a light (and inexpensive) touch (such as a robocall or text message) is generally preferred.

In late-stage collections, where your odds are worse, and you are likely competing with other lenders to get paid back first, more intensive (and expensive) tactics are more common.

In recovery and debt buying, where the odds of getting anything back are terrible (companies and investors will buy charged-off debt for pennies on the dollar), companies have a strong incentive to get creative.

The word ‘creative’ probably sounds a bit sinister in this context. And yes, most of the laws and regulations that govern the collections and recovery industry were put in place to constrain its most unethical creative ideas.

However, that same incentive to be creative, to think different, in order to beat the odds in working with seriously delinquent and financially vulnerable consumers has produced some outstanding fintech innovations over the last couple of decades, everything from debt consolidation and refinance apps (such as Tally) to digital-first, customer-centric collections agencies (like TrueAccord).

Sign up for Fintech Takes, your one-stop-shop for navigating the fintech universe.

Over 41,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

These fintech innovations combine modern technology (something you don’t see much in traditional loan servicing and debt management systems) with obvious-yet-somehow-novel insights such as “being nice to your customers and treating them like human beings actually improves collections results” and “offering to help proactively rather than waiting for something bad to happen to your customers is both cheaper and more effective”.

What’s fascinating, though, is that despite the clear applicability of these fintech innovations (and the insights they’re built on) to earlier stages in the servicing lifecycle, there has been very little adoption of this creative thinking in early and late-stage collections and pre-delinquency servicing.

To be totally honest with you, I’m not sure why that is.

My best guess is that once the performance of business processes becomes measured in terms of operational efficiency (e.g. right-party contact rate, promise-to-pay rate, etc.), it becomes very difficult to change. Other considerations, such as the customer’s level of satisfaction or overall financial health, are inconvenient because doing something new to improve them, over the long run, might harm certain existing efficiency metrics in the short run.

Having said that, I think these metrics are going to have to change. The glimmers of fintech innovation and customer-centricity that we see today at the end of the servicing lifecycle will eventually come to dominate the entire servicing lifecycle.

My prediction is that competing and winning in consumer lending over the next couple of decades will require lenders to invest in creating an exceptional servicing experience for their customers.

My prediction is based on the convergence of three different trends in financial services, each of which I’ve spent a lot of time discussing in the newsletter, and each of which will have a profound impact on the servicing lifecycle.

Let’s review them quickly.

#1: Embedded Lending

What is it?

The distribution of loans through indirect channels, which is being enabled at scale by the diffusion of SaaS software across industries.

How will it impact servicing?

Wherever embedded lending goes, it tends to win. This was true in auto lending in the 1990s, and it has been true (so far) with BNPL in the 2020s.

It’s not surprising. Consumers don’t want loans. They want the things that loans allow them to buy. Thus, creating a more convenient path to acquiring a loan (and the thing the loan is for) will almost always result in that path becoming the most popular choice for consumers.

If we assume this is true, then we can assume that embedded lending channels will become increasingly dominant in the future.

This would dramatically shift the field of competition for traditional lenders. They would no longer be fighting to acquire new customers directly, but rather to acquire them indirectly through partnerships with consumer-facing brands or by refinancing the initial loan down to a lower rate (BTW, the refi opportunity in embedded lending is going to be massive … embedded lending is great at delivering convenience, but less shopping around is going to lead to worse pricing for consumers).

If this happens, the servicing experience becomes much more important because it will be the lender’s first and only opportunity to establish its brand with the customer and create a foundation for future relationship building and cross-sell.

#2: Open Banking

What is it?

The ability for consumers to share their financial data with authorized third parties, which is being enabled, more reliably, in the U.S. through rulemaking by the CFPB.

How will it impact servicing?

It’s an unfortunate but true axiom that a company’s most loyal customers tend to get the worst service and pricing. As I explained a while back:

Retaining customers, even customers who aren’t perfectly satisfied, usually costs very little. Inertia and switching costs keep most people where they are. This basic reality allows companies to over-invest in the acquisition of new customers, even though that is, objectively, unfair to their existing customers, who provide much more value.

This is how most consumer lenders approach running their business. It’s all acquisition, no retention.

Open banking has the potential to shake up this equation.

In a market where consumer-permissioned data sharing is table stakes, it becomes much easier for A.) other companies to help consumers figure out that they’re getting mistreated (they’re charging you how much on this loan?), and B.) consumers to switch to a different provider.

If this happens, the war between lenders will shift from acquisition to retention and the servicing lifecycle will become a critical battleground on that new front. Lenders will need to earn their customers’ trust and satisfaction every day.

#3: Generative AI

What is it?

A new field of AI that allows models to be trained on large, unstructured data sets and then generate content (text, images, videos, synthetic data, etc.) based on those data sets.

How will it impact servicing?

Digital technology has allowed servicing workflows to evolve from human-to-human (a customer chatting with a bank employee over the phone) to human-to-bot (a customer attempting to navigate a complex web of automated notifications, text messages, and chatbots).

This has largely (though not exclusively) been to the benefit of companies and the frustration of their customers. However, generative AI has the potential to push this evolution to its logical endpoint – bot-to-bot.

If this happens, consumers will be empowered with intelligent, flexible, and inexhaustible digital agents (powered by generative AI models) working on their behalf, and servicing strategies that rely on customer ignorance, fatigue, or sub-optimal decision-making – and there are many of these today, across the entire servicing lifecycle – won’t survive.

An Opportunity to Build Trust

Lenders have never seen servicing as an opportunity.

They’ve seen it as a bad hand of cards that needed to be played with cold, calculating precision in order to minimize their losses.

This is exactly the wrong way to look at it.

Servicing a loan means helping customers figure out how to keep their commitments. Doing this well, especially in moments of financial stress or instability, creates opportunities to build trust.

As embedded lending becomes more popular, open banking becomes more solidified, and generative AI becomes more ubiquitous, I suspect that lenders will begin to seize every opportunity they can find to build trust with their customers.

Investing in a better servicing experience will become a strategic imperative.