After a busy (and nerdy) week in New York, allow me to empty my notebook (while adhering to the Chatham House Rule, of course).

A North Star for Credit Builder Products

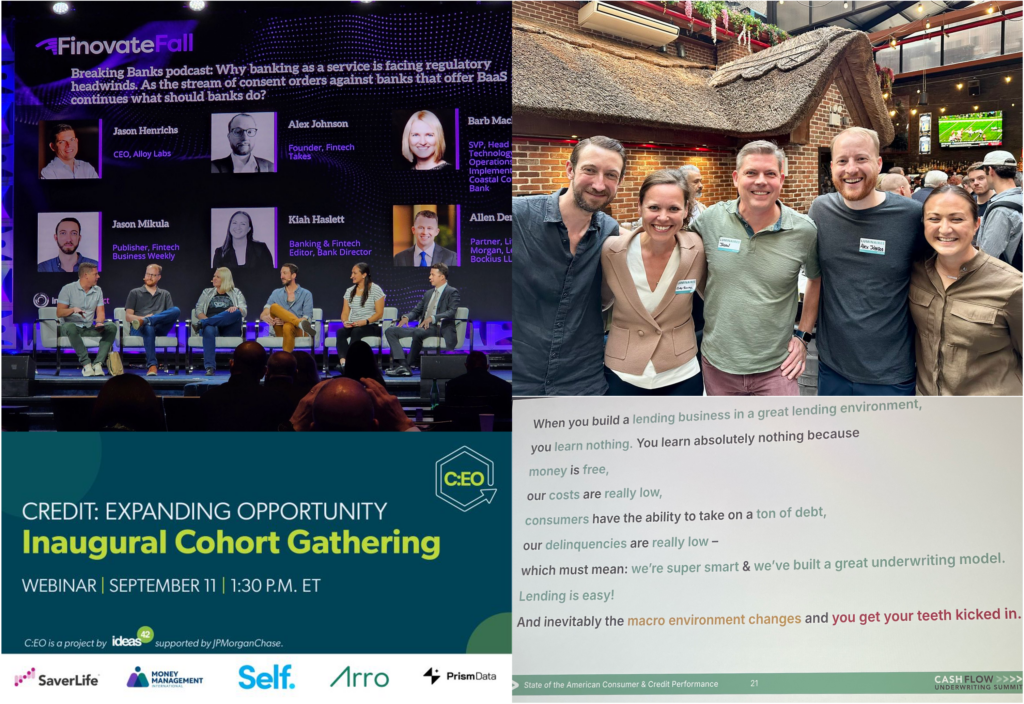

I have the honor of serving on the Advisory Board for the Credit: Expanding Opportunity Initiative, which is being run by Ideas42 to improve and build solutions to unlock and expand credit opportunities for consumers with sub- and near-prime scores, with a focus on those with low-to-moderate incomes.

The first cohort of organizations participating in the project met this week, and I had the opportunity to share my perspective. Specifically, I spoke about the importance of having a common ‘north star’ that everyone in the space could build towards.

I thought it would be helpful to share the three core principles that make up my north star for responsible credit building:

- Credit builder products should always help lenders more accurately price risk. I harp on this point a lot in the newsletter — if your product is not generating a useful signal for lenders to use to better price risk, you are hurting your customers and the entire lending ecosystem.

- Credit building should never be confusing, embarrassing, fast, or easy. Classic bank credit builder products like secured credit cards were often confusing to use and embarrassing to sign up for. That should never be the case. By the same token, many fintech credit builder products are sold to consumers as silver bullets. Fast and easy to use. No effort or sacrifice required. Neither of these product positioning extremes is helpful. We need to be somewhere in the middle.

- Credit builder products should never be the primary way you make money. It’s fine to charge a fee if it is commensurate with the value you are providing. Charging a fee can even help drive positive selection. However, in broad terms, credit building needs to be seen as a means to an end (cultivating long-term customer relationships) rather than as an end in and of itself.

Another way to Think About Credit Builder Products

Here’s a way to think about credit builder products, which I had never considered before hearing it in a conversation this week — credit builder product tradelines tell you different things depending on who the tradelines belong to.

If a consumer with a sub-prime credit score starts using a credit builder product, that can be seen as a positive risk signal because they are showing agency and initiative in repairing their score.

However, if a consumer with a near-prime or prime credit score starts using a credit builder product, that can be seen as a negative risk signal because there’s no apparent reason why they would need to use such a product (they have a good score already!) which might indicate they know something bad about their financial situation that you don’t know.

Fascinating!

Keeping Predatory Lenders Out of the Credit Journey

The most vulnerable points in consumers’ credit journeys are when they are being handed off from one set of service providers to another.

On the way down, that might look like a consumer who has entered into severe delinquency or default with one or more creditors. What they need, at that moment, is access to debt counseling and debt management planning services (ideally offered for free by a non-profit). What they often get, unfortunately, are predatory loan offers from payday lenders and unscrupulous fintech companies.

On the way up, that might look like a consumer who has begun rebuilding their personal balance sheet and credit score. What they need, at that moment, is access to affordable and prudent credit options, ideally offered by less profit-motivated institutions like Community Development Financial Institutions (CDFIs). Instead, what they often get is a bombardment of “recommendations” for credit products through marketplaces that are selling leads to the highest bidders.

A question I am now obsessed with — how can we build the infrastructure to responsibly handle these handoff points in the consumer credit journey and exclude predatory actors?

Big Banks Can’t Make Up Their Minds on Open Banking

I heard about one large U.S. bank this week that is simultaneously doing the following things:

- Making it marvelously easy for customers to permission access to their data for third-party service providers via the biometric authentication capabilities on their mobile devices.

- Warning customers that payment transactions initiated through those same third-party service providers are not as secure as transactions made with the bank’s debit cards (a claim that makes no sense).

- Aggressively investing in open banking infrastructure, products (payments, specifically), and partnerships (this bank has many data sharing agreements in place with data aggregators and fintech companies).

- Scheduling the maintenance downtime window for its consumer-permissioned data-sharing API on Super Bowl Sunday.

At this point, I honestly can’t tell if they’re trying to profit off of open banking or kill it. Maybe both? I don’t know. It’s confusing.

Then there’s PNC, which has, for the last few years, been one of the most openly aggressive banks trying to stop or restrict the growth of open banking (see this article for one example). But now PNC CEO Bill Demchak wants to use open banking to crush his smaller rivals:

“We’ll pull share out of smaller banks who won’t have the technology to be able to take advantage of open bank[ing],” Demchak said.

Regulators are “doing this because they think they’re going to lower switching costs,” he said. “All they’re going to do is drain [small] banks of accounts, by big banks who have the technology.”

OK then!

Cash Flow Servicing

I was delighted to moderate two different panels at Nova Credit’s inaugural Cash Flow Underwriting Summit.

It was a great event, and I learned a lot about cash flow underwriting from all the experts in the room.

However, an unexpected theme that kept coming up was the excitement from all the folks in the room about how cash flow data can be applied after a loan is originated. Servicing use cases (e.g., proactive financial health monitoring and line management) and collections use cases (e.g., debt repayment planning powered by open banking) were all the rage, both on stage and in all the hallway conversations I was having.

This makes me so happy, I can’t even tell you. Loan servicing is tragically underinvested in IMHO.

It would be great to see open banking and programmatic access to cash flow data catalyze a change in this area.

And I absolutely want a speaking slot at Nova Credit’s future Cash Flow Servicing Summit!

I Have the High Ground!

Here’s a random fact I didn’t know — if you are delinquent in paying your cell phone bill with any of the big U.S. carriers, they won’t shut off your ability to make calls (at least not right away). Do you know what they do instead? They redirect the calls you try to make to their call center so they can help you get that late payment taken care of.

Smart.

If you extend credit of any kind, you want to be Obi-Wan, not Anakin.

(Editor’s Note — It’s totally fine if you don’t understand this reference!)

In a modern context, if you control foundational infrastructure (network, hardware, OS, etc.), you have the high ground.

Who Pays for Trust?

The amount and quality of bank nerd content this week was unbelievable.

One of my favorite bank nerd conversations was about the cost of trust.

We talk all the time in financial services about the value of trust. We spend much less time talking about what it costs to create and sustain trust in financial services.

It’s not free!

One of the reasons that I think we haven’t seen a Synapse-sized problem in the world of payment card issuing and merchant acquiring (at least recently) is that we have something in that space that we don’t have in the BaaS deposits space — Visa and Mastercard.

As everyone in payments knows, the card networks’ rules are extensive and aggressively enforced. They can feel a bit unfair when you’re on the wrong side of them, but, in general, they’re extraordinarily helpful for establishing and maintaining the trust that allows commerce (online and in-store) to flourish.

Merchant interchange fees pay for trust in card-based commerce.

The FDIC plays a similar role with banks and deposit products.

The FDIC’s superpower in creating trust is not the insurance fund (which is rarely spent and is, as we saw with SVB, backstopped by the U.S. government anyway). It’s the FDIC’s Division of Resolutions and Receiverships, which facilitates the orderly failure of banks and the seamless transfer of their customers over to new banks (usually all over the course of one weekend).

The FDIC DRR is a badass group and it costs money to operate. That money comes from the quarterly assessment fees that banks pay to the FDIC.

Put simply, in retail banking, banks pay for trust.

As the Synapse clusterfuck has dramatically illustrated, the FDIC doesn’t insure fintech companies or other non-bank service providers. If those companies want to earn back the trust of the public, it would be wise for them to remember that trust costs money.

Why Don’t U.S. Banks Pay for Financial Health?

Related to the point above, why don’t banks pay some type of recurring fee or donation to help protect and sustain consumers’ overall financial health?

Did you know that in the UK there is an organization called PayPlan, which offers consumers free debt advice and free debt management plans? PayPlan is funded by donations from UK lenders, which are apparently enlightened enough to understand that jointly paying for an impartial service to help consumers get out of debt is a better solution than competing in zero-sum collections contests.

WE SHOULD DO SOMETHING LIKE THIS IN THE U.S.!

Why Don’t We Link Lending and Savings Together?

You set up auto-pay for a loan. An installment loan with a fixed interest rate, let’s say. You become accustomed to paying that $120 every month. You build it into your budget and your lifestyle.

Then you finish paying it off.

Why don’t more lenders offer you the option to automatically continue to make that payment (or a portion of it), except now it will go into a high-yield savings account or a wealth management account of some type?

Is this not an obviously good idea? Among other things, wouldn’t this be an excellent way for banks and neobanks to convert customers they pick up through indirect channels into long-term customers? Imagine if Chime got into indirect auto lending and built this feature to convert their auto loan customers into loyal members.

Why Can’t Borrowers Pick Their Payment Due Dates?

In this same vein, one last question — why can’t borrowers pick their own payment due dates?

It’s not uncommon for low-to-moderate-income borrowers to strategically apply for credit on specific days of the month so that their payment due dates (which are typically decided based on the account open date) will align well with their cash flow patterns.

Wouldn’t a much better solution be allowing borrowers to pick their payment due dates? And what if we went one step further and leveraged open banking to present them with a personalized view of their average monthly cash flows and a recommendation on which day(s) might work best?