Despite Block beating analysts’ earnings estimates for Q2, 2024 has been a rough year for the fintech company:

Interestingly, the picture looks slightly more positive if you extend it to a full 12 months:

Why is that? Why was September of 2023 the recent nadir for Block?

Well, I think it’s the same reason that Block’s stock price has continued to lag well into 2024 — Square.

While Cash App, Block’s consumer-facing neobank, continues to grow ($1.3 billion in gross profit in Q2 2024, a 23% year-over-year jump, and a year-over-year increase of 13% in monthly active users), Square hasn’t been able to find its footing since a two-day service outage in September of 2023 (which impacted small businesses’ ability to process payments) and the subsequent ouster of then-CEO Alyssa Henry (who was replaced by the company’s founder, Jack Dorsey).

Having just passed the one-year anniversary of Mr. Dorsey’s return to the top job at Square, I thought it would be a good time to review what he’s been trying to do at Square and discuss some of the larger strategic challenges facing the business.

(Editor’s Note — much of the rest of this essay, as well as my overall insights into Square, are built on the excellent analysis of my fintech friend Jev Kazanins, particularly his article What is going on at Square?, which you should absolutely read.)

What is Jack Dorsey Trying to Do With Square?

A lot of changes have happened over the last year, but I think most of them can be grouped into two buckets:

- Restructure the Organization

- Reorient the Strategy

Let’s walk through each.

Restructure the Organization

This initiative started with the layoffs (across all divisions of Block) — 1,000 in January, another 112 in March — with the goal of keeping Block’s total number of employees under 12,000 until revenue and growth justify climbing back up above that threshold.

Pretty standard stuff for a large public company with a struggling stock price.

The next phase is more interesting.

Motivated, perhaps, by reports of strife between its different product divisions, Block has undertaken a fundamental restructuring of its org chart. As Block explains, the reorg divides up employees by function rather than product or division:

We are moving Block to a functional organization, meaning an employee’s discipline (e.g., engineering, design, product, or sales) will drive who they report to and how they work.

And according to Dorsey, this change is specifically designed to elevate engineering and design as cross-company disciplines:

We’re reorganizing the people in Square back to a simple Engineering/ Product/ Design/ Sales structure. The past organizational structure was holding us back, slowing us down, and weakening our skills. I want Square to be a leader in engineering and design again.

Reorient the Strategy

Along with this reorganization, Block is making some fairly significant changes to its strategy for Square.

Under Alyssa Henry, Square’s strategy was built around three pillars:

We are focused on 3 strategic priorities. First, omnichannel software. We want to help sellers make the sale no matter where their buyers are. Second, global expansion. While commerce is different around the globe, all sellers face similar challenges. Third, growing upmarket. We already serve a growing number of larger sellers and expect that growth to continue.

As Jev astutely pointed out in his article, these priorities are nowhere to be found at Square in the new Dorsey regime. Instead, Dorsey is focused on the following four strategic priorities:

- Building a “rock solid and flexible multi-vertical platform.”

- Providing a “local” experience to sellers of all sizes.

- Banking on Square.

- Growing with AI.

“Growing with AI” appears to be mostly fluff for investors. Square has released a few AI tools for sellers (like one that can automatically generate product descriptions and menus), but all of them seem to be more incremental than transformative.

Banking, on the other hand, has been transformative for Square. Here’s Jev:

In Q2 2024, gross profit from Square’s banking products grew 27% YoY. Square originated more small business loans than Chase ($1.45 billion vs. $1.31 billion), and banking now contributes 23% of Square’s gross profit.

Providing a “local” experience to sellers of different sizes is a harder strategic priority to parse, but it appears to be mostly about adjusting Square’s sales and go-to-market efforts to focus more specifically on verticals, including those that are inherently local, like restaurants and service businesses.

This strategic shift seems to be one of the motivating factors in Dorsey’s recent promotion of Nick Molnar, co-founder and CEO of Afterpay, who will “lead a centralized sales function across Block, inclusive of Square.”

Here’s how Dorsey explains Molnar’s promotion:

Nick will focus immediately on raising the performance bar of the Square team, continuing to hire across inbound and outbound sales, building out our field sales strategy and team, strengthening our sales motion.

While Square is trying to take a more diversified and vertical-specific approach to sales and GTM, on the product side, it’s almost the exact opposite. Dorsey said he wants to build a “rock solid and flexible multi-vertical platform.”

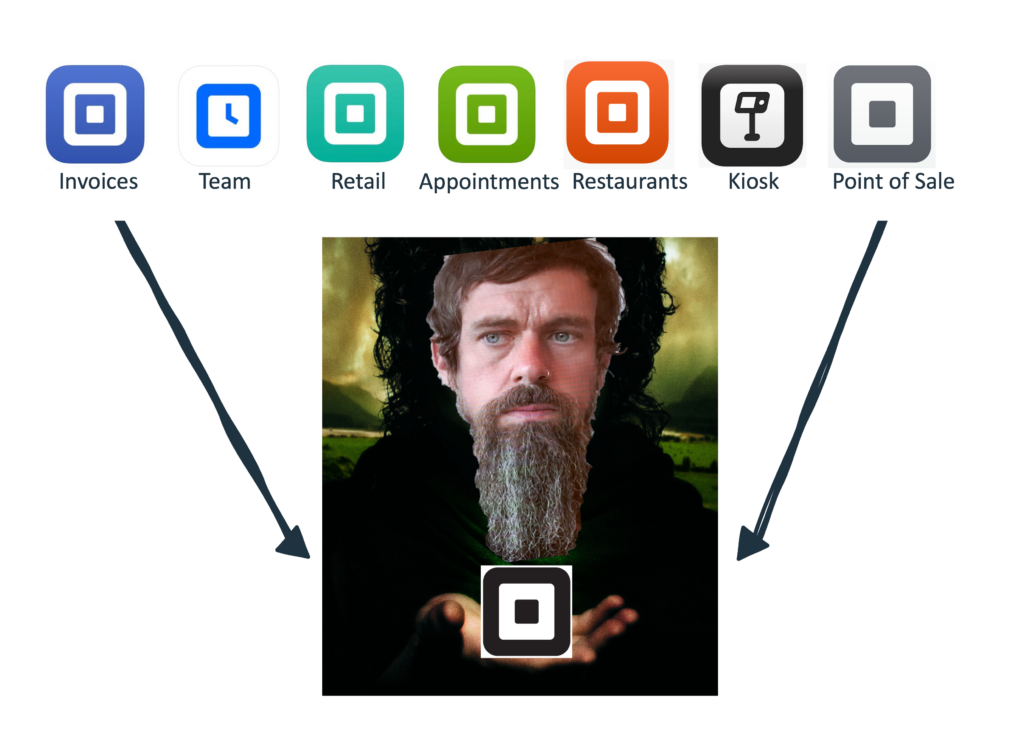

This is obviously a response to last year’s outage, but it’s also a recognition that Square’s previous product strategy — building different apps for different verticals and use cases (Square Point of Sale, Square Restaurants, Square Kiosk, etc.) — isn’t feasible given Dorsey’s raised expectations for performance and feature velocity.

Thus, Dorsey has said that all of Square’s apps are going to eventually be pulled back into a single app.

One app to rule them all.

The Strategic Challenge with Square’s New Strategy

It’s this last priority — building a rock-solid and flexible multi-vertical platform — that most clearly illustrates the strategic challenge facing Square.

The reason that the company built all those separate apps in the first place was that it was responding to the increasing verticalization and product specialization that we’ve seen in the small business space over the last couple of decades.

Here’s how Matt Brown, an investor at Matrix, describes this evolution:

Starting in the 2000s, the dominant strategy for most B2B categories was to build a single product, target a horizontal or at least a broad market, and monetize through SaaS. Think of the companies founded in 1995-2010 … I call this “SaaS 1.0”.

2005-2015 represents the era of “vertical software” or “vertical SaaS.” These companies targeted specific verticals but also monetized via SaaS. Their vertical focus was the common denominator. Some focused on a single product for a vertical. Others embraced a multi-product approach, often including non-software financial products, like payments (e.g., Mindbody doing scheduling and payments and more for fitness studios).

Starting in the late 2010s, there was a variation to vertical software that I think is significant enough to warrant its own label, which I called “vertical ERPs.” These focus on a specific vertical, are multi-product with both software and embedded financial products like payments, and, most critically, attempt to become that vertical’s system of record by orienting their multiple products to create, capture, and expose the core data for that business. These companies will often describe themselves as the “operating system for <<vertical>>” or “all-in-one <<vertical>> management platform.”

Toast is the biggest and most threatening example of this trend. The company provides a vertical ERP for restaurants, featuring a wide array of capabilities, including payments. In Q2 2024, Toast delivered 26% year-over-year growth in payments volume (compared to 7.8% for Square) on a similar volume ($41 billion) to what Square processes ($58 billion).

This makes intuitive sense.

Toast is built for restaurants. That’s all they think about. Everything they build is tuned for restaurant owners, operators, and employees.

Square has made a valiant stab at competing with Toast:

But it just can’t bring the same organizational focus to the space that Toast can.

And the big problem is that Square’s core business — helping entrepreneurs process payments and run their businesses — isn’t just being challenged in the restaurant vertical. It’s being challenged by vertical ERP providers in every vertical. Childcare (Brightwheel), architecture & engineering (Monograph), law (Clio), laundry (Cents), and hundreds more.

Square can’t possibly be expected to build individual apps to compete with all of these vertical ERP competitors (which aren’t staying still, as Matt Brown explains in his latest essay), but its strategy to build one single app (which it clearly feels is necessary to restore the product quality and reliability that Dorsey expects) and have Nick Molnar sell it into every vertical feels like a daunting task.

Like Jon-Snow-at-the-Battle-of-the-Bastards level daunting.

However, if Molnar doesn’t find a way to compete with these vertical-focused competitors, the most successful part of Square’s business — embedded banking and lending — will start to falter as well.

As I have written about previously, the embedded banking and lending model in B2B, which Square helped pioneer, is entirely dependent on the platform’s ability to capture the payments processing business of the small businesses that it wants to bank and lend money to.

If that payment processing business gets taken away by the Toasts and Brightwheels of the world, Square’s bank (which it spent a lot of money setting up) loses the high ground.

If you’re not processing payments for a small business, what right do you have to win their deposit business? If you don’t have visibility into a small business’s cash flow and the ability to intercept its incoming payments, how can you safely underwrite them for a loan?

Those are tough questions to answer, and I don’t think it’s entirely a coincidence that some of the folks who previously ran those embedded finance products at Square (Jackie Reses, Luke Voiles) are now building infrastructure products to enable Square’s competitors to better compete with them.

The question is how will Square — a true OG in fintech and the creator of my single favorite logo — respond?