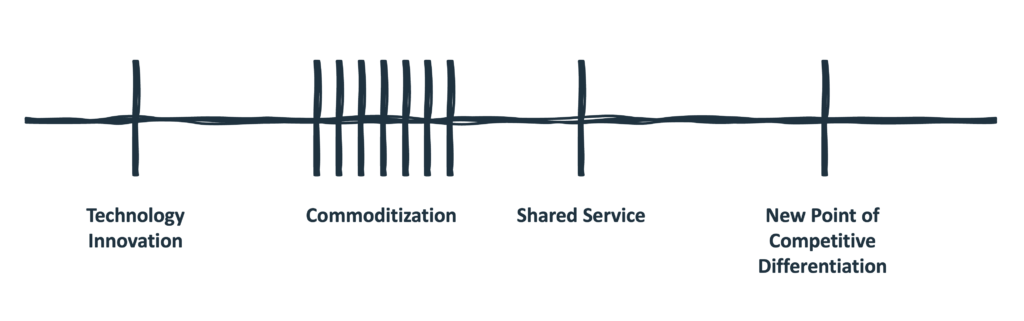

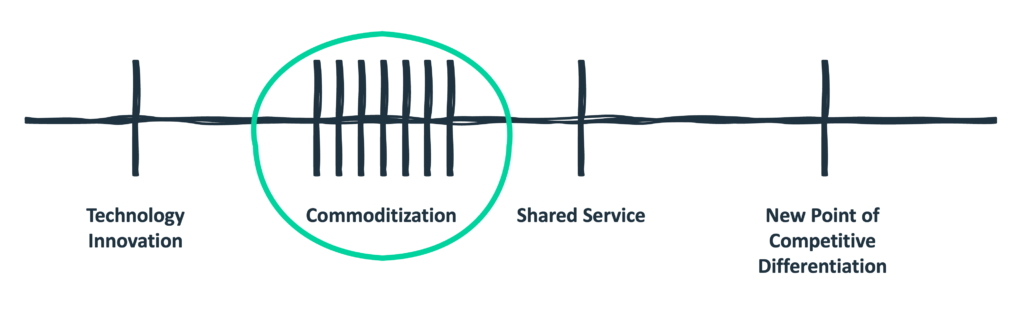

Let’s start with a pattern, which I see constantly:

- Technological progress leads to the development of something fundamentally new and valuable.

- A few forward-thinking companies (usually startups) capitalize on this technological innovation to deliver a differentiated product, service, or experience.

- Eventually, their success attracts competition from other startups and market incumbents, which all attempt to harness the same innovation.

- This concentration of competition leads to diminishing returns as everyone copies everyone else, and the best practices for utilizing this innovation become commoditized.

- Someone in the market identifies this moment of commoditization and builds a shared service that provides access to this innovation at a dramatically lower cost. This shared service usually delivers superior performance because it benefits from a scale and experience with edge cases that no single company can match.

- Forward-thinking companies (usually startups) take advantage of this shared service and invest their resources in building competitive differentiation in a different part of their business instead.

It looks roughly like this:

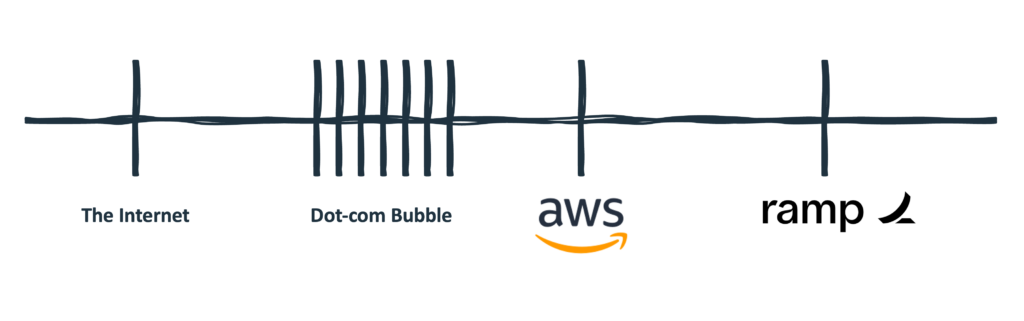

A good example is the emergence of cloud computing over the last 30 years:

- The commercial internet emerges in the early 1990s. It becomes clear that the internet can be used to deliver data and services directly to consumers.

- Early internet-native businesses appear, seeking to capitalize on this opportunity.

- The dot-com bubble of the late 1990s occurs. Aspiring internet-native businesses burn through incredible amounts of money (mostly supplied by venture capital investors), building the computing infrastructure to compete with early leaders like Amazon, eBay, and Google.

- The dot-com bubble bursts.

- In the early 2000s, Amazon realizes that it can productize its extensive investments in its computing infrastructure as a service for other developers to build on. In 2006, Amazon launches Amazon Web Services (AWS), with Andy Jassey (then the head of AWS) describing the vision thusly: “We tried to imagine a student in a dorm room who would have at his or her disposal the same infrastructure as the largest companies in the world. We thought it was a great playing-field leveler for startups and smaller companies to have the same cost structure as big companies.”

- Startups and small companies take advantage of AWS (and the emergence of cloud computing, more generally) to significantly increase the pace at which their developers ship code, allowing them to build a compounding product innovation advantage over incumbents. Ramp, a well-known example of this in fintech, credits AWS: “AWS really helps by abstracting away the details of running all of our components. Our developer velocity across the organization has significantly increased from using AWS.”

The emergence of the modern e-commerce industry, which began in earnest in the late 2000s and early 2010s, appears to be following a similar path.

Innovations from digital payments companies like PayPal and Stripe make selling products over the internet much safer and easier than it was previously. This leads to an explosion of direct-to-consumer (D2C) retailers and subscription services. All of these companies (rightly) obsess over building the most frictionless e-commerce checkout experience possible, an effort that becomes an even higher priority during the COVID-19 pandemic.

The result is today’s e-commerce landscape, in which most checkout pages are reasonably well-optimized (the basic principles of e-commerce UX and conversion are broadly understood at this point), but the “perfect” checkout page remains frustratingly elusive, as Stripe explains:

Recent Stripe research found that 99% of the leading e-commerce sites make five or more basic errors in their checkout, such as not auto-filling addresses, not allowing customers to save their payment details for future use, or not offering the payment methods their customers prefer.

No one issue is huge on its own, but they add up to revenue death by a thousand cuts. And businesses would fix these problems on their own, except that a great checkout is a moving target that requires continual updating as consumer preferences change and technology evolves. It’s more than most businesses can manage, and the challenge is even more pronounced for large, sophisticated companies—the complexity of their checkouts compounds with the scale of their business.

The observation here is strikingly similar to Amazon’s observation in the 2000s that other companies, while becoming proficient in building and operating data centers, would never be as good at it as Amazon was.

So, like Amazon, Stripe has been working to build a superior shared service for e-commerce checkout. Here’s how the company describes the value of this service:

Teams of Stripe engineers and designers obsess over every aspect of the checkout page, from reducing load time to streamlining how customers fill in their addresses. We sweat the details to an extent that would be irrational for nearly any company building their own checkout flow.

Stripe Checkout adapts to each customer down to their location, device, browser, and individual user settings. For example, Checkout automatically surfaces the right payment methods based on your customer’s location—you don’t have to run A/B tests to identify the highest converting payment methods in Belgium. We just handle it for you. If a customer in Japan accidentally has their keyboard set to full-width characters, we’ve done the work to ensure they can seamlessly complete their purchase without needing to build CJK numeral support. (If you don’t quite know what that means, that’s the point! We’ve handled the edge case.)

Stripe Checkout and its sister service, Stripe Elements (which focuses on modular UI components for checkout), aim to free retailers from obsessing over e-commerce conversion optimization at the expense of other, more important initiatives.

It’s too early to say if Stripe will be as successful in this strategy as Amazon was or what the next point of competitive differentiation in retail might be (although I think brand-led marketing might make a comeback if the recent lessons learned by Nike are any guide).

Regardless, it seems safe to assume that the era of competitive differentiation in e-commerce UX design and checkout page optimization is coming to an end.

The relevant question for us is how this cycle — innovation → commoditization → shared service → innovation — might manifest in financial services.

There are numerous possibilities, but there’s one that I want to focus on.

Digital Account Opening

Digital account opening — the process of approving a customer for a financial account and onboarding them entirely online — emerged in the late 1990s and early 2000s. It started with credit cards and deposit accounts before eventually expanding into unsecured personal loans, small business loans, and mortgages.

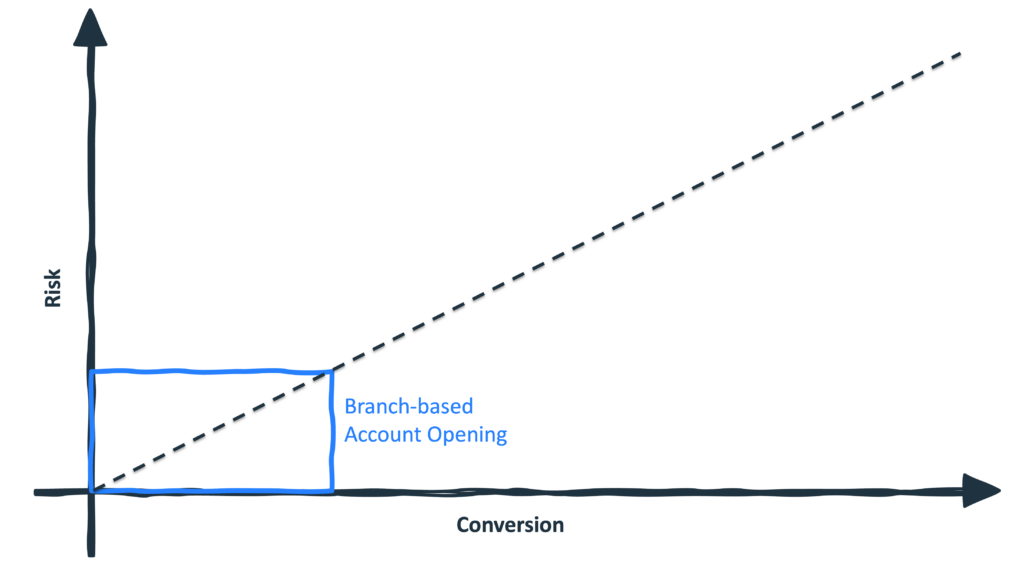

It was a much better experience for customers compared to the dominant distribution model that proceeded it — branch-based account opening.

As such, the first companies to offer digital account opening in their respective product areas realized a significant competitive advantage over the rest of the market.

Rocket Mortgage is an instructive example. The company launched the first fully online mortgage application experience in 2015, and by 2018, it had become the largest mortgage originator in the U.S.

Predictably, this competitive advantage did not last.

Between 2010 and 2020, almost every incumbent financial services provider enabled some level of digital account opening for their products. Simply offering a digital account opening experience wasn’t enough to win anymore. Now, you had to offer the best digital account opening experience.

The challenge in building the best digital account opening experience is that, unlike similar use cases in other industries (such as e-commerce checkout), it is a multivariate problem.

In financial services, we can’t just optimize for conversion rate. We have to optimize for risk-adjusted conversion rate because the products we are selling come with a variety of risks, including fraud risk (is this person who they say they are?), compliance risk (am I allowed to do business with this person?), and credit risk (is this person going to do what they are promising to do?)

Now, in a branch setting, the constraints of this multivariate optimization problem are fairly tight.

Your conversion rate will be limited by two simple facts: 1.) You won’t have branches near every potential customer, and 2.) Many potential customers won’t endure the inconvenience of coming into the branch, even if it is nearby.

However, your risk is also constrained. Most fraudsters don’t like to walk into buildings with lots of security cameras, and the level of certainty inherent to face-to-face interactions (where the bank employee can look at your ID, match it to your face, and observe your body language) creates a more trusted environment in which to establish a new relationship.

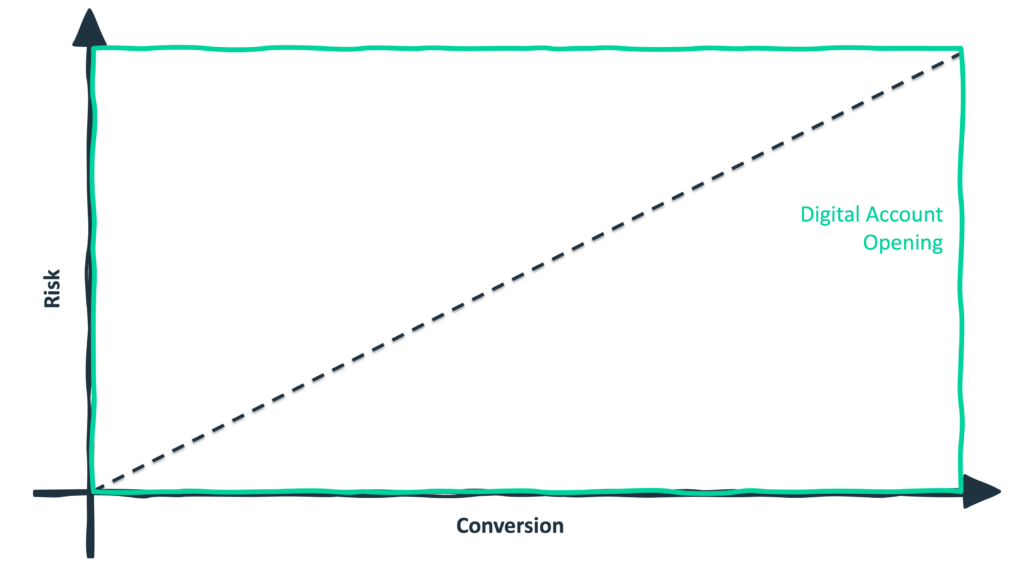

In digital account opening, these constraints disappear. This significantly widens the top of the acquisition funnel (since branch proximity and convenience are no longer limiting factors), but it also massively increases the potential for losses (since digital interactions are anonymous by default and highly efficient for fraudsters).

So, over the last 5-10 years, one of the primary points of competition in financial services has been finding the optimal point within this conversion—risk management trade-off.

Ten years ago, this was a challenge. There weren’t a lot of know-your-customer (KYC) and fraud management solutions built specifically to address the unique requirements of digital channels. In fact, when I was designing digital account opening process flows in fintech at that time, we had to make do with a combination of credit bureau header data and ID and document scanning, which was only available from two vendors.

Fast forward to today, and things have changed.

I can name 16 different ID and document scanning vendors off the top of my head, and ID and document scanning is just one of many different categories of KYC and fraud management tools built specifically for digital account opening.

It’s a lot:

Indeed, it’s so much that an entire complementary class of solutions — orchestration platforms — has sprung up to help banks and fintech companies integrate with and utilize this ecosystem of KYC and fraud management products.

We’re also seeing significant consolidation in this space as larger KYC and fraud management companies gobble up smaller ones, and the lines between point solutions and orchestration platforms continue to blur (Socure’s recent acquisition of Effectiv is a good example).

I expect this consolidation to continue for the foreseeable future, which suggests to me that we might already be well into the commoditization phase of the cycle for digital account opening:

If that’s true, the question is, what comes next?

Will we see banks and fintech companies utilize shared services for best-in-class digital account opening and onboarding?

And if we do, what will be the next point of competitive differentiation in financial services?

A Game With Memory

If the only thing a financial services provider cares about is top-line growth (which, incidentally, was the defining characteristic of the fintech ecosystem during the low interest rate years), then it makes sense to myopically focus on finding that optimal balance point between conversion and risk management within the digital account opening process.

And it certainly makes a fintech product manager’s job seemingly straightforward:

Design a waterfall decisioning process for identifying bad actors who apply for our product while minimizing user friction and cost.

This is what we’ve been doing for the last 5-10 years. And today, even as fraudsters have become more sophisticated and fintech companies’ incentives have shifted from generating growth-at-all-costs to focusing on profitable unit economics, this competition to design the “best” digital account opening process is as fierce as ever.

However, it’s useful to remember how account opening used to work back in the day.

For all the problems with branch-based account opening (and they are myriad), the subtle benefit is that it is focused on identifying and establishing relationships with good actors, not screening out bad ones.

That may seem like a distinction without a difference, but it’s not.

When you begin a new relationship with a bank through a branch, you are establishing an identity and a reputation with that bank that will persist.

Sure, that first visit will be inconvenient and perhaps a little awkward or intimidating (there’s a reason why many of us got our first bank accounts with the banks that our parents used … it’s less scary to walk into the branch with your parents next to you).

However, the second visit — to deposit a check or make a transfer or open another account — will be a little more convenient and a little less awkward or intimidating. And the same for the next time and the time after that and the time after that. Because the bank (or, more accurately, the bank employees working in the branch) remember you.

Every interaction you have with them gives them more insight into who you are and more context on how your finances work and how they can help you improve them. It strengthens your reputation with them as a good, profitable, and (hopefully) pleasant customer to deal with, and the benefits of that strengthened reputation — less friction and more personalized service and cross-sell offers — strengthen your trust in them. And that trust becomes a competitive moat for the bank.

In the transition from branch-based account opening to digital account opening, we lost this.

Imagine how strange it would be for a bank operating a branch-based distribution strategy to have a dedicated person for opening accounts with net-new customers who those customers never saw again post-account creation. Yet this is what digital account opening resembles today. Point solutions are used to assess risk at a moment in time, and then different tools are used to pick up the job when that new customer signs in or attempts to open another account.

Blackjack is the wise gambler’s preferred game because it’s a game with memory. The longer you play — if you pay attention — the better you do.

A digital account opening process that is myopically focused on screening out bad actors as efficiently as possible is akin to playing Blackjack without counting cards — a losing proposition.

You can minimize your losses by playing perfect basic strategy (this is what banks and fintech companies have been doing by using orchestration platforms to design their sophisticated waterfall decisioning processes), but the odds are still not in your favor.

If the cycle that we saw in cloud computing and that we have started to see in e-commerce — innovation → commoditization → shared service → innovation — plays out in digital account opening, I think this is the innovation that the market will jump to next.

We will figure out how to persist identity and reputation beyond account opening.

This isn’t a problem that will be solved through further enhancements to fraud/KYC tooling. Instead, the solution will harness new technology, technology we didn’t have 10 years ago, such as standardized cryptographic passkeys for secure re-authorization and secure, isolated compute environments like AWS Nitro Enclaves, to imbue memory into digital identity.

Competing In A World Without Walls

As I just explained, I think a big reason why consumers and business owners rarely switched banks in the days when branch banking was ascendent was because they valued the reputation that they had built with their banks and the benefits that reputation afforded them.

However, in the interests of intellectual honesty, I should also point out the other, more obvious reason why switching has historically been so rare — it was a massive pain in the ass!

Switching banks in the days before digital banking (and digital account opening, specifically) was a logistical and administrative nightmare that only the most desperate would sign up for.

This has changed.

We now live in a world without walls. Digital channels have flattened the competitive playing field, and regulatory initiatives like open banking are making consumers’ financial lives portable in a way that they have never been before. AI agents, powered by large language models, will make switching the default behavior for financial services customers.

How do banks and fintech companies compete in this world? How do you build a sustainable business in an environment where every one of your customers can be taken away from you as easily as you took them away from someone else?

A more optimized digital account opening process isn’t the solution.

Instead, we need to use that account opening process to establish a persistent digital identity that follows the customer through every subsequent touch point and is enriched by every subsequent interaction. A digital identity that, over time, unlocks more convenient, personalized, and rewarding experiences.

Today, most banks and fintech companies lack the infrastructure to enable this persistent digital identity. Tomorrow, such infrastructure will be a competitive necessity.

About Sponsored Deep Dives

Sponsored Deep Dives are essays sponsored by a very-carefully-curated list of companies (selected by me), in which I write about topics of mutual interest to me, the sponsoring company, and (most importantly) you, the audience. If you have any questions or feedback on these sponsored deep dives, please DM me on Twitter or LinkedIn.

Today’s Sponsored Deep Dive was brought to you by Footprint.

Footprint is a single, simple-to-integrate SDK that brings trust back into onboarding. For years, onboarding has been replete with disjoint point solutions, leaving companies unsure of how to gain comfort in their users at onboarding and through the customer journey.

The point solutions were a necessary solution for the time, but as new technology came online, we can now view onboarding more holistically and progressively. Advances in strong authentication (such as FIDO2) allow for high-fidelity re-authentication combined with a built-in, high-security vaulting solution powered by the latest in secure vaulting technologies, giving Footprint the ability to store sensitive data in very high-security ways. By combining identity, fraud management, authentication, and data vaulting, Footprint enables companies to intelligently onboard and maintain memory as they continually verify and service customers.