Seemingly simple questions will often have surprisingly complex and interesting answers.

Here’s one that I’ve been obsessing over recently — Why doesn’t every small business have a credit card?

Let’s level set with some data.

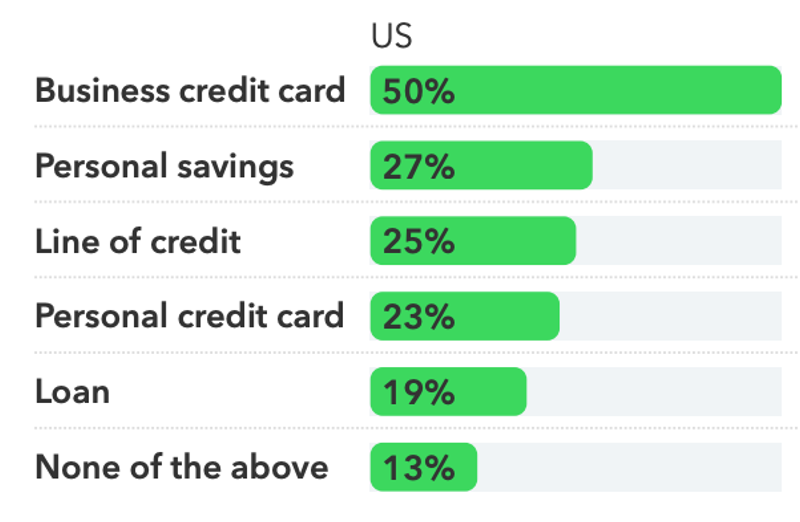

The first thing that we should note is that while not every small business has a credit card (only about half do), credit cards are the single most popular form of credit used by small businesses.

According to the 2025 Intuit Quickbooks Small Business Index Annual Report (say that ten times fast), 50% of small businesses (defined as those with 0-100 employees) in the U.S. used a business credit card last year, which placed it at number one on the list of financing products used:

This makes intuitive sense.

The two things that are universally true about small business owners are that they are time-constrained (I always picture Bugs Bunny playing all the positions in a baseball game when I think about the average small business owner) and always in need of capital (3 in 5 small business owners said that their business needed additional financing more in 2024 than they did in 2023, according to a survey from WalletHub).

By blending together a payment instrument with ubiquitous acceptance and a financing instrument that allows for both short-term and long-term unsecured borrowing, credit cards solve for both the convenience and cash flow needs of small business owners in a very elegant way.

Here’s how the owner of an HVAC installation company described the utility of credit cards for his business to Intuit:

We use a credit card every single day. That can include buying burritos for my team in the morning, to buying a piece of equipment, to buying materials. It’s a heck of a lot easier to go swipe a credit card than to get a loan.

Indeed, according to the Intuit report, small businesses that received more capital from banks (through higher credit card limits) had higher employment and revenue growth than those that did not.

So … case closed, right? Business credit cards are good for small businesses and we should focus on figuring out how to get more of them into the hands of small business owners.

Well, not quite. Here’s Intuit again:

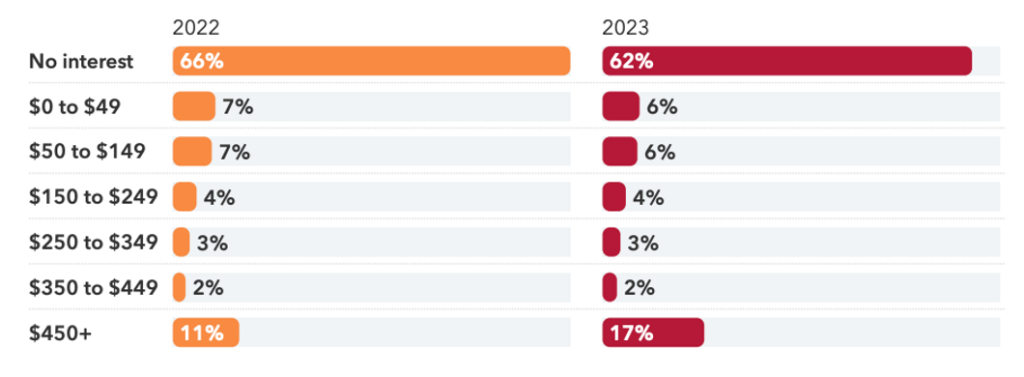

In 2022, 66% of small businesses were borrowers. In 2023, this number increased by 4 percentage points. Not only did more small businesses become borrowers, the amounts that they borrowed and the interest expense associated with such borrowings also increased notably. The number of small businesses paying more than $450 a month in interest charges, for example, increased by 6 percentage points. This suggests that between 2022 and 2023, more businesses became debt-burdened.

The problem with small businesses using credit cards is the same problem that we see with consumers using credit cards: revolving credit card debt can be very expensive and very risky.

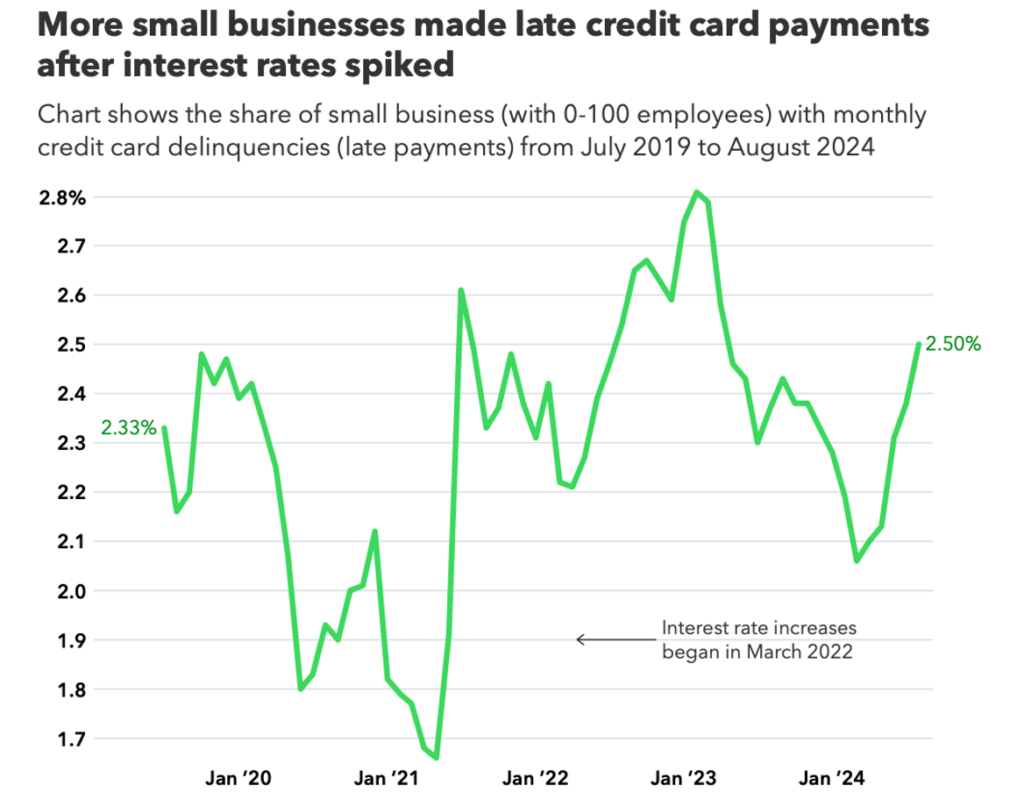

This has proven especially true for small businesses as interest rates have risen, sharply, over the last couple of years, which has unfortunately led to an increase in delinquencies according to Intuit:

So, now our question gets more complicated — How can we get more business credit cards into the hands of small business owners *and* ensure that small business owners don’t misuse those cards in a way that will harm the long-term prospects for their businesses?

I think the short answer is that banks need to be less directly involved.

The Inherent Challenge With Banks and Small Business Lending

Banks’ share of the business credit card market has actually grown substantially over the last 15 years.

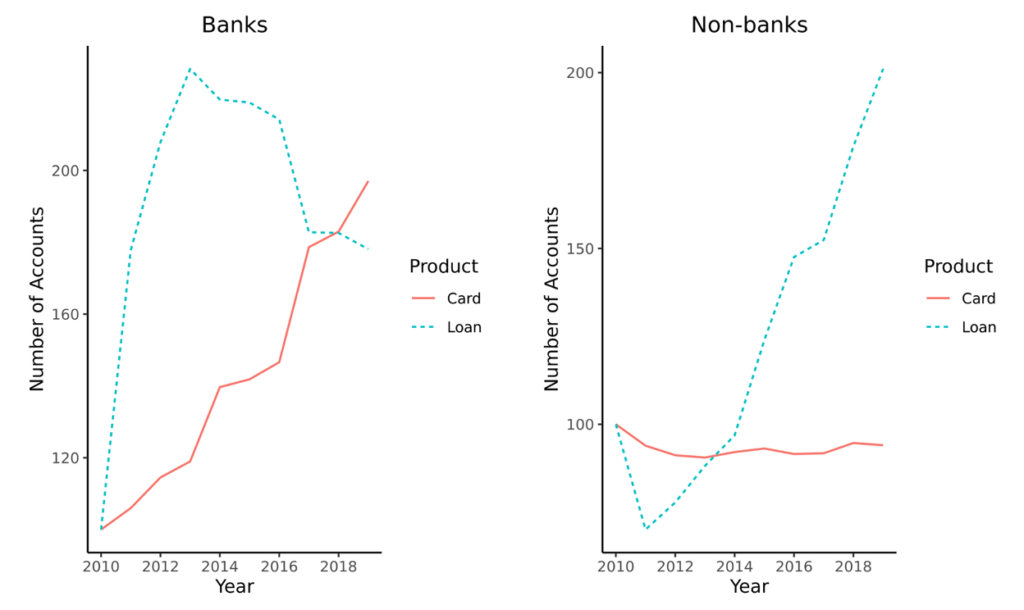

A 2022 paper — Wide or Narrow? Competition and Scope in Financial Intermediation — published by the FDIC found that the number of commercial credit card accounts opened by banks increased significantly between 2010 and 2018, while the number of commercial installment loans started decreasing by a comparable rate, starting around 2013.

Correspondingly, non-bank lenders (such as fintech companies) picked up a lot of market share in commercial installment lending during that same time period, while their participation in the commercial credit card market stayed relatively flat.

The authors of the paper primarily attribute this flip in the market to regulatory changes to banks’ capital requirements following the Great Recession. Specifically, Basel III changed the risk weight on small business credit cards from 75% to 45%, which incentivized banks (which are constantly constrained by capital) to prefer small business credit cards to small business term loans (which didn’t see the same reduction in risk weight).

This helps explain the success of 2010s-era non-bank small business lenders like Kabbage and OnDeck Capital.

However, it also illustrates the challenge for small business owners.

As we’ve established, small business owners like credit cards. Their combined payments and unsecured lending capabilities are deeply appealing. The problem with banks being the primary purveyors of small business credit cards is that they’re not very good at it!

According to J.D. Power’s 2024 U.S. Small Business Credit Card Satisfaction Study, 51% of U.S. small businesses are currently categorized as financially unhealthy. Among those who are financially unhealthy, 61% are carrying revolving debt on their business credit cards and 63% are borrowing with those cards to fund operating expenses. These small business owners are less likely to be satisfied with their card issuers, less loyal, less likely to recommend their product, and less likely to feel like the credit card rewards they are earning are helpful to their business.

The factors driving these results are structural.

It’s not that banks are doing a bad job, individually, but rather that banks as a group are not well-positioned to optimize both market penetration and financially healthy product usage. These factors include:

- Customer acquisition. Acquiring small businesses is hard. There are a bunch of them. They are spread out, both in terms of geography and industry. They go out of business constantly. And, as we have already discussed, they are run by stressed, overworked entrepreneurs who rarely take the time to carefully shop around. Banks can usually cross-sell small business products to their existing consumer customers who also own businesses (upgrading a consumer card being used for business purchases to a small business card is a common tactic), but growing outside of that footprint is expensive and that cost ends up getting priced in.

- Underwriting. Small businesses, as I have written about previously, are more difficult to underwrite than consumers because they are heterogeneous. They don’t look the same or act the same. And banks, for the most part, lack access to the deep industry expertise and proprietary data necessary to meaningfully improve the accuracy of their underwriting for specific small business customer segments. The result is higher credit card interest rates across the board, to compensate for the added risk.

- Servicing. Banks need to make money on their small business credit card portfolios. As such, they don’t have an incentive to encourage their small business customers to minimize the amount of debt that they revolve or to offer them other forms of financing (unsecured term loans, equipment financing, etc.) that would eat into their interest income. Obviously, there’s a balance here. Too much revolving debt can lead to an increase in delinquencies and charge-offs, which hurt banks’ bottom lines. But still, in general, banks are incentivized to encourage small business customers to carry excessive amounts of revolving debt for as long as possible. Additionally, when a small business does hit a rough patch and is unable to make their credit card payments, banks aren’t nearly as accommodating with them as they are with their larger commercial clients, with whom they have bigger and more profitable relationships.

Given these structural challenges, who should we look to, as viable competitors to banks in the small business credit card space?

An obvious guess would be fintech companies focused on areas like B2B neobanking and spend management.

This is a good guess, and I do think that B2B fintech companies have a role to play in this market. However, I think their role is likely going to concentrate more on the “M” in SMB, rather than the “S”.

Many of the same structural challenges that limit what banks can do in the small business credit card market also limit what B2B fintech companies can do. Customer acquisition is still difficult and expensive. Underwriting is still burdened with lots of unknowable risks. And providing perfectly tailored products and customer service experiences is still difficult, given the limited revenue potential of each individual customer.

Brex, which has built a very successful spend management and business banking platform for high-growth startups, provides a good example. The company tried to expand into serving small businesses more generally in 2017, but by 2022 it had reversed course after experiencing, firsthand, the challenges I’ve been describing.

So, if not B2B fintechs, then who? Is there any viable path forward for increasing the responsible use of credit cards among small businesses?

I think there is.

The Path Forward: Embedded Finance

We’ve talked a lot about embedded finance in this newsletter, but here’s a quick refresher — embedded finance is the delivery of financial products and services through non-finance companies’ products and distribution channels.

It’s not a new idea. Sears was doing it with insurance and its retail stores nearly 100 years ago.

However, it has recently become a very popular concept in fintech thanks to the digitization of everything, which has made the process of embedding a financial product or service as simple as integrating with an API.

I believe embedded finance is the solution to our problem. In fact, I would predict that within 10 years, a majority of new small business credit card accounts will be originated through embedded distribution channels.

This is a bold prediction, given the extent to which banks dominate the small business credit space today. So, let’s walk through my reasoning:

- Distribution. Acquiring new small business customers is difficult and expensive. Distributing credit cards to the existing small business customers of non-finance brands and platforms is comparatively easy and inexpensive. Distribution is the number one reason why indirect channels tend to beat direct channels in financial services, and I think this dynamic is especially valid in the small business lending space.

- Data. There is no single, massive dataset out there that can help lenders evaluate the risk of a prospective small business borrower. Instead, there are thousands of small datasets, clustered around common attributes (company size, industry, geography, etc.) and collected by the non-finance companies that serve those small businesses. Leveraging those companies to distribute credit cards allows issuers to tap into those proprietary datasets for underwriting and servicing.

- Incentives. Unlike banks, non-finance companies that engage in embedded finance have other ways of making money. Embedded finance may deliver some incremental revenue, but it’s not the only (or even primary) motivation for the company. As such, these companies are highly motivated to keep their small business customers from engaging in financially unhealthy behaviors (racking up excessive debt, revolving a balance for an extended period, etc.) that lead to increased revenue but also increased customer dissatisfaction. Indeed, many non-finance companies that would make good candidates for delivering embedded small business credit cards are explicitly incentivized to help their customers improve their financial health.

That’s a bit abstract, but hopefully it makes sense.

Now let’s get a bit more concrete — where, specifically, will we see traction for delivering embedded small business credit cards?

Two areas jump to mind.

Small Business Co-Branded Cards

Co-branded credit cards have long been a staple of the B2C financial services ecosystem. If you fly on planes or shop with specific large retailers frequently enough, you probably have one (or have at least been pitched on them multiple times).

It’s a smart model. The merchant works with a bank to issue a credit card, which is underwritten (at least partially) using the merchant’s proprietary customer data (allowing the issuing merchant and the bank to more accurately price risk). Once issued, the card can be used by the merchant’s customers to buy products and services from the merchant (which saves the issuing merchant money because it doesn’t have to pay interchange fees on on-us transactions), products and services from other merchants (which the issuing merchant makes money on), access additional capital (allowing them to buy more from the issuing merchant), and to earn rewards and other benefits (which the issuing merchant funds with some of the money it is saving/making).

Co-branded card issuing and program management used to be a monolithic, expensive endeavor, only offered by a few of the biggest banks and only economically viable for the largest merchants. Then modern, tech-enabled card issuing and program management came along and, recently, we’ve seen a surge in smaller B2C merchants and brands launching their own co-branded credit cards.

An immutable law of the universe is that innovation always comes to B2C, before trickling down to B2B. So, I’m not surprised that we haven’t seen a similar surge in co-branded credit cards for small businesses … yet.

However, I think we will see this soon. A few of the largest horizontal platforms for SMBs like Square and Shopify already offer credit cards, but there’s really no reason why many more B2B brands and platforms focused on serving small businesses can’t follow suit. I’d expect to see more embedded small business credit card offerings from wholesale suppliers (Worldwide Brands, Faire, etc.), e-commerce platforms (Squarespace, WooCommerce, etc.), and digital advertisers (Meta, X, etc.), among others.

Vertical SaaS Platforms

Companies in this category build software that is designed exclusively for the business and workflows of one specific vertical (construction, childcare, legal, etc.) That software is designed to be an all-in-one “operating system” for as much of the business as possible.

Toast (restaurants), Mindbody (wellness), and ServiceTitan (home repair and improvement) are canonical examples, but there are hundreds more (Matt Brown at Matrix found 450 of them in a research project that he did on this space last year).

Seen through an embedded finance lens, these vertical SaaS platforms hit on all the attributes that are important for small business credit cards.

Distribution is straightforward because the specificity and depth of functionality in the platform attracts small business customers in the target vertical (this is a textbook case of product-led growth).

Data is plentiful because customers are using the platform to run the day-to-day business. This creates a tremendous underwriting advantage because the vertical SaaS platform has access to highly valuable data (leads, customers, seasonal patterns, outstanding payments, etc.) that banks don’t have.

And the incentives are aligned because the vertical SaaS platform is primarily making money for the subscription fees that the small businesses are paying for the “operating system”. Thus, the platform provider is not motivated to encourage lucrative but financially unhealthy behaviors like carrying revolving debt for an extended time period.

In fact, if the vertical SaaS platform is designed well, it can actually reduce the riskiness of the small business using it. Ramp, even though it isn’t tightly focused on a single vertical, is a good example of what I’m talking about here.

As you likely know, Ramp’s mission is to help its business customers save money. By using the company’s charge card and tightly-integrated suite of software, businesses can effectively enforce finance policies and procedures, identify unused paid services, find better pricing for SaaS subscriptions, and eliminate redundant business expenses. One of the subtle, but incredibly important implications of this is that Ramp’s software (which is enabled, in numerous ways, by its card) helps businesses become more financially healthy, thus reducing Ramp’s credit risk over time.

Talk about incentive alignment.

Pulling The Future Forward

Credit cards are the ideal solution for small business owners. And I think embedded finance is the ideal distribution to get them into the hands of small business owners.

The two embedded B2B finance models discussed above — small business co-branded cards and vertical SaaS platforms — are nascent, but promising.

However, in order to pull that future forward, horizontal SMB platforms and vertical SaaS companies will need to do a few things:

- Invest in flexible card issuing and processing. Let’s return to Ramp, as our example. The card isn’t just a payment mechanism. It’s a data integration layer that powers the software workflows and automations that Ramp is so famous for. This is only possible because the platform that issues the card and processes transactions is flexible enough to accommodate Ramp’s ambitious and constantly-growing product roadmap.

- Lean on program management. The difference between issuing a commercial debit card and a commercial credit card is massive. You have to know a lot about marketing, underwriting, servicing, collections, fair lending compliance, and a whole host of other topics to do the second one well. That’s why robust program management is essential for launching and managing a credit card. Do not wing it.

- Carefully evaluate bank partners. Embedded finance pushes banks down the stack, but it does not remove the need for banks entirely. Indeed, as we have seen numerous times over the last 18 months, the selection of a bank partner to enable an embedded finance use case is one of the most important decisions that a non-finance company will make. Take your time. Look for partners that will tell you what you need to hear, not what you want to hear.

About Sponsored Deep Dives

Sponsored Deep Dives are essays sponsored by a very-carefully-curated list of companies (selected by me), in which I write about topics of mutual interest to me, the sponsoring company, and (most importantly) you, the audience. If you have any questions or feedback on these sponsored deep dives, please DM me on Twitter or LinkedIn.

Today’s Sponsored Deep Dive was brought to you by Marqeta.

Marqeta makes it possible for companies to build and embed financial services into their branded experience—and unlock new ways to grow their business and delight users. The Marqeta platform puts businesses in control of building financial solutions, enabling them to turn real-time data into personalized, optimized solutions for everything from consumer loyalty to capital efficiency. With compliance and security built-in, Marqeta’s platform has been proven at scale, processing more than $200 billion in annual payments volume in 2023. Marqeta is certified to operate in more than 40 countries worldwide and counting.