Editor’s Note — This article is sponsored by LoanPro and is the first in a series of three that will explore trends in the credit card market. As with all sponsored content in Fintech Takes, this article was written, edited, and published by me, Alex Johnson. I hope you enjoy it!

If you’ve worked in financial services long enough, you’ve likely seen a news headline like this:

“The End of the Credit Card? Why Young Adults Are Turning Away From Plastic.”

The first time I saw a headline like this was 15 years ago, and the young adults they were referring to were Millennials.

And, of course, the trend they were pointing to turned out to be a mirage. It turned out that Millennials (like the Gen Xers and Boomers before them) actually liked and used credit cards … once they reached a stage in their lives where the unique attributes of credit cards (convenience, liquidity, rewards, etc.) became important.

The lesson I took from this is that credit cards are a generational product. Almost no 18-22 year old wants one, but almost every 22-40 year old does.

More recently, similar headlines have been written about Gen Z’s attitude toward credit cards. They think they’re bad. They prefer debit cards. They prefer BNPL. They are children of the Great Recession and will never trust banks.

Blah, blah, blah.

Turns out, this was another mirage.

As they got older, Gen Zers became much more enamored of credit cards. In fact, according to data from TransUnion:

84 percent of 22- to 24-year-olds had a general-purpose credit card during the fourth quarter of 2023, compared with just 61 percent of 22- to 24-year-olds exactly a decade earlier.

Interesting! Gen Zers are getting into credit cards earlier than Millennials, and according to research from Rivel, more Gen Zers are expected to open new credit card accounts in 2025 than any other generation.

Unfortunately, this elevated interest in credit cards has also resulted in comparatively worse financial outcomes for Gen Z:

Gen Zers aren’t just using more credit than millennials did at the same ages — they’re also racking up higher debt loads and falling behind on their payments more often, TransUnion says. Those behaviors, needless to say, are not advantageous for one’s credit score or financial well-being.

Bottom line: As Gen Zers age, we have every reason to expect a significant increase in their use (and misuse) of credit cards.

This prompts a couple of questions:

- Which companies will provide those credit cards?

- How will these companies design and position their cards to compete with incumbent products?

- What investments will those companies make — in marketing, origination, issuing, servicing, and collections — to support their credit card programs? And what innovations will these investments lead to?

| Sponsored by LoanPro You know how there are just some webinars that are an automatic “yes”? Because either the topic or the speakers are just so obviously intriguing that you know immediately that it’ll be worth your time? This LoanPro webinar — Transforming Credit Origination: Trends, Challenges, and Opportunities — with Jason Mikula, Colton Pond, and Maik Wehmeyer was one of those for me. Luckily, you can still catch this one on demand. And it’s worth it! Great topic, great speakers, great insights. Trust me. |

A New Era of Competition

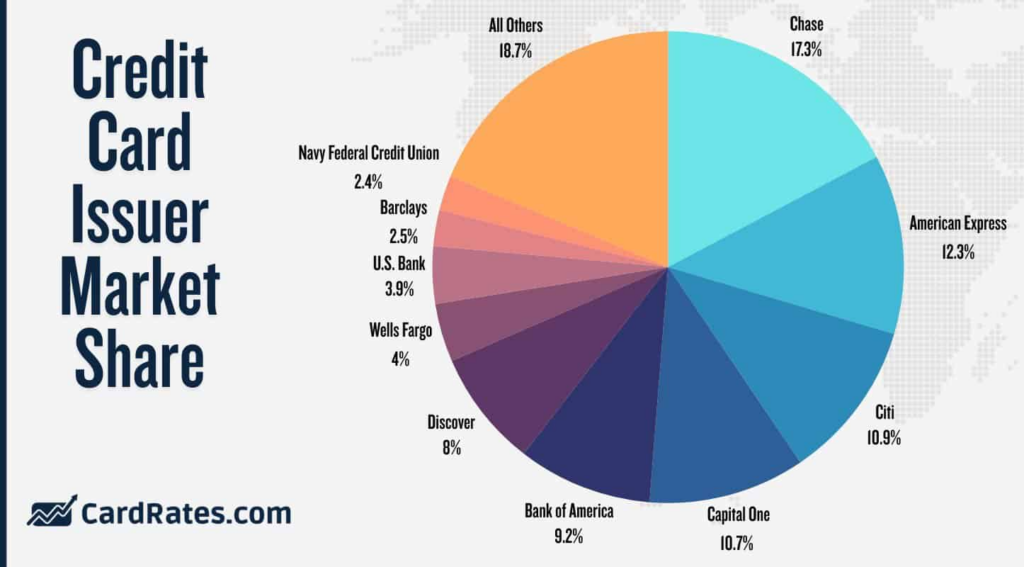

The U.S. credit card market is very consolidated today. According to the Nilson Report, the top five issuers — Chase, American Express, Citi, Capital One, and Bank of America — accounted for 69% of the total U.S. credit card purchase volume for the first six months of 2024. If you add the next 25 issuers to that group, the collective share of purchase volume jumps to 90%.

However, there are a couple of trends that suggest to me that these large issuers might be in for some significant competition.

The first trend is the rebundling of fintech.

The basic idea here is that fintech companies, which have a disproportionately high percentage of Gen Z customers, are likely to respond to Gen Z’s growing fondness for credit cards by expanding into that product category in an attempt to rebundle their way into better unit economics.

SoFi’s credit card (launched in 2020), Affirm’s BNPL/debit card hybrid (announced in 2021), and Robinhood’s credit card (launched in 2024) are all relevant examples, which, I believe, presage a wider move by fintech into the credit card space that will become evident over the next couple of years.

Notably, none of the examples cited above are trying to appeal to younger consumers using the exact same formula that has worked so well for the big issuers like Chase and American Express.

Robinhood is aiming for higher-income investors and is tying its Gold Card’s rewards to its premium brokerage account product. Affirm is explicitly positioning its card as the anti-credit card, hoping to appeal to Gen Zers who want the flexibility and convenience of a credit card without the potential to get into long-term debt. And SoFi, in its press release announcing its card, framed the product as a part of an integrated financial health ecosystem:

With total consumer debt reaching a record $14.3 trillion this year, the SoFi Credit Card offers a revolutionary card experience that allows people to pay down debt with rewards that are earned for spending. Members will also be able to set up automated redemptions into their account of choice, creating a frictionless way to redeem cash back, pay down debt, invest, or save for the future.

Additionally, we are starting to see early evidence of greater personalization in fintech companies’ credit card products, such as a co-brand card with a local sports team that offers preferred pricing on tickets.

Put simply, fintech companies are designing and counter-positioning their credit cards as the personalized solution to the problem created by the incumbent issuers they are competing with.

The second trend is embedded finance.

I wrote about this recently in the context of small business credit cards. However, there’s no reason to assume that this trend — the distribution of credit cards through non-finance brands, products, and channels — won’t also manifest in the B2C credit card market.

Indeed, we already have significant evidence that this model can work: co-brand credit cards.

According to TransUnion, co-brand credit cards (credit cards offered in-store and online by large retailers and other consumer-facing brands) were quite popular with young Millennials a decade ago (44% percent of 22-24-year-olds had one in 2013) but have proven less popular with Gen Zers (26% of 22-24-year-olds had one in 2023).

This dip is likely due to increasing competition from BNPL providers like Affirm and Klarna at the point of sale. However, as I recently wrote, pay-in-four BNPL isn’t a perfect substitute for credit cards. It seems to me that at least some of the brands that are all-in on BNPL today may at least consider launching a co-brand credit card, especially when you consider their built-distribution advantage (zero CAC!) and the revenue and cost-saving contributions that such products can deliver. Additionally, these brands could incorporate elements from BNPL (like the ability to roll over individual transactions into pay-in-4 installments) into their cards (as many large bank issuers have done) in order to deliver Gen Zers an even more attractive hybrid product.

Sponsored by LoanPro

Which Path Will New Competitors Choose?

If we accept the premise that Gen Z’s full-on embrace of credit cards will attract increasing competition from outside the current top 25 issuers, then the next question we need to answer is, how will these new market entrants get to market?

How will they launch these new products? How will they personalize and differentiate them? Which partners will they choose to work with? How will they balance control, profitability, and speed to market?

These are great questions, and they will be the subject of the final two articles in this series. Stay tuned!