Editor’s Note — This article is sponsored by LoanPro and is the second in a series of three that will explore trends in the credit card market (check out Part 1 here). As with all sponsored content in Fintech Takes, this article was written, edited, and published by me, Alex Johnson. I hope you enjoy it!

In the first article in this series, I made two assertions:

- Contrary to popular belief, Gen Zers love credit cards and are, in fact, more likely than prior generations to adopt them in large numbers.

- Gen Z’s growing adoption of credit cards will attract new competitors and new innovations in credit card product design, marketing, and customer service.

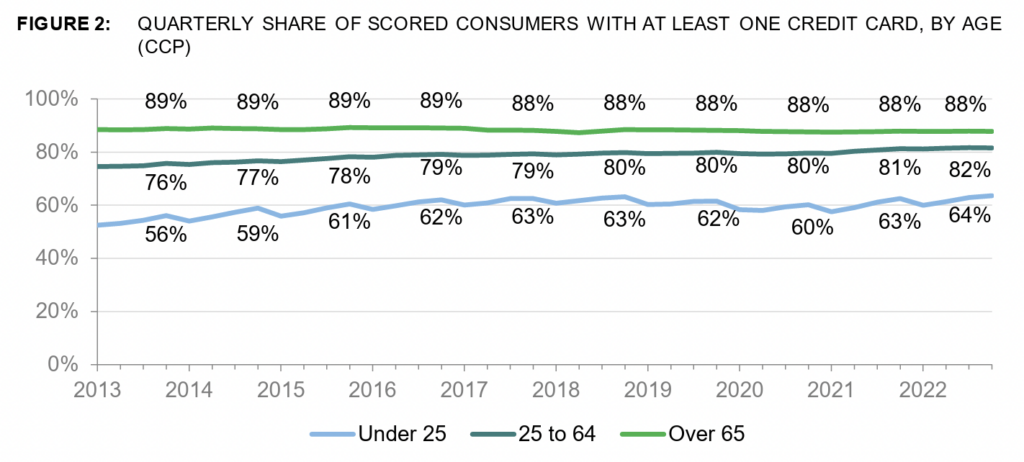

If you need more evidence of the first assertion, take a look at this chart from a 2023 CFPB report on the U.S. credit card market:

Look at that light blue line! The kiddos are coming!

Indeed, this data only goes up to 2022, so I have to imagine that the percentage of under-25 consumers with at least one credit card has continued to increase over the past 2-3 years.

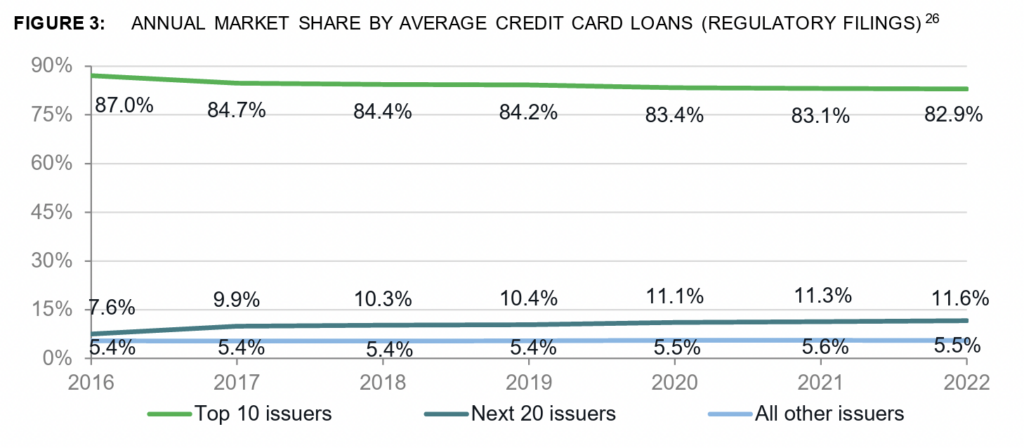

However, when we look at the evidence for assertion #2 (the credit card market is going to become much more competitive), my overall argument looks a little less compelling:

Yes, the credit card market has become a bit more competitive over the last 10 years, but still, look at that green line! The top 10 general-purpose credit card issuers still control 83% of the market! And most of the ground that they have lost since 2016 has been picked up by the next 20 big issuers. Market share for the remaining 3,800 issuers hasn’t gotten above 5.6%.

So, what are we to make of this?

Are Gen Zers destined to all become Chase, AmEx, and Capital One cardholders?

Or is a more diverse and competitive ecosystem possible? And if it is, what paths might new issuers take to get there?

| Sponsored by LoanPro If card program managers want to win Gen Z customers, they need a product that doesn’t look like every other card on the market. They need personalization. LoanPro lets you tailor each card to its customer, from transaction-level financial mechanics to borrower communication to repayment schedules. |

New Infrastructure = New Options

As you might guess, I believe that a more diverse and competitive credit card ecosystem is possible, and, indeed, likely.

To understand why, we should look at the co-brand and private label credit card market.

The market for these cards, which are issued and serviced by banks but marketed and distributed by non-bank brands such as airlines and retailers, is even more concentrated than the general purpose credit card market.

According to the CFPB, the top six issuers in the private label credit card market represented 95% of the outstanding balances in that market.

“Wait,” I hear you saying. “Why is this concentrated corner of the credit card market evidence that a more diverse and competitive ecosystem is possible?”

Great question!

And the answer lies in why the co-brand and private label credit card space ended up becoming so concentrated in the first place.

Why is it that a comparatively small number of issuers and non-bank brands work together to offer credit cards?

It’s because, historically, issuing and servicing a credit card portfolio was really expensive and extremely complex.

Credit cards are complex because they carry a lot of credit, fraud, compliance, and reputation risk. Managing all of those risks and delivering a product that works reliably was a job that required a great deal of specialization, which is why a small number of issuers (think Synchrony, Citi, Capital One, Wells Fargo) have dominated the private label and co-brand credit card market for so long. They were the ones that invested the time and money to get good at it, pulling disparate systems together (albeit on legacy infrastructure). And it’s also why only large non-bank brands (think Delta, Amazon, Marriott, Apple) ever launched them. Only companies above a certain size had the scale and resources to make it worth it!

Fast forward to today, however, and the market looks significantly different. Smaller issuers and smaller non-bank brands are beginning to issue their own credit cards, thanks to the emergence of modern card issuing and servicing infrastructure (along with the growth and maturation of the bank and credit sponsorship ecosystem).

Broadly speaking, this infrastructure is available in two different configurations.

| Sponsored by LoanPro Between CFPB chaos, the Hawley/Sanders proposed 10% rate cap, and new state-level regulations, compliance in 2025 might go in a dozen different directions. Is your operation ready to adapt with rapid regulatory changes? LoanPro can help you adjust your strategy, making compliance the default. Reach out. |

All-In-One vs. Modular

Over the past fifteen years, several technology companies, such as Marqeta and Cardless, have launched all-in-one platforms for credit card programs. They provide a comprehensive platform that brings together everything that is needed to launch and support a credit card portfolio — bank partner(s), card network(s), payment processing, marketing, underwriting, compliance, card design and issuance, portfolio analysis, servicing, collections — into a single service. Several card issuers have successfully launched and scaled using this model.

The all-in-one platform drastically simplifies the process of launching a credit card. And in exchange, the bank, fintech company, or non-finance brand that is launching the credit card agrees to pick from a fairly limited menu of configuration options (branding, rewards, etc.) and give up a large chunk of the revenue generated by the card.

Now, to be clear, this can be a very good trade-off for the bank/fintech/brand, depending on what their goals are.

If you need to get to market fast. If you aren’t worried about the card itself having significant competitive differentiation. If you are strenuously adverse to any level of credit, fraud, compliance, or reputational risk.

An all-in-one credit card platform can be the right path to go down … at least initially.

However, eventually (if your card product is successful and sticks around long enough), you may want a greater degree of control and a larger share of the financial upside.

Or, if you know from day one that those things are important for you, you will likely want to build your own credit card program from the ground up.

This is where a more modular approach comes in.

Over the past five years, regulatory pressure and customer demands have ushered in a new modular approach to launching a credit card, where a card issuer can deconstruct aspects of the card technology stack and ecosystem for their benefit. For example, several infrastructure providers have recently arisen that provide a credit ledger to integrate with existing processors and fill in the remaining functionality gaps around them.

This is the more difficult path, but it has become significantly easier over the last 5 years, and my hypothesis is that it will become a much more popular path for companies aspiring to make the U.S. credit card market a more competitive place over the next 10 years.

In the third and final article in this series, I’ll explain why I think that.