3 Fintech News Stories

#1: The Reinvention of ACH

What happened?

Newline, Fifth Third’s embedded finance business unit, launched a new product:

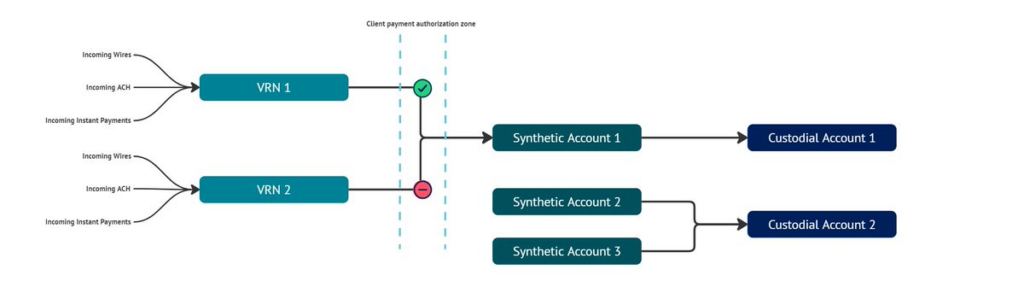

Newline is launching our new VRN and Authorization Stream products to the world, enabling clients to create unlimited account numbers, or aliases, for deposit accounts and authorize A2A payments in real-time.

With Newline VRNs, you can create unlimited account numbers for every vendor, invoice, or even your own ledger or GL, making your payments safer and your reconciliation mapping process easier.

You can spin them up or shut them down in real-time with one API call.

So what?

A macro theme in fintech right now is the reinvention of ACH.

Over the last 20 years, the card networks, card processors, and issuing banks have introduced a lot of smart ideas for modernizing payments, everything from tokenization and virtual cards to programmatic payment routing and card controls. These innovations unlocked significant new value for fintech and SaaS product developers, which, in turn, transformed the competitive landscape in traditional (and, dare I say, moribund) corners of the financial services landscape (the second story in today’s newsletter is about one such area).

An obvious next step is to apply these ideas to deposit accounts and non-card payment rails like ACH.

And that’s exactly what’s happening.

Faster payments. More sophisticated ACH and instant payments fraud models. Pay-by-bank (which is the application of open banking to remove friction from the payment initiation process). And now this — virtual reference numbers.

Think of VRNs as a much smarter, more flexible, interoperable cousin to the tokenized account numbers (TANs) that some payment networks like The Clearing House already offer.

VRNs can be combined with Newline’s Payment Authorization Stream to apply the same programmatic capabilities to ACH that we have for cards:

Combine VRNs with our Payment Authorization Stream for even more fine-grained control over your payments. Cards have long had the ability to approve/deny payments programmatically–Now you can do that with ACH, Wire, RTPs, etc. in real-time.

Neat stuff.

#2: Know When to Hold ‘Em

What happened?

American Express is buying a fintech company:

American Express today announced that it has entered into an agreement to acquire Center, a software company modernizing expense management.

Center’s software, together with American Express’ corporate and small business cards, will aim to create a seamless expense management platform that delivers more value across the commercial card payments process – from choice in premium card offerings and rewards to automated accounting and reconciliation.

So what?

The emergence of modern corporate spend management platforms like Ramp and Brex has always been a bigger threat to American Express (which has a narrow, payments-focused business model) than to the other big corporate card issuers like JPMorgan Chase and Citi (which provide a much broader suite of corporate banking, lending, and treasury management solutions).

So, it’s not really surprising to see AmEx plunk down a rumored $600M to acquire a fintech company focused on spend management (Center was founded in 2018 by the son of one of the co-founders of Concur).

However, it is a little disappointing to see AmEx take the easy way out.

In an essay last year, I outlined two different ways that large corporate card issuers could compete with Ramp and Brex:

The question for these banks isn’t “Should we do something about these fintech companies?” It’s “What should we do about these fintech companies?”

What’s the right strategy?

Well, it most certainly isn’t to try to build spend management software that can compete directly with these fintech companies. Banks don’t want to play that game, which is smart because they wouldn’t be likely to win it.

Instead, from what I can tell, banks’ strategy for competing with fintech corporate card providers is to compete with the modern issuer-processors that they are built on (or, in the case of Brex, that they’ve built themselves).

These banks are wrapping new API-accessible services around their existing corporate card products in order to enable spend management fintech companies with the same level of configurability, control, and intelligence that Ramp and Brex get by issuing their own cards.

I went on to praise AmEx, specifically, for its efforts to build out a developer platform (Sync) for the issuance of virtual cards.

The idea (I thought) was for AmEx to lean into its role as both a payments network and an issuer and play the long game by enabling (and perhaps even investing in or incubating) a new generation of modern corporate spend management platforms (maybe focusing on platforms going after specific verticals?) that could, over time, compete with Brex and Ramp using a “Bring-Your-Own-Card” strategy.

This acquisition suggests that AmEx has opted for the more direct, short-term strategy of acquiring a Ramp/Brex competitor and using AmEx’s muscle to expand its reach and capabilities.

Consider me skeptical.

#3: Split ‘Em

What happened?

Highnote partnered with Splitit to enable an interesting BNPL use case:

Enabled by Highnote’s technology, Splitit’s unique installment payment option will now be available through a digital wallet at the point of sale for the first time.

With this new partnership, Highnote’s tokenized virtual cards are leveraged to pay merchants and create real-time functionality so that Splitit can offer the consumer a new way to choose payments over time. From the consumer perspective, they can now use their digital wallet to access Splitit’s card-linked, embedded, installment payment options which includes a low-friction pay-later approval process that leverages a consumer’s existing available credit — eliminating the need for a credit check.

So what?

This partnership combines a few different ideas from BNPL world, so it’s worth describing each of them:

- BNPL enabled by virtual cards. When there isn’t a direct integration between the BNPL provider and the merchant, it’s common to use one-time virtual cards to facilitate the payment between the consumer and the merchant. That’s one of the jobs that Highnote is doing in this partnership.

- BNPL inside a digital wallet. Following in the footsteps of Apple and Google, which have both enabled BNPL through partners in their digital wallets, it sounds like Splitit is doing the same for a different, unnamed digital wallet provider. Collectively, this enablement *should* help increase the use of BNPL in-store, which currently lags well behind e-commerce.

- BNPL built on top of credit cards. Again, this isn’t unprecedented. Many of the large credit card issuers offer embedded installment lending within their products (and this feature is quite popular among consumers). The difference here is that Splitit enables this experience for any credit card the consumer chooses to use. From what I can tell, the way it works is that Splitit authorizes the full transaction amount on the consumer’s credit card (checking to see if they have sufficient available credit) and then places a hold for that amount on the card (similar to a hotel holding a security deposit on the card-on-file). The first installment payment is charged immediately to the credit card, and then, as each subsequent payment is made, the hold amount is adjusted to reflect the remaining balance due on the loan until the loan is paid off.

Interesting!

I wasn’t familiar with Splitit’s approach to BNPL before digging into this news. It’s certainly creative, although it does trigger a few thoughts for me:

- To make money, Splitit would need to charge a rate that is higher than the 2-3% that merchants pay to accept credit cards because Splitit is using the credit card to actually make the loan payments. Therefore, the cost to the merchant (or the digital wallet provider or the consumer) would need to be CC interchange + Splitit’s revenue. Charging more than 2-3% isn’t uncommon in BNPL world, but their model would put them automatically on the higher end of the spectrum.

- A large portion of BNPL customers use BNPL in addition to credit cards, often because their credit cards lack sufficient available credit. These consumers wouldn’t be a good fit with Splitit’s model. To be clear, this isn’t a bad thing (those folks are higher risk), but I do wonder how much market share that leaves for Splitit, especially considering the availability of installment lending features in many credit cards these days (and Affirm’s move to enable debit card issuers to add buy later functionality).

- Credit card issuers generally don’t love it when their customers use their cards to pay their BNPL loans, and a few have banned their customers from doing it. I’m not sure if Splitit’s model would concern issuers in the same way, but it’s not hard to imagine. Additionally, this model would be very tricky to furnish data to the credit bureaus from if Splitit were ever to go down that road.

2 Fintech Content Recommendations

#1: The Trump Organization’s Shake Down of Capital One (by Adam Levitin, Credit Slips) 📚

The Trump organization is suing Capital One for closing its accounts after the January 6th insurrection.

Debanking is the claim here, but as Adam astutely points out in his article, that’s not a recognized tort you can sue over. The suit has many, many, many problems beyond that (including the fact that it names the wrong defendant!), which likely means that Capital One could get it dismissed … if it chooses to fight.

As we have seen in the Trump Organization’s recent tussles with media companies like Disney, there is a strong argument for settling when the plaintiff is a company owned by the President of the United States.

And in this particular case, Capital One would be risking a lot if it chose to fight.

#2: Rushing to Judgment and the Banking Crisis of 2023 (by Steven Kelly & Jonathan Rose) 📚

It’s interesting how the stories we choose to tell ourselves can diverge from reality.

The 2023 banking crisis is a good example. The first things folks talk about when they recount the crisis are Silicon Valley Bank and the role of social media and digital banking in speeding up bank runs.

This paper is a useful reminder that our collective memory of the crisis might not be serving us as well as we would want.

Very much worth a read!

1 Question to Ponder

Which bank or fintech company most needs to make an acquisition and why?

If you have any thoughts on this question, hit me up on Twitter or LinkedIn.