Lawyers and accountants might disagree with this statement, but I’ve always thought that the process of becoming a public company is, primarily, a storytelling exercise.

You are trying to engineer the best possible response from public market investors while complying with all the regulatory requirements for accurate business and financial reporting, which requires a very specific approach to telling your story.

The S-1 Registration Statement detailing the financials, risks, and business model of the company is obviously the Rosetta Stone for this process, which makes it a useful document to review if you’re trying to understand how the company is attempting to position itself.

We haven’t had many fintech companies go public in the last few years. However, as I wrote about briefly on Monday, Klarna has filed its F-1 (the equivalent to an S-1 for a foreign entity) with the SEC, which means we have a very juicy document to analyze.

I have been trawling through the F-1 all week (with a little assistance from fintech friends like Jevgenijs Kazanins), and I thought it would be useful to share my three big observations!

#1: Profitability & Efficiency

2024 was Klarna’s first profitable year:

Our net profit in 2024 was $21 million, a 109% improvement from a net loss of $244 million in 2023.

That’s a significant milestone! But the question is how sustainable this turn towards profitability really is. Is it the result of a long-term trend that seems likely to continue? Or is it an accounting trick?

I think this is a fair question because $21 million in net profit is a pretty small number (when compared to $2.8 billion in revenue). And it turns out that there was a little accounting trickery in 2024. Here’s a footnote explaining the “other income” line item in Klarna’s consolidated profit and loss statement:

Other income for the year ended December 31, 2024 primarily related to a net gain of $171 million as a result of the divestment of KCO.

KCO is Klarna Checkout, which Klarna sold last year for $520 million. The reason given at the time was that KCO was creating competitive conflicts with Stripe and Adyen, which may very well be true. However, selling the business last year helped Klarna (barely) turn a profit, which has undoubtedly been helpful in positioning the business to go public this year.

(Correction — An earlier version of this essay incorrectly interpreted the metric “Transaction Margin” as a metric that excludes credit losses. In fact, that metric does include credit losses by subtracting them from revenue. Klarna’s Transaction Margin increased from 2022 to 2023 and slightly decreased in 2024. That portion of the essay has been removed.)

#2: AI

Klarna has built a big part of its pitch to public market investors around its ability to reduce its operational costs (particularly in customer service and marketing) and software subscription costs (by eliminating licenses for enterprise SaaS products like Salesforce). From the F-1:

Our ability to deliver improvements in our operating results is a function of our increasing operating leverage. From 2022 to 2024, we saw a decrease across our operating expenses both in absolute terms and as a percentage of our revenue. Technology and product development expenses as a percentage of revenue decreased 7 percentage points, sales and marketing expenses as a percentage of revenue decreased 16 percentage points, customer service and operations expenses as a percentage of revenue decreased 8 percentage points and general and administrative expenses as a percentage of revenue decreased 7 percentage points. This led to our total operating expenses as a percentage of revenue decreasing 47 percentage points from 2022 to 2024, even as our GMV increased 27% (28% on a like-for-like basis) in the same period.

The company’s explanation for how it has achieved these impressive operational efficiency gains is (primarily) its use of AI, especially generative AI, which Klarna CEO Sebastian Siemiatkowski has been talking about constantly.

But how much of a role has AI played in these efficiency gains? How sustainable are they really?

Let’s zoom in on customer service and operations costs, which decreased from $287 million in 2022 to $240 million in 2023 and down again to $203 million in 2024. How much of these gains, which were very consistent year to year, were due to generative AI?

Perhaps less than we think! From the F-1:

We announced a partnership with OpenAI in 2023 and in February 2024 launched our AI assistant powered by OpenAI to improve customer support.

So, the company saw a $47 million decrease in customer service and operations costs between 2022 and 2023, before it implemented its OpenAI-powered customer support chatbot, and then just a $37 million decrease in customer service and operations costs between 2023 and 2024, after it had implemented the chatbot?

Interesting!

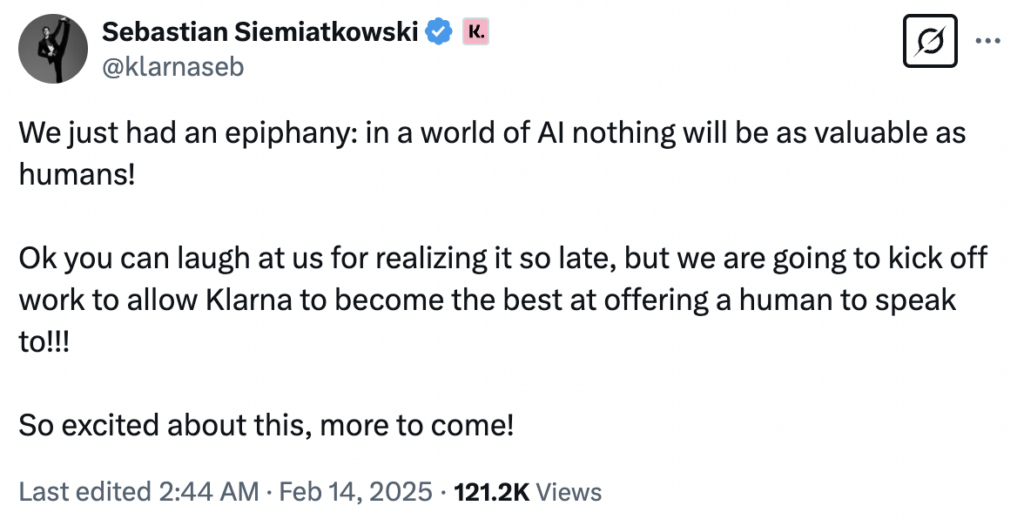

Perhaps generative AI is not yet the customer service silver bullet that some have claimed that it is. Indeed, it seems that Siemiatkowski himself might have changed his mind a bit on this topic recently:

#3: Customer First

Siemiatkowski’s letter to prospective shareholders in the F-1 works hard to convince readers that Klarna is a new type of bank. One that takes an aligned, customer-first approach (emphasis mine):

Banking is about trust. At its core, trust is rooted in the profound yet daring belief that someone else will place your needs above their own. It’s a distinctly human trait, the glue of relationships, and the bedrock of progress.

Yet, somewhere along the way, traditional banks traded this principle for profit, losing sight of what truly matters. Instead came financial engineering, raking in profits through late fees, overdraft penalties, revolving debt traps, and countless other tricks designed to exploit their customers. Trust in banks has never been lower.

Klarna has broken through the barriers! This is the choice of a new generation—one smart enough to avoid credit cards and banks that rely on outdated tricks. Close to 100 million people across the globe have realized Klarna has something different to offer. It is an amazingly diverse group of people with really one thing in common: their resentment of traditional banks. They want simple and transparent fees. They want to avoid mishap fees. They want fixed and clear payoff horizons for major purchases. Ultimately, they want a bank that delivers trust by putting their interests first—and yes, preferably interest-free.

In the F-1, Klarna proudly highlights specific metrics that illustrate this commitment to customers’ financial health, such as the fact that in 2024, 99% of the consumer loans that it extended were paid on time.

However, this messaging — that Klarna doesn’t make money on its customers’ mishaps and that it would strongly prefer to make money without charging customers interest — is a bit difficult to square with the data.

According to the F-1, 76% of the revenue that Klarna made in 2024 was “transaction and service revenue” (down from 77% in 2022), while the remaining 24% was interest income from interest-bearing loans (up from 23% in 2022).

Transaction and service revenue in 2024 was comprised of merchant fees (75%, down from 76% in 2022), advertising revenue (8%, down from 11% in 2022), and consumer service revenue, which is primarily made up of reminder fees (AKA late fees) and that represented 16% of transaction and service revenue in 2024 (up from 12% in 2022).

So, to sum up, between 2022 and 2024, Klarna increased its share of both interest income and consumer service fees despite its claims that it is focused on helping consumers avoid mishap fees and interest-bearing loans.

Hmmm.

And, of course, Klarna just announced a new partnership with Walmart’s fintech division OnePay, which is focused on … drumroll … interest-bearing loans:

Klarna will make underwriting decisions for loans ranging from three months to 36 months in length, and with annual interest rates from 10% to 36%