A lot of interesting stuff has happened over the past couple of weeks (and this morning!) with late-stage private fintech companies and public fintech companies, so I thought it would be fun to use today’s essay to dissect them.

Klarna

The original plan for today’s essay did not include writing about Klarna. Many fintech observers (including me) have written about Klarna filing to go public and what the data from their F-1 means for Affirm, the BNPL market, and late-stage private fintech companies.

But this morning it was reported that Klarna is pausing its public listing. If you’ve checked your 401K recently, you can probably guess why:

Klarna has paused plans to launch a long-awaited $15bn New York public listing because of market turbulence in the wake of US President Donald Trump’s wide-ranging tariff announcements.

The Sweden-based “buy now, pay later” fintech was set to launch its so-called initial public offering roadshow with investors next week, but the sell-off in US stocks has put the plans on ice, said a person familiar with the plans.

I guess this isn’t surprising. President Trump has thrown the global economy into chaos with these broad-based “reciprocal” tariffs, and investors (who apparently didn’t believe he would actually do what he has now done) are frantically repricing all of their investments.

To me, this is a reminder of just how fickle the IPO window is.

You can build a successful company over more than a decade, with an eye towards a public market debut that finally rewards your very patient investors and early employees. And then your endgame gets fucked up by some guy from Queens.

Plaid

The latest news on Plaid is that they have raised $575 million at a $6.1 billion post-money valuation from a mix of existing investors (NEA, Ribbit Capital) and new investors (Franklin Templeton, Fidelity Management and Research, BlackRock).

The stated purpose of this capital is to take care of employees by converting expiring RSUs (restricted stock units) to shares and offering some liquidity to its current team via an employee tender offer. This is different than a secondary share sale, in which existing shareholders (typically early employees) sell their shares directly to other investors. However, Plaid characterized the transaction to TechCrunch as “not a Series E,” but rather a sale of common stock.

This positioning is a bit odd.

Traditionally, if a private company wants to give employees and existing investors a chance to cash out, it will either agree to be acquired (which Plaid famously tried to do with Visa in 2020) or it will go public.

On the other hand, if a private company wants to invest more in building out its products and/or its customer base, it will traditionally raise a round of equity funding from private market investors, ideally at a higher valuation than its last fundraise.

In this latest fundraise, Plaid’s valuation is taking a significant hit from its 2021 Series D valuation of $13.4 billion (2021 was a wild time. None of the valuations from back then make any sense today.) And Plaid has announced that it will not be going public in 2025.

What this all suggests to me is that A.) Plaid’s core business (which now includes three distinct product lines — cash flow underwriting, fraud mitigation, and pay by bank) is doing well, and new investors are confident in its future prospects (this round was reportedly oversubscribed and Plaid says that its revenue grew by more than 25% in 2024) and B.) As the Klarna news clearly demonstrates, the IPO window is (for the moment) closed.

Chime

Speaking of IPOs, Chime has been positioning itself to go public for a while now. I had been expecting an S-1 to appear sooner rather than later, but now I’m guessing it’ll be later. (Perhaps in 2026? Who knows! Economic uncertainty is super fun!!)

Regardless, there have been a few recent announcements from Chime (as it has been positioning itself to go public) that I have found interesting, so let’s break them down.

The first is the launch of Chime+ (big fumble on not going with Chime Prime as the name, but whatever).

Chime+ is a premium membership tier for customers who move their direct deposit over to Chime. Chime+ combines existing Chime products that already require your direct deposit (MyPay earned wage access, SpotMe fee-free overdraft protection) with some new features and perks. I’ll let Chime describe those:

The initial set of new exclusive benefits to Chime+ members include:

- Higher Savings Rate: Chime+ members can enjoy 3.75% APY to accelerate their savings.

- Exclusive Chime Deals: Chime+ members get new, custom cashback offers from top retailers, on top of the savings already available through Chime Deals on everyday purchases like gas and groceries.

- Priority Support: Chime+ members will have expedited response times to answer questions about their account.

In addition to these, Chime also recently launched a new lending product called “Instant Loans,” which are three-month installment loans to pre-approved Chime customers up to $500 with fixed interest rates, and expanded access to fee-free in-app federal and state tax filing (through partnerships with April and Column Tax).

But wait! There’s more!

The second big announcement is Chime Workplace, a new offering from the company’s Enterprise division, which is led by DailyPay co-founder and former CEO Jason Lee (who joined after his next startup, Salt Labs, was acquired by Chime last year).

Chime Workplace is described as an integrated employee financial wellness platform, which is comprised of “Capital Management” ( 2-day early pay, no fee overdraft), “Capital Growth” (high-yield savings, the ability to set savings goals), “Capital Expansion” (credit score monitoring, credit building), and a premium “Employee Rewards and Loyalty” program (this is the reskinned version of the Salt Labs loyalty program that rewards workers with “salt” AKA points based on hours worked and other positive actions).

Put simply, Chime Workplace is a repackaging of all of Chime’s existing B2C products and features (plus the employee rewards and loyalty program) into a B2B2C offering for large employers (targeted, I’m guessing, at companies that employ lower-income hourly workers). That might not sound all that innovative, but better packaging and UX can make a big difference. Here’s how Chime describes the employer experience of Chime Workplace:

Chime Workplace provides employers with a centralized platform that simplifies benefits administration while boosting employee participation. Employers gain aggregated and measurable insights into the financial health of their employee base—such as savings growth, credit health improvement, and overall engagement—through a centralized data portal.

So, what does all of this mean?

Well, I think Chime+ is more a marketing thing than a real step forward on the product side. It’s mostly just a reshuffling of Chime’s existing products into a “premium” membership tier designed to encourage more customers to move their direct deposits over to Chime.

Cash App has recently taken a similar approach to positioning its product to encourage more direct deposits (although it has instituted a $300/month minimum to unlock the best benefits):

(Editor’s Note — I find Chime and Cash App’s “offer” to get priority customer service for customers who give them their direct deposits pretty funny. It strikes me as less of a benefit and more of a threat. “If you don’t want to wait for 40 days to get an email reply, you better give us your direct deposit!”)

Obviously, there are some differences between Chime and Cash App. Chime has a stronger focus on credit building (cue: Alex screaming into the void). Cash App inherited some of Jack Dorsey’s obsession with Bitcoin (cue: Alex screaming into the void again). Chime has EWA. Cash App has a far more robust P2P payments network. Cash App offers a higher possible savings APY, but Chime’s has fewer strings attached.

But fundamentally, Cash App and Chime’s B2C product are on the same trajectory. The winner will be the one that does a better job capturing direct deposits, consolidating card spending, and scaling up a lending business without taking on too much risk.

The bigger opportunity for Chime (IMHO) is Chime Workplace.

“Fintech as an employee benefit” was a hot trend 3-5 years ago, but a lot of the companies that were pursuing it as a distribution strategy either failed or pivoted away from it because A.) selling to HR leaders at large corporations is annoying and time-consuming, and B.) most HR teams don’t have budgets for this type of thing and the EWA industry has brainwashed companies into thinking that “fintech as an employee benefit” should be free to employers (kinda like how banks convinced consumers that checking accounts should be free).

That said, I remain stubbornly optimistic about employers as a distribution channel for fintech, for two reasons. First, EWA worked. Yes, employers aren’t willing to pay for it, but they do value it and the larger ones have expended meaningful effort to integrate it. Second, and more depressingly, I think employers will be forced to shoulder a much greater burden regarding their employees’ financial wellness over the next 10 years, as the affordability crisis worsens. Just think about it. If you employ a lot of low-income hourly workers in a city that is increasingly expensive to live in, you either need to invest in a robotic workforce or start subsidizing mortgages and other financial services for your employees. Door number one is possible, but I think door number two is more likely (at least in the short term).

Rocket

Last but certainly not least, we have Rocket, which made a few HUGE acquisitions in the mortgage space over the last month. Here’s Paige Smith at Bloomberg:

In the span of just three weeks, Rocket Cos. has thrown around more than $11 billion in a bid to reshape the way Americans buy, sell and finance their homes.

The goal: make everything run through Rocket, from start to finish.

In Rocket’s vision of the housing market, buyers and sellers will connect through Redfin Corp., the home-search platform it agreed to purchase for $1.75 billion earlier this month. Then homebuyers in need of a mortgage will turn to Rocket, which has become the No. 3 player in an industry once dominated by banks. And, finally, that loan will need servicing, which can be done by Mr. Cooper Group Inc., which Rocket announced on Monday that it will buy in an all-stock deal valued at $9.4 billion.

$11 billion. Rocket isn’t messing around.

From a first principles perspective, these acquisitions are another example of Jim Barksdale’s famous quote, “There’s only two ways I know of to make money: bundling and unbundling.”

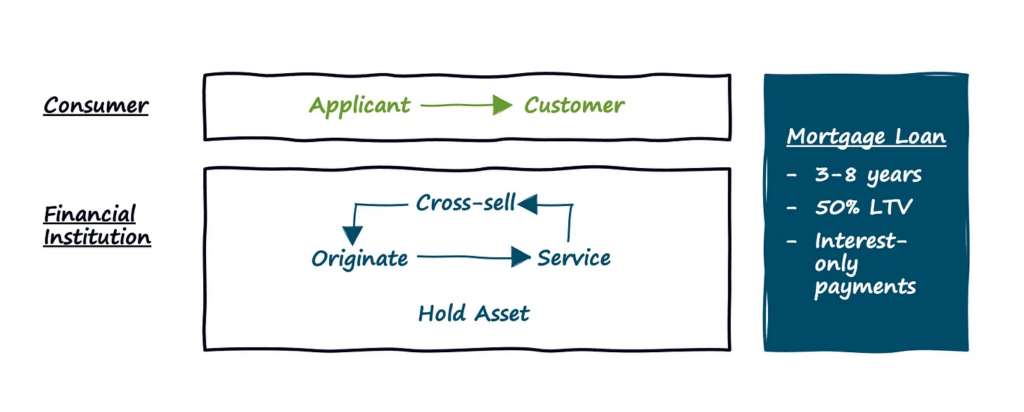

In the wake of the Great Depression, the U.S. government worked with the financial industry to radically unbundle the mortgage industry. They transformed it from something that looked like this:

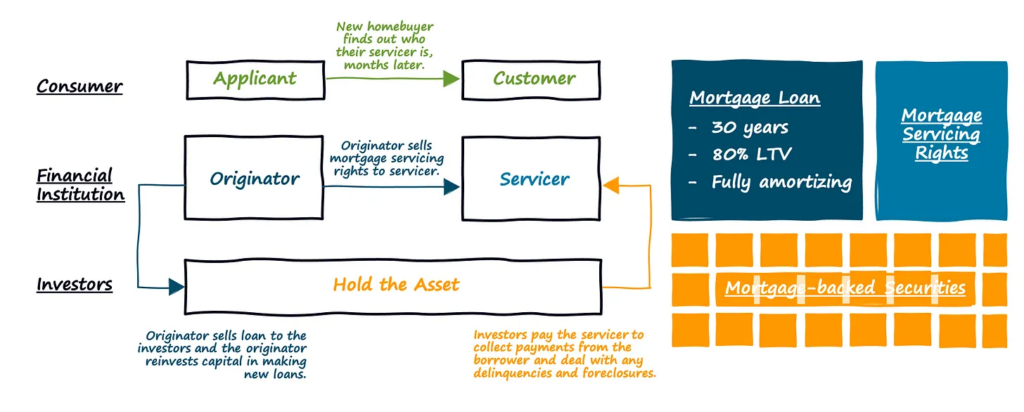

To something that looks like this:

This unbundling was great for homeowners (a 30-year, fully-amortizing loan is an INCREDIBLE deal), and it brought an unprecedented amount of liquidity into the mortgage market. It also (arguably) made pricing more fair for consumers by increasing the amount of competition at each step of the home buying and home ownership process (the Real Estate Settlement Procedures Act or RESPA, passed in 1974, played a big role here as well).

The problem, as is frequently the case with unbundling, is that it created a fractured and highly confusing customer experience.

I have written, multiple times, about how dumb mortgage servicing is. How big of a missed opportunity it is. Here’s how I described its terribleness, from the end customer’s POV:

You close on your mortgage and buy the house of your dreams. Your lender tells you that in the next month or two you’ll find out the name of the company that you will be making payments to for the next 30 years.

You’ll find out when they send you a letter in the mail! So make sure to watch out for generic, plain-looking letters from companies you’ve never heard of. One of them is your new mortgage servicer telling you where to send your payments.

In that letter is a set of instructions for creating an account and setting up your payments. It will require you to wade through the oldest still-functioning websites in the financial services industry and tussle with mobile apps that Apple and Google, in good conscious, never should have allowed into their app stores. You may even need to send a fax.

Once all of this is set up, guess what? Your mortgage servicer can change at any time! You just get another generic letter mailed to you informing you that the MSR associated with your loan has been sold and then yet another letter introducing you to your new servicer with instructions for how you can *easily* set up your new account and schedule your payments.

This is a terrible customer experience! It makes no sense! It’s such an obviously low-hanging piece of fruit for any company that wants to help consumers get more value out of … [checks notes] … the most valuable and important asset they will ever own!

Well, in acquiring Mr. Cooper (the largest mortgage servicer in the U.S.), Rocket is plucking that low-hanging fruit.

And for those who have been paying attention, it’s not a surprise. Rocket recognized the value of an end-to-end relationship with homebuyers back in 2010, when it made the strategic decision to start hanging onto the servicing rights of the mortgages it was originating:

In 2010, we made the strategic decision to invest in loan servicing. Servicing the loans that we originate provides us with an opportunity to build long-term relationships and continually impress our clients with a seamless experience. We employ the same client-centric culture and technology cultivated in our origination business towards our servicing effort. The result is a differentiated servicing experience focused on client service with positive, regular touchpoints and a better understanding of our clients’ future needs.

Now it is gobbling up other originators’ servicing rights. Assuming the acquisition is approved (more on that in a sec), the combined Rocket and Mr. Cooper will service a book of $2.1 trillion of loans and nearly 10 million clients. This will be enormously helpful in making Rocket a less rate-dependent business, as Paige at Bloomberg explains:

When interest rates rise, borrowers are less likely to refinance, unlocking extended payments for the servicer. That provides a helpful counterbalance for Rocket’s home-loan business, which tends to see originations decline when rates rise. Similarly, when they fall, there’s more refinancing, so the lending business becomes more valuable while the servicing business is hurt.

These acquisitions are also very well timed. Biden Administration regulators like Rohit Chopra and Lina Khan weren’t big fans of vertical integration or excessive market power. Indeed, the CFPB sued Rocket for violating RESPA, alleging that it had given incentives to and pressured real estate agents to exclusively refer homebuyers to Rocket.

That lawsuit was one of many that the Trump Administration’s CFPB chose to drop. And the conventional wisdom is that there is going to be much less regulatory scrutiny on mergers and acquisitions (assuming you are paid up with the right people) over the next four years, which means [Uruk-hai voice] “vertical integration’s back on the menu, boys!”