There’s something poetic about Chime’s newest commercial, featuring former NBA star, coach, and TV announcer Mark Jackson.

Depending on your point of view, you might think of Mark Jackson as an indelible part of recent basketball history; a great player with a sneakily influential style, an important coach who helped nudge the Warriors towards their dynastic destiny, and a broadcaster whose signature catchphrases will outlive him (Mama, there goes that man!)

Or you might think of him as consistently overrated; a forgettable player who was traded half a dozen times, a coach who couldn’t get the Warriors to the mountaintop, and a broadcaster who had to hammer the same five catchphrases into the ground because his in-game analysis was useless.

Put simply, he’s a Rorschach test for how basketball fans feel about the NBA.

That makes him the perfect spokesperson for Chime, which has grown into a Rorschach test for fintech and banking nerds.

Depending on how you squint and tilt your head, you either see a behemoth in the process of redefining financial services or an overvalued moneypit that will be mercilessly cut down to size by public market investors.

So, let’s do a little Rorschach test of our own. I’ll hold up a series of facts about Chime, as revealed in the company’s S-1 document, and give you two different interpretations of each image.

(Editor’s Note — My sincere thanks to my fintech friend Jevgenijs Kazanins, author of the best publication on public fintech companies — Popular Fintech — in the world. He and I have been exchanging messages and theories about Chime since the S-1 dropped, and much of his thinking is expressed below.)

I see rapidly growing top-line revenue built on an efficient, asset-light business model.

Revenue growth has been strong (up 30% between 2023 and 2024), and the percentage of revenue generated from payments (i.e., debit and credit card interchange) has been decreasing as platform revenue (fees earned when members use out-of-network ATMs, fees paid for Chime’s small-dollar loan products, payments from Chime’s bank partners based on deposits users hold, and third-party partnerships) has increased (up 54% between 2023 and 2024).

Yes, Chime’s business doesn’t really look like your typical bank, but that’s by design. Chime believes that the typical bank business model (net interest margin) isn’t well designed for everyday Americans. From the S-1:

Traditional banks rely on a net interest margin-based business model with nearly 70% of their revenue coming from customer deposits and lending.7 This approach works well for the most affluent customers with higher credit scores, who have high deposit balances and large borrowing needs, but is ineffective for everyday Americans, most of whom live paycheck-to-paycheck and often have more modest account balances and limited credit histories. We believe that the majority of Americans can be better served by a payments-based banking model rather than the net interest margin-based model used by traditional banks. Everyday Americans earning up to $100,000 annually are estimated to account for less than 35% of consumer deposits yet over 75% of debit card transaction volume.8 We are focused on serving everyday Americans with a banking model aligned with this financial reality.

I see an uneven history of revenue growth and an undiversified business model that has never been tested at this scale.

Yes, revenue was up 30% between 2023 and 2024, but if you rewind the clock a few years, you can see that revenue growth wasn’t always so strong ($1.08 billion in 2022). The reality is that growth (across a range of metrics) for Chime has been quite uneven over the last five years.

That would be problematic under normal circumstances, but when we’re dealing with a business model this concentrated on debit interchange, it’s potentially catastrophic. We’ve never seen a business this big that is almost entirely dependent on debit interchange revenue. It’s unprecedented.

And remember that debit interchange revenue has been artificially boosted by the Durbin Amendment’s debit card interchange cap and the exemption for banks under $10 billion in assets (and their partners). The Durbin Amendment has hobbled big banks’ ability to compete with smaller banks and fintech companies on debit cards and low-dollar deposit accounts. However, as Chime notes in the S-1, the rules could change:

The Durbin Amendment and Regulation II exempt issuing banks that, together with their affiliates, have assets less than $10 billion from the limitations on the amount of debit card interchange fees. While our bank partners are currently exempt from the limitations on debit card interchange fees, and we expect them to continue to be exempt, we can offer no assurance or guarantee that they will remain exempt, and various events outside our control may cause our bank partners to become subject to the interchange fee limits in Regulation II.

I see tremendous membership growth and early indications of high attachment rates for additional products.

Chime has achieved a big increase in “active” members — meaning those that initiated a money movement transaction through Chime’s platform in the last calendar month — from 4.7 million in 2022 to 8.6 million in Q1 of 2025.

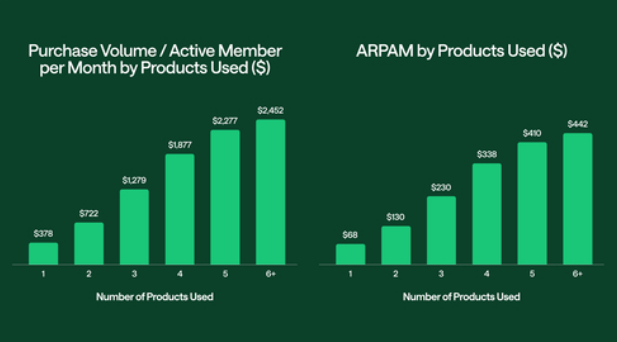

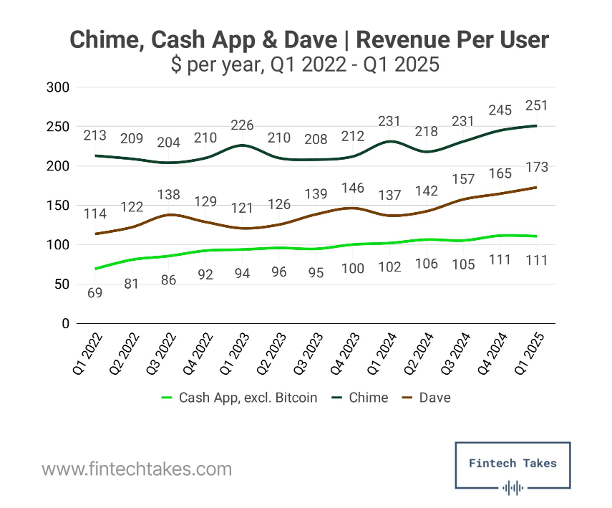

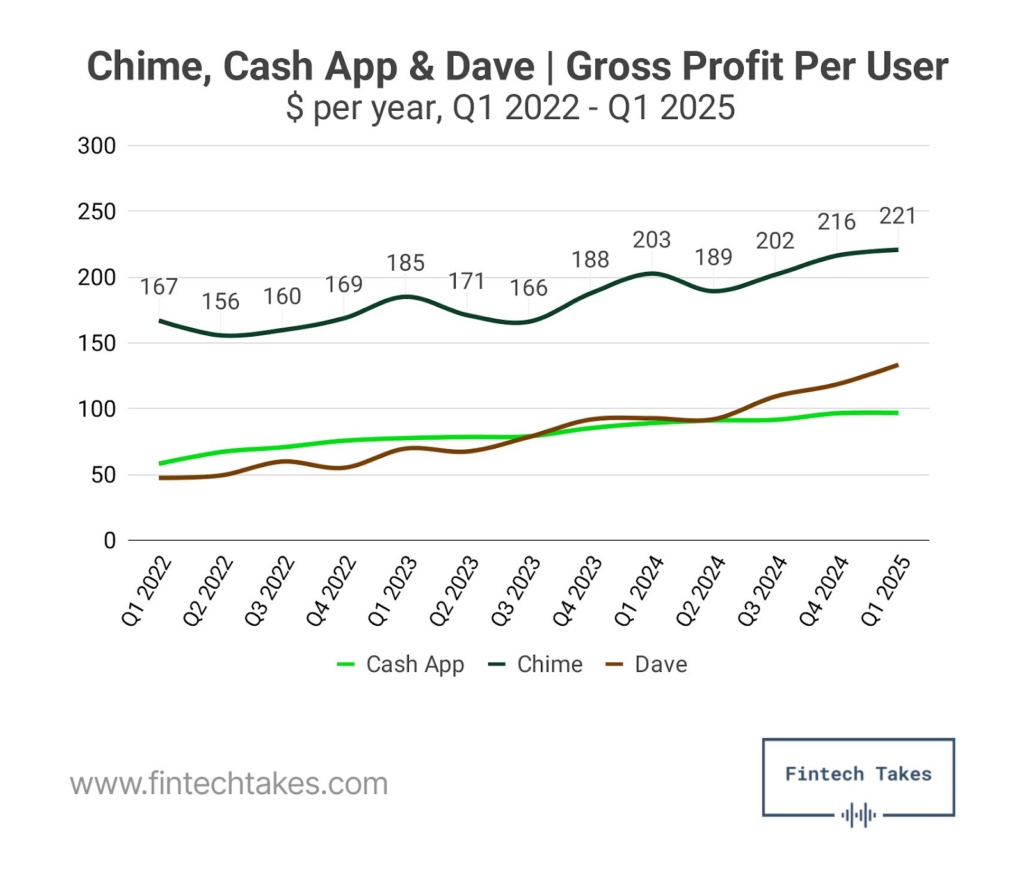

Additionally, as Chime has introduced new products, they have seen success in cross-selling those products to their members. These high “attach rates” are critical because they increase retention rates, purchase volume, and average revenue per active member, as these graphs suggest:

I see tremendous marketing spend and minimal growth in average revenue per active member.

As Jason Mikula pointed out in his most recent newsletter, Chime reached 8.6 million active members by dumping truckloads of cash on digital advertising and brand marketing. Here’s Mr. Mikula:

From the start of 2022 through to the end of Q1 2025, Chime spent a jaw-dropping $1.53 billion on sales and marketing. This war chest drove an increase of approximately four million active members, from 4.7 million actives at the end of Q1 2022 to 8.6 million actives at the end of Q1 2025.

Chime says its cost of customer acquisition (CAC) in 2024 was $109 per new active member, inclusive of advertising, brand marketing, referral bonuses, and other marketing incentives. The company says that excluding brand marketing, CAC per new active in 2024 was $91.

However, looking at the total sales and marketing expense, which includes personnel-related expenses and stock-based compensation for employees engaged in marketing functions, Chime spent $519.7 million on sales and marketing in 2024 to drive 1.4 million new active members, or an “all in” cost of about $371 per new active member.

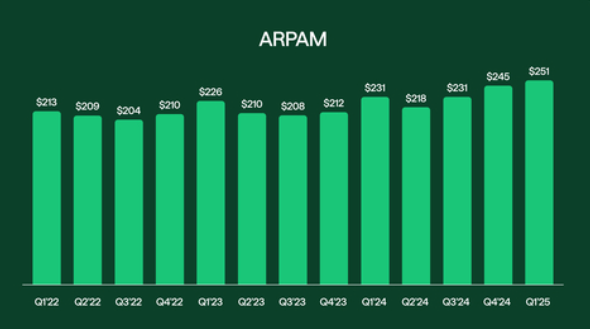

And there’s not a lot of evidence (yet) that Chime can bend the average revenue per active member (ARPAM) in a positive direction:

I see a strong focus on capturing direct deposits and becoming the primary financial provider, which is already paying dividends and will continue to do so.

67% is a big number! And it makes logical sense, because Chime has designed its suite of products and services to encourage members to direct their paychecks to Chime and to concentrate their spending and saving activity on the platform.

Two-day early access to your paycheck, fee-free overdraft protection, the credit builder card, earned wage access loans, and Chime+ (the new premium product tier, which comes with a higher 3.75 % APY on savings, cash-back offers, and priority customer support) all require having your direct deposit at Chime.

Capturing primary status powers Chime’s flywheel. These members spend more money on Chime cards, including significant amounts of non-discretionary spend (gas, groceries, etc.), repay loans at higher rates, accept cross-sell offers for additional products more readily, and generate a wealth of valuable first-party data.

I see a push for primacy that isn’t going as well as they pretend.

Let’s look at the definition that Chime uses for a primary financial relationship:

We define a primary account relationship as a relationship with a member who made 15 or more purchases using their Chime-branded debit or credit cards in the past calendar month or who had at least one qualifying direct deposit of $200 or more through Chime in the past calendar month.

That definition is specific and anchored on numbers far smaller than the average totals for those activities (the average gross monthly pay for consumers who make less than $100,000 a year is approximately $4,500, and U.S. consumers made an average of 32 card transactions per month in 2024). This makes me wonder just how much primacy Chime is actually capturing among its target customer segment.

The reason this matters is that a flywheel only works if the initial energy that is expended to get it moving translates into more efficient movement later. Chime spends a lot of money to acquire members. That investment only makes sense, at scale, if it is likely to lead to the development of sticky, high-revenue relationships with a large percentage of those members.

If that part of the funnel is broken (or simply less effective than the company claims), it’s a waste to pour more money in at the top of the funnel. Indeed, doing so is likely to just make other problems (like first-party fraud, which Chime has famously struggled with) worse.

I see a digital bank that is well-positioned to move upmarket without abandoning its principles.

Chime’s ambition (as stated in the S-1) to expand its addressable market by redefining its target customer from those who make less than $100,000 a year to those who make less than $200,000 a year is a smart strategy and justified by the success that the company has seen to date.

They are no longer in the same league as the peers they are often compared to, as the following two charts (prepared by Jev Kazanins) show:

It’s time to jump into the big leagues, and Chime is well-positioned to do it.

As the company notes in its S-1, nearly half of Americans earning more than $100,000 annually are estimated to live paycheck to paycheck. This means that these more affluent consumers are likely to need and value many of the products that Chime has already built for its less affluent members.

Additionally, the company has stated its intentions to expand its product suite to serve these more affluent consumers (e.g., installment lending, unsecured credit cards, longer-term savings, investing and wealth management, insurance, enhanced member rewards), and, based on its history to date, I am confident that it will build the best possible products for those consumers.

I see a payments company that may not be able to meet the holistic financial needs of its existing members, to say nothing of more affluent future members.

Jev asked me a good question when we were debating Chime — why haven’t the roughly 42 million U.S. consumers with deposit accounts at JPMorgan Chase switched to Chime?

If all consumers really do hate fees and love well-designed digital banking products, why hasn’t Chime stolen more market share from the big banks?

The obvious answer is that the big banks are doing stuff that Chime isn’t doing. Stuff that might be difficult for Chime, which has explicitly chosen to pursue a payment-centric asset-light business model, to replicate.

Here are a couple of possibilities:

- Lending. I know that Chime is planning to add more lending products over time, but it will find that to be much more difficult than it expects. This isn’t a criticism of Chime specifically. It’s just reality. Lending is hard, and the bigger the loan amounts and the longer the terms, the harder it is.

- Branches. A big part of Chime’s cost advantage is its lack of branches. However, there is evidence that a large branch network creates significant acquisition and retention advantages. There’s a reason Chase keeps building more of them.

- Bank Charter. I don’t get the sense that Chime has any interest in becoming a bank, but there may come a time when it needs to consider it. From what I can tell, Chime does an excellent job managing its bank partner relationships, but that doesn’t completely eliminate the risk of consumer confusion or anxiety regarding bank-fintech arrangements, as the Synapse debacle reminded us.

It’s hard to definitively say why some financial services providers win more than others, but, as a general rule, I try not to assume it’s because their customers are stupid. Chime may have a more challenging road to climb than it anticipates.