Editor’s Note — This article is sponsored by JUDI.AI. As with all sponsored content in Fintech Takes, this article was written, edited, and published by me, Alex Johnson. I hope you enjoy it!

Let’s work backwards.

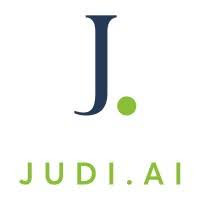

According to Cornerstone Advisors’ annual What’s Going On in Banking? Report, a growing percentage of community banks are making loans to small businesses (microloans under $75,000 and loans to sole proprietorships) a growth priority.

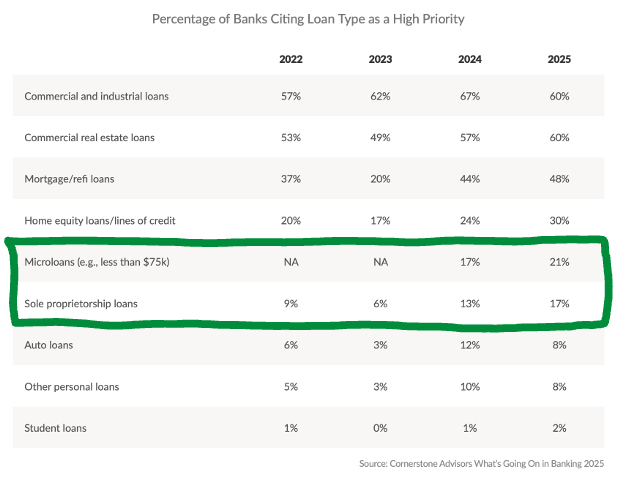

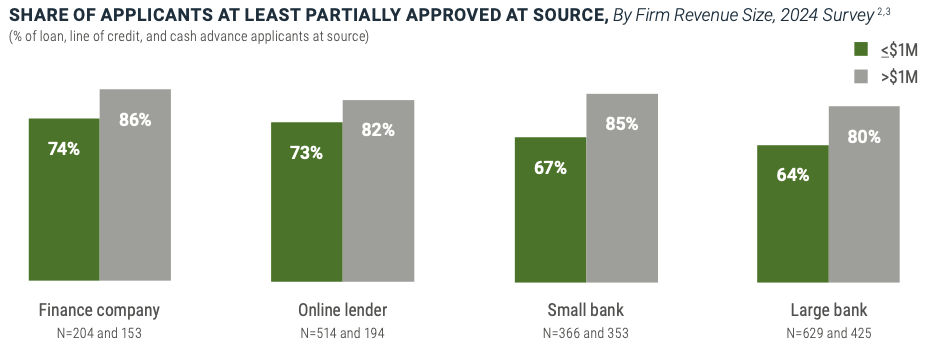

This is a logical decision. Community banks and credit unions are well-positioned to succeed in serving small business owners. In fact, according to the Federal Reserve’s 2024 Small Business Credit Survey, small banks and credit unions had the highest levels of customer satisfaction, according to small business owners who received at least some financing in 2024:

One of the reasons for this elevated level of satisfaction is that small business owners are far more likely to receive the full amount of financing they requested from small banks than from any other category of lenders. Given that nearly 60% of small businesses that applied for financing in 2024 did not receive the full amount of financing they requested, this is a significant competitive differentiator.

That’s the good news.

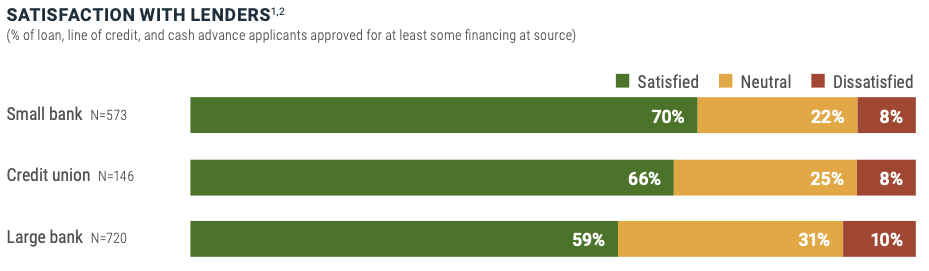

The bad news is that when it comes to actually acquiring small business lending customers, small banks have been losing ground to online lenders (i.e., fintech companies) since 2020:

Why is this?

Well, first, the distribution of small businesses and small business loans isn’t equal. There are far more sole proprietorships and small businesses (less than 100 employees) in the Small and Medium-sized Business (SMB) category than medium-sized businesses (100-1,000 employees).

The reason this matters is that, according to the Federal Reserve, non-bank lenders are more likely than bank lenders to make loans to smaller small businesses, which make up a majority of the market:

But why is that? Why do online lenders and other non-bank finance companies do better with sole proprietorships and small businesses?

Well, because smaller businesses are inherently more challenging to underwrite than larger ones.

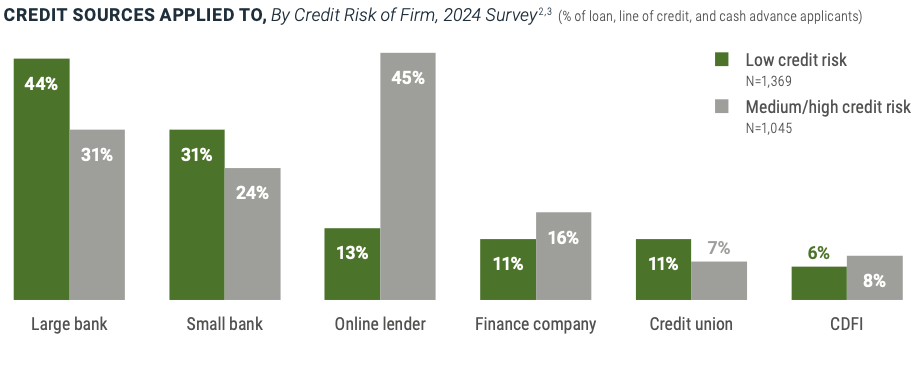

If you want to see an even more stark visualization of where online lenders are winning, look at this chart from the Federal Reserve, which shows the distribution of where small businesses are applying for loans, broken out by the risk level of the small businesses:

Nearly half of medium and high-risk small businesses that applied for loans in 2024 applied to online lenders!

Here’s the thing, though, and this is really important — the Fed’s definition of medium and high-risk is based on the self-reporting of the small businesses’ business and personal credit scores. If you reported high scores, you were classified in the survey results as low risk. If you reported lower scores, you were classified as medium or high risk.

Many small businesses, particularly those that are younger or have fewer employees, are likely to have low credit scores. Not because of a persistent history of late payments or defaults, but simply due to a lack of reported credit performance data.

The trouble is that many lenders lack the willingness and/or ability to sort those two groups — bad risks and unknown risks — apart.

Ironically, this includes online lenders.

Why Online Lenders Win

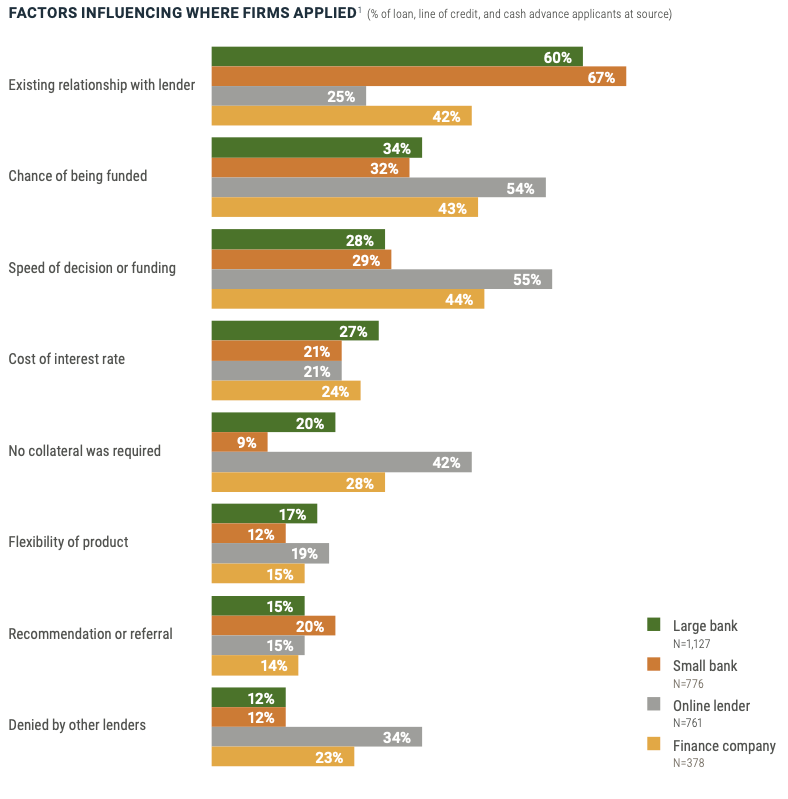

According to the Fed’s survey data, small business owners choose online lenders for two primary reasons.

The first is speed. Small business owners perceive (correctly) that online lenders will be able to make lending decisions quickly, and if the decision is “yes”, that they will disburse the funds from the loan quickly as well.

Speed matters to small business owners. The most common reason that small businesses apply for financing is to enable them to meet operating expenses (payroll, AP, etc.), per Fed data. In other words, they need to fill in gaps in their cash flow. And if they can’t do it in time, they go out of business. Speed of financing is, for many small businesses, existentially important.

The second reason that small business owners apply to online lenders is because of the belief that they are likely to be approved. This shouldn’t be a surprising motivation since, again, financing is existentially important to small businesses.

However, it’s important not to get confused on this point.

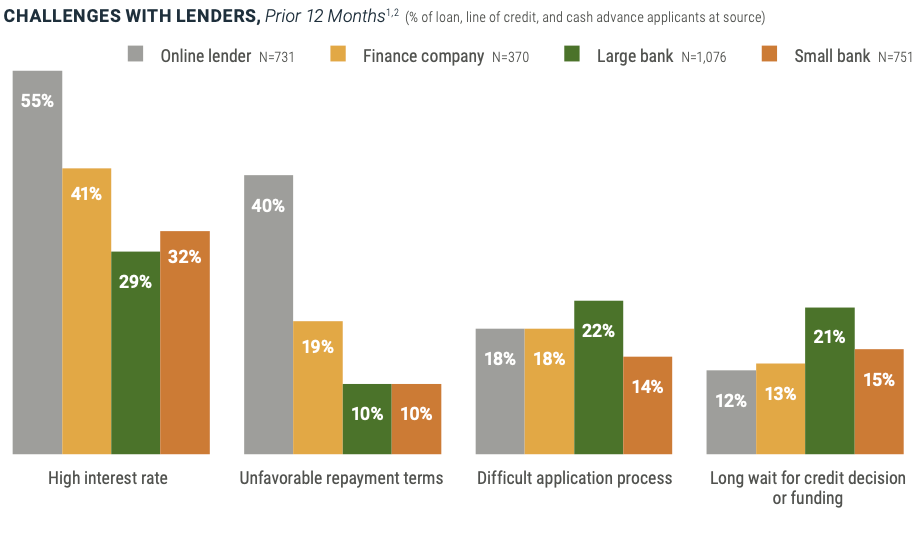

What small business owners want is to work with a lender that understands them and approves them for loans with fair pricing and terms based on the risks they actually pose. What they often settle for (because they have no choice) is a lender who will quickly say yes to them, even if that means putting up with unfavorable pricing or terms.

That second outcome is precisely what small business owners report about their experiences working with online lenders:

This is an opportunity for community banks and credit unions.

Small business owners aren’t satisfied with working with online lenders. They certainly aren’t loyal to online lenders.

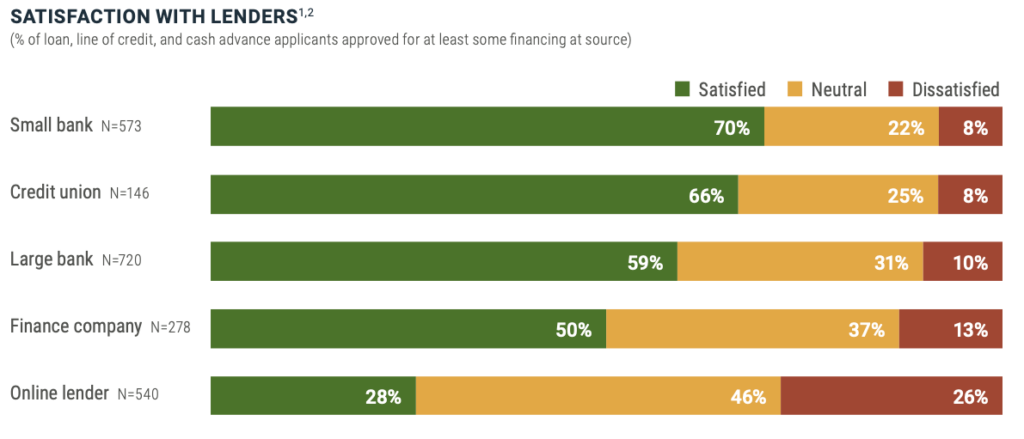

Remember that chart I showed at the beginning of this article, showing the relative satisfaction levels of different small business lenders?

Here’s what the full version of that chart looks like. Look who is at the bottom:

Community banks and credit unions can move down market and gain share with smaller small businesses looking for smaller loans (according to the Fed, 40% of small business loan applicants in 2024 were looking for less than $50,000 in total financing).

But to succeed here, community banks and credit unions cannot:

- Offer similarly unattractive terms to what online lenders offer.

- Rely on business or personal credit scores.

- Manually underwrite small business applicants the way they do for larger commercial clients.

They have to find a different way to win.

How Community Banks and Credit Unions Can Win

Do you know the number one factor that drives small businesses to apply for loans with small banks?

According to Fed data, it’s an existing relationship with the bank:

Think about what that means. Small business owners are telling us, “If I can just work with a lender who knows me, who understands the unique quirks and rhythms of my business, they will understand why I need the money and will be willing to quickly loan it to me at a fair price.”

Community banks and credit unions do this very well today for the small business customers/members who bank with them.

The challenge is extending this understanding beyond the boundaries of lenders’ existing deposit relationships, and doing so in a way that meets the funding speed expectations of small business owners.

This is where open banking and cash flow underwriting come in.

If you are a regular reader of Fintech Takes, you likely know that open banking infrastructure has enabled bank customers and credit union members to programmatically share access to their bank account data for the purposes of automated credit risk evaluation (i.e., cash flow underwriting).

Cash flow underwriting is most often discussed in a consumer lending context, but it is, perhaps, even more useful in commercial lending, particularly small business lending.

Remember, the most common reason small businesses seek out financing is to help them address temporary gaps in their cash flows.

Cash flow underwriting enables lenders to instantly harness granular bank transaction data to understand (and even predict) those gaps and to gain enough comfort in the business’s historical financial performance and regular cash flow patterns to approve them for fairly priced, well-tailored loans to fill them.

Put simply, cash flow underwriting addresses both small business owners’ need for speed and understanding.

For community banks and credit unions focused on growing their share of the small business lending market (particularly growing beyond their existing deposit relationships), it is a critical capability.