Editor’s Note — This article is sponsored by BILL. As with all sponsored content in Fintech Takes, this article was written, edited, and published by me, Alex Johnson. I hope you enjoy it!

It’s universally acknowledged that running a small business is difficult.

What’s less well-understood is why.

Listening to the often-grim discourse around entrepreneurship and seeing stats like “one quarter of small businesses fail within the first year,” you’d be tempted to think it’s simply a liquidity problem: small business owners don’t have enough money to stay afloat.

Yet, according to a new report — The 2025 BILL Report: Building the Future of Finance — which surveyed 1,003 small and medium-sized business (SMB) owners, executives, and finance leaders, that’s not the case. When asked how their cash position has changed over the last 12 months, 53% of survey respondents said that it had improved! Only 14% reported that their cash position had deteriorated over that time, and less than 20% said that they needed to take on debt to keep their business healthy over the next six months.

Put simply, most SMBs don’t have a cash problem. They have a cash flow management problem.

I Can’t Plan For What I Don’t See Coming

Cash on hand is only as useful as the line of sight you have into it, and SMB owners and executives report that their sightline is far from clear.

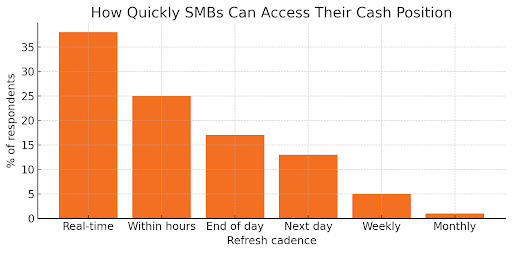

Only 38% reported having real-time visibility into their cash position at any given time. Everyone else is forced to wait: 25% must wait a couple of hours, another 30% wait a day or two, and the remaining 7% wait anywhere from a week to a month. This chart makes the cliff obvious: visibility falls off a ledge after real-time.

This lack of real-time visibility comes with significant consequences. When asked what their top three cash flow management challenges are, survey participants said unexpected expenses (42%), late customer payments (35%), and seasonal swings (29%).

Note that these are all, fundamentally, data problems.

If you can see an invoice drifting thirty days past due while payroll looms, you can chase the customer, proactively tap into a line of credit, or roll out an early-pay discount. However, if you only spot the gap after it punches a hole in your balance sheet, your available options are … less appealing.

The systems that SMBs use to manage their businesses have shaped how they operate. A lack of on-demand data and insight has taught SMB owners and executives not to bother checking. According to the survey, only 18% of respondents think about their cash flow like they check their phone — constantly or multiple times per day. Most treat it like paying the bills: 36% check weekly, 32% look monthly, and 13% only dig into the data when there’s a problem.

Spend control suffers the same blind spot. Ask finance teams what gives them headaches, and they don’t start with shoeboxes of receipts; they start with invisible budgets. Last year, 44% of respondents rejected reimbursement claims, and the top reason was that they exceeded the approved budget. Additionally, when asked what their biggest frustration related to expense and spend management was, most commonly listed “Lack of budget or spend visibility” as a top point of friction.

Where the Signal Dies

So, where does the signal die?

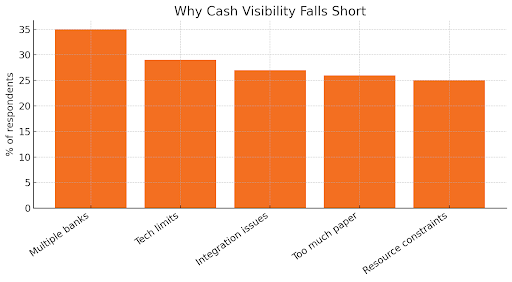

More than one-third of respondents blamed multiple banking relationships, each with its own portal and CSV format, as the top culprit. 29% pointed to the limitations of their technology systems, and 27% listed integration issues as a top challenge to achieving more visibility. “Too much dependence on paper” comes in at 26%, while 25% admit they lack the headcount to stitch their various systems together.

The Importance of AI and Automation

SMB leaders are hungry for a solution to this data problem.

When asked what would help them slice through all the red tape, 42% mentioned AI and automation.

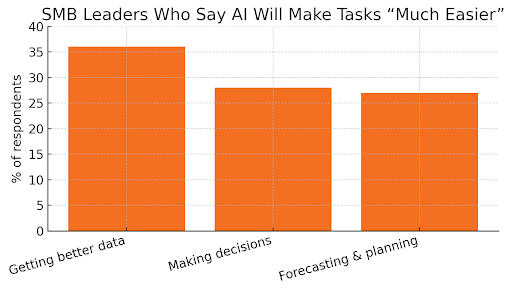

And when asked how AI might make starting or running a business much easier, respondents listed getting better data (36%), making decisions (28%), and financial forecasting and planning (27%):

And yet only 12% called AI an “essential advisor” today.

That ambivalence doesn’t reflect an undue concern about the reliability of AI. It’s about the underlying plumbing. An AI model can’t analyze what it can’t see. Until account balances, invoices, card swipes, and payroll runs land in the same ledger, the tangible benefits of AI will remain elusive.

So the solution isn’t smarter algorithms; it’s a rich and well-integrated data fabric — first-party transaction data, open banking data, expense management policies — for those algorithms to run on.

Once pipes are built, everything flips. 50% of respondents say tighter cash management would let them jump on new opportunities or tweak prices in real time. Those are strategic weapons, not clerical conveniences. The company that instantly understands its own cash position can green-light a new product line before the holiday season, while slower rivals are still waiting for last week’s close.

SMBs are already planning the leap. For the 2026 tax season, 42% aim to automate “as much as possible,” 33% intend to go completely paperless, and 33% will upgrade their tech stack — proof that SMB owners and executives understand the cure begins with the pipes, not the models.

Pick The Right Platform

History suggests that this data fabric will most likely be found within the financial operations platforms (or Small Business Operating Systems, as I have previously called them) that SMBs already utilize — commerce hubs, accounting suites, and payment and expense management stacks.

Each new feature pulls in more daily usage, generating richer data, making forecasts sharper, luring still more usage. It’s a virtuous loop that will crown a handful of dominant platform providers, giving their customers big-company superpowers without the big-company headcount.

If small and medium-sized businesses pick the right platforms to build their businesses on, they will gain sophisticated forecasting and cash management capabilities. When that happens, today’s “we’re good on cash” story will evolve into “we’re great at turning cash into advantage.”

Running a small business is difficult, yes. But with the lights on and the data flowing, it doesn’t have to be a shot in the dark.