Lending is a relationship business.

However, I believe one of the enduring frustrations in lending is that consumers and lenders are rarely in the same place in the relationship at the same time.

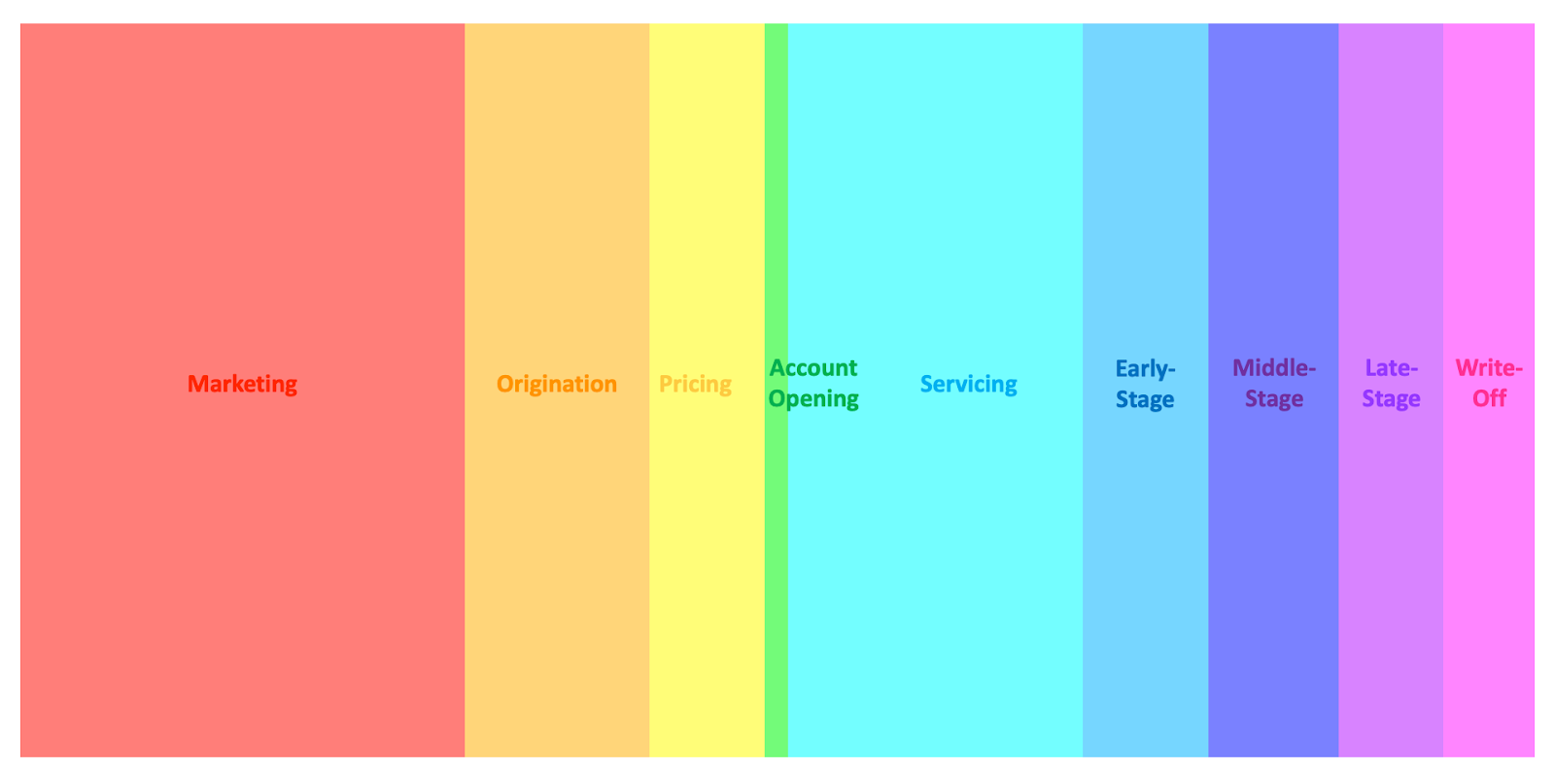

Think about the consumer credit lifecycle.

You start out in marketing. Consumers sift through a range of similar-looking options via comparison sites and lead aggregators, weighing factors like rates and terms to find the best fit. Lenders, meanwhile, pull out all the stops to differentiate their offerings — through rewards programs, personalized recommendations, and eye-catching ads across digital channels — to capture attention and drive applications.

Once a consumer applies, the origination phase begins, with lenders doing everything possible to streamline the process (auto-filling applications, verifying information with minimal friction, etc.) to reassure the consumer that they made the right choice.

After the consumer is approved for the loan, the lender determines the pricing and terms that will optimize the acceptance rate and risk-adjusted profitability.

Account opening is where the loan is booked and funds are disbursed.

Servicing comes next, handling routine tasks such as payment processing, balance updates, and basic support inquiries through apps or automated systems, with a focus on maintaining steady operations to generate revenue.

If repayment issues arise, early-stage delinquency (1-30 days past due) involves sending light-touch reminders via email or text to encourage resolutions without escalation. Middle-stage delinquency (31-90 days past due) ramps up with direct outreach, such as calls proposing modified repayment plans, to address emerging problems. Late-stage delinquency (91-180 days past due) intensifies efforts, including potential legal warnings or recovery actions like repossession. And finally, write-off occurs when accounts are charged off as unrecoverable, often leading to sales to third-party collectors and debt buyers.

Pretty standard stuff.

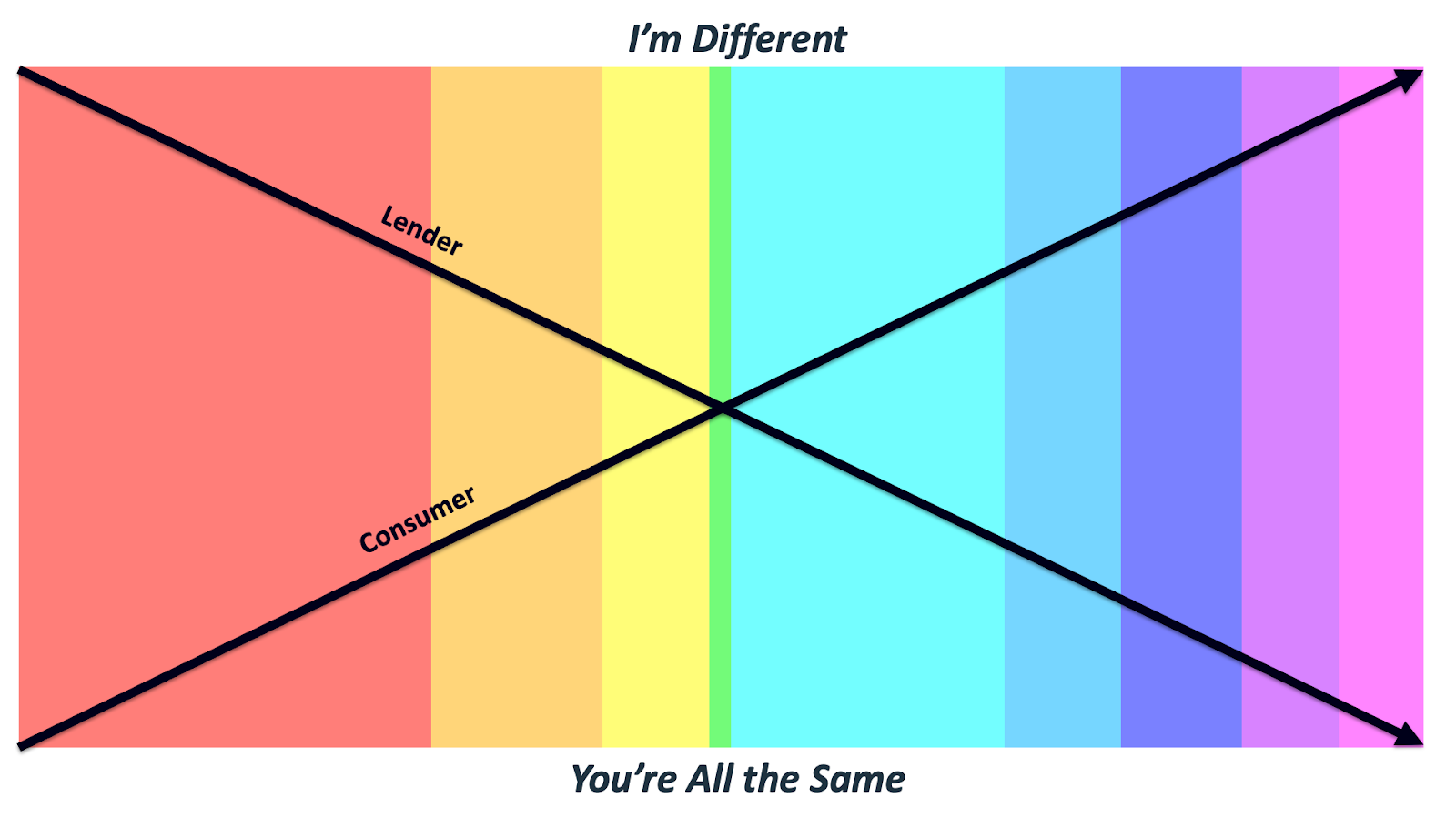

What’s interesting is how consumers and lenders experience this journey.

During the customer acquisition phases of the lifecycle (the left side of the graphic), lenders invest in standing out to attract borrowers. However, consumers, who are shopping around, often perceive little real variance among commoditized options. The lender’s upward slant toward “I’m Different” shows their marketing intent, while the consumer’s downward trajectory towards “You’re All the Same” reflects skepticism.

The servicing and debt management phases of the lifecycle (right side of the graphic) are the inverse.

Lenders treat accounts as a homogenized portfolio for efficiency (slanting toward “You’re All the Same”), optimizing via automation and standardized risk models. Consumers, facing real-life hurdles, gravitate toward “I’m Different,” seeking empathy for their specific situations (e.g., job loss or medical bills).

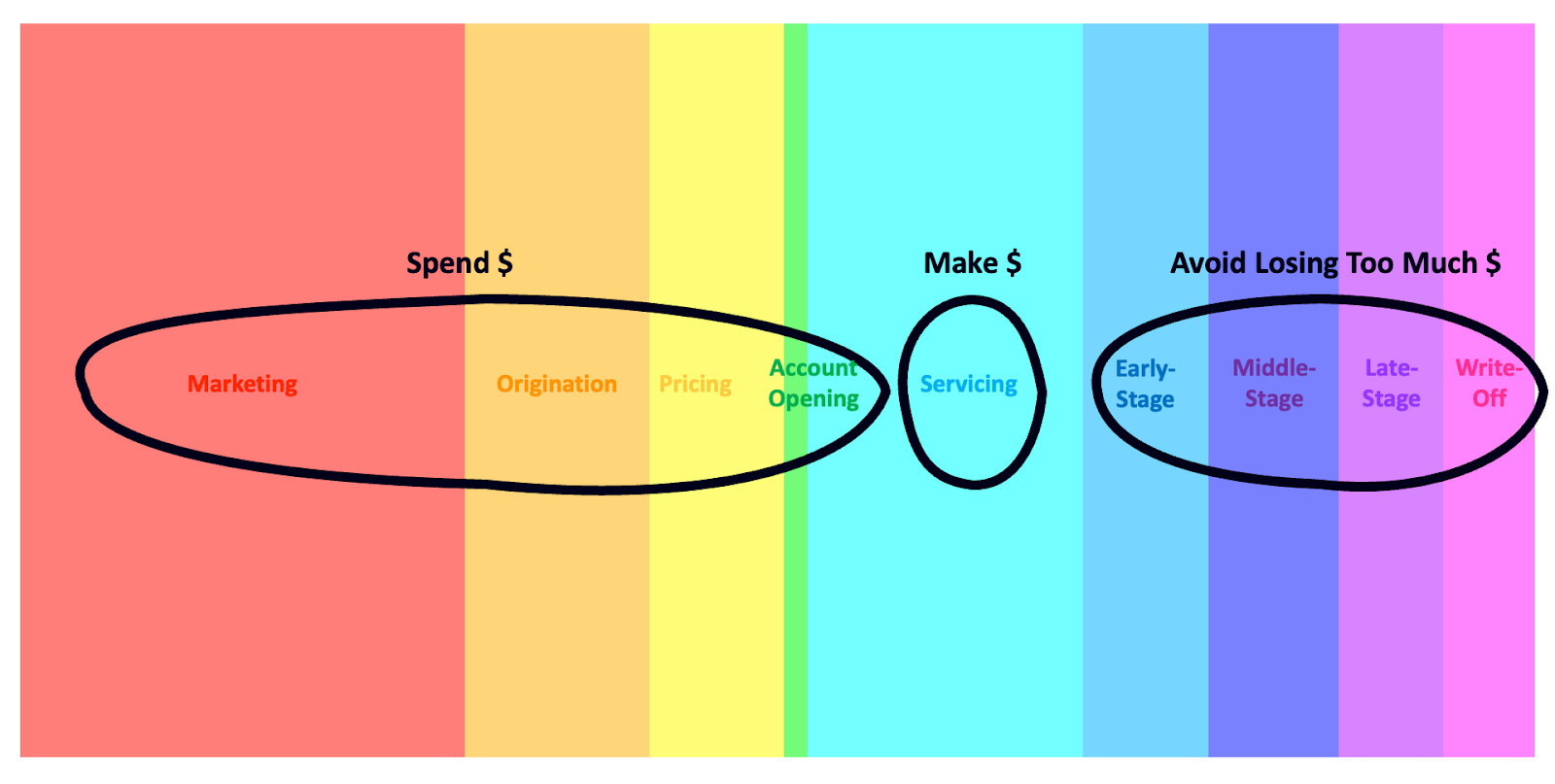

This paradox directly influences lenders’ traditional resource allocation decisions across the lifecycle, dividing it into distinct zones: heavy spending in the early acquisition stages, moderate investment in servicing, and minimal intervention for loss mitigation at the end.

On the customer acquisition side of the lifecycle, lenders invest substantial funds to differentiate themselves and capture market share. They invest in advanced digital marketing campaigns that utilize data analytics for precise targeting and develop robust technology infrastructure to streamline account opening. This front-end emphasis is designed to maximize volume by converting leads into new borrowers, with every expenditure geared toward growing the portfolio.

As the lifecycle moves to the middle (servicing), the focus shifts to operational reliability. Lenders allocate resources to create efficient systems, such as automated payment gateways and user-friendly digital portals for self-managed adjustments, which support consistent revenue generation through interest and fees. This mid-cycle phase requires steady, but not extravagant, funding to maintain smooth functionality, allowing lenders to harvest returns from established accounts with minimal risk of disruption.

In contrast, the debt management stages of the lifecycle receive far less attention, approached primarily as a defensive mechanism to contain losses. Lenders have historically limited their investments to essential tools, such as standardized call scripts, basic automation for reminders, and contingency-based partnerships with external agencies, viewing these as sufficient for basic recovery efforts. This underinvestment stems from the perception of inherent challenges — unpredictable borrower behaviors, high variability in case outcomes, and the resource-intensive nature of individualized handling — which leads to a strategy of cost containment over innovation.

This resource allocation strategy makes sense.

Or, I should say, it used to make sense.

Two critical assumptions underlying this formula have been rendered invalid in recent years, and these changes are driving a wholesale transformation of loan servicing and debt management.

Assumption #1: Acquisition > Retention

The first outdated assumption underpinning lenders’ traditional resource allocation strategies is that customer acquisition should always be prioritized over retention.

In the past, this made sense: lenders could build moats through physical branches or proprietary data, and the front-end investments paid off handsomely in an era of less competition.

But the landscape has shifted dramatically. Competition has intensified with the explosive growth of fintech lenders and private credit funds, which have expanded the lending pool and eroded the traditional advantages enjoyed by incumbents. Private credit assets under management, for instance, reached nearly $2 trillion in 2024 and are poised for continued growth in 2025 as funds diversify into areas like asset-based lending and distressed debt. This surge, combined with fintechs’ agility and eagerness to innovate on product structure, has filled in distribution gaps — branches are no longer a differentiator in a market dominated by apps and lead aggregators.

Embedded lending exacerbates this, integrating financing directly into non-financial platforms such as e-commerce sites or software apps, thereby siphoning volume from direct channels. As I have written previously, embedded lending tends to displace direct lending over time, as it is almost always more convenient for consumers to obtain loans within their existing workflows rather than seeking them out separately.

Underwriting and pricing have also matured industry-wide, closing off the kind of arbitrage opportunities that propelled early innovators, such as Capital One, in the 1990s. Today’s sophisticated tools — advanced analytics, machine learning for risk scoring, and real-time pricing engines — have leveled the playing field, making it harder to gain an edge solely through front-end smarts.

As a result, the market is pivoting toward customer retention, recognizing what consumers have long understood — lending is a relationship business, and loan servicing and debt management are where strong relationships are forged.

Rocket Mortgage exemplifies this.

By aggressively acquiring mortgage servicing rights (MSRs) — the company held roughly $7.3 billion in MSRs at the end of Q1 2025 — and leveraging an 85% recapture rate on refinances, they’ve turned servicing into a growth engine. Their recent acquisition of Mr. Cooper, the nation’s largest servicer, in a $9.4 billion deal further cements this strategy, combining forces to manage a $2.1 trillion servicing book and enhance client retention across nearly 10 million borrowers. This shift underscores that in a saturated market, holding onto customers through superior servicing yields more sustainable returns than perpetual acquisition battles.

Assumption #2: The Efficiency-Effectiveness Trade-off

The second outdated assumption is that debt collection inherently involves a trade-off between efficiency (handling high volumes at low cost) and effectiveness (achieving high recovery rates through personalized engagement).

The most effective interventions occur early (ideally before delinquency), are tailored to the borrower’s unique circumstances, and are delivered with empathy to elicit reliable commitments (the metric that measures this outcome is called “promise to pay”).

However, this approach to collections is very difficult to do efficiently. Lenders’ systems are not well-tuned to detect early signs of financial distress, and human judgment and communication skills are generally required to understand the unique financial situations of delinquent borrowers and work with them to proactively resolve problems. And humans, as we all know, are expensive to employ.

By contrast, the efficient approach to debt collection can best be described as triage: accurately identifying and sorting high-priority cases from those that are likely to self-cure, and ruthlessly optimizing the time of human collection agents to maximize their impact.

Technological advances in debt management — such as multichannel automated communications (SMS, email, apps) and predictive machine learning models for risk scoring — have supercharged this efficiency-focused approach over the last 10-15 years. However, they haven’t fundamentally disrupted the trade-off; they’ve optimized for scale and cost savings without fully enabling the deep, individualized interactions needed for peak effectiveness, leaving the core dynamic of volume versus quality intact.

Fortunately, large language models (LLMs) are changing this equation. They offer the potential to blend efficiency with true personalization — either as fully autonomous agents or as augmentations for human staff.

To appreciate why, it’s worth stepping back for a brief overview of LLMs.

At their core, LLMs are advanced AI systems trained on massive datasets of text — often trillions of words from books, websites, and conversations — to predict and generate human-like language. Models like GPT-4 operate as transformer-based neural networks, weighing the importance of different words in a sequence, allowing them to capture context, nuances, and patterns far beyond simple keyword matching. They ‘learn’ through pre-training on broad data, followed by fine-tuning on specific tasks, and can be prompted to perform a wide array of functions, from summarization to creative generation.

What sets LLMs apart from traditional machine learning (ML) models is their generative capability and contextual understanding.

Traditional ML in debt collection might use supervised algorithms — like logistic regression or random forests — to predict delinquency risk based on fixed features (e.g., payment history, credit score), outputting probabilities or classifications. These are discriminative models. They excel at identifying boundaries and patterns in structured data but cannot create novel outputs or handle unstructured inputs, such as free-form borrower emails.

LLMs, by contrast, are generative: They produce coherent, context-aware responses, simulating reasoning chains and adapting dynamically. This difference matters profoundly for debt collection, where success hinges on unstructured, human elements — detecting emotional cues in a borrower’s message, crafting persuasive yet empathetic replies, or simulating negotiation scenarios.

For early intervention, LLMs can analyze subtle signals across data sources (e.g., app usage patterns or support chat logs) to flag at-risk accounts preemptively, generating proactive outreach, such as personalized hardship assessments, before a payment is missed.

True personalization becomes scalable: an LLM can ingest a borrower’s full profile — past interactions, financial trends, even inferred life events from communication tone — and output customized plans, such as “Based on your recent job change, how about reducing payments for 60 days?” This not only feels individualized but also drives better outcomes. Traditional ML might flag sentiment, but LLMs generate responses that mirror human compassion, using natural language to de-escalate (I understand this is tough — let’s work through it together), boosting promise-to-pay adherence by fostering trust.

As autonomous agents, LLMs can handle full conversations via chat or voice, negotiating in real-time with decisioning logic that adapts to borrower pushback, potentially resolving a significant number of cases without human involvement.

For augmentation, they empower staff by suggesting scripts, summarizing histories, or even role-playing scenarios for training, cutting agent workload while maintaining compliance through built-in safeguards. Unlike rigid ML, LLMs handle ambiguity (e.g., interpreting vague borrower excuses) and evolve with feedback, fine-tuned on collections datasets to improve over time.

In a field where human-like reasoning and understanding of nuance were the bottlenecks, LLMs democratize them, helping transform collections into a strategic brand-building and customer retention asset rather than simply a cost center.

First Steps

This isn’t about incremental tweaks; it’s a strategic pivot to treat servicing and debt management as the most important components of the relationship between a lender and its customers.

This shift won’t happen overnight, but in researching this essay, I identified five specific steps that lenders can take to start heading down this path.

#1: Break Down Silos and Create a Unified Servicing Architecture

Traditional lending systems are fragmented, with separate platforms for origination, servicing, and collections, which create operational blind spots. This siloing makes it challenging to view the borrower journey holistically — collections teams often refer to servicing as “pre-collections” because upstream systems aren’t equipped for proactive distress handling, forcing clumsy integrations such as data exports or API patches that delay responses and increase errors.

To address this, prioritize a “single pane of glass” architecture: a centralized platform that integrates all lifecycle data into one dashboard, enabling seamless transitions from routine servicing to early interventions.

This approach can be extended to human operations by consolidating call centers: replace specialized agents (e.g., separate teams for inquiries versus collections) with versatile generalists trained across multiple functions, augmented by AI for real-time guidance. This reduces handoffs (borrowers hate being transferred) and improves outcomes.

(Editor’s Note — This white paper from C&R Software contains some good insights on how to start tackling the challenge of siloed systems of record within servicing and debt collection.)

#2: Develop a Flexible Strategy for Agentic AI and Human Augmentation

LLMs’ rapid evolution means capabilities shift weekly — what’s augmentative today could be fully agentic tomorrow. Lenders need a hybrid roadmap that balances autonomous AI (e.g., bots handling routine negotiations) with augmentation (e.g., real-time suggestions for human agents).

Experiment. Use A/B testing to deploy LLMs in low-risk scenarios, like email drafting or vulnerability detection, and scale based on metrics like resolution time.

A clever tactic is leveraging natural attrition. Avoid backfilling departing human agents and, instead, redirect headcount savings to AI experiments. This creates an organic space for bots to take over monotonous tasks, such as initial outreach, thereby freeing humans to focus on more complex cases. Done right, it lowers the attrition rate because human agents report higher satisfaction when AI handles the drudgery.

Crucially, steer clear of public missteps like Klarna’s decision to replace 700 agents with AI, which drew regulatory scrutiny and backlash; focus messaging on enhancement, not elimination, to keep stakeholders comfortable.

#3: Implement Deterministic Guardrails for LLM Compliance

LLMs’ flexibility is a double-edged sword: while they enable empathetic and adaptive interactions, they risk unintended outputs that violate regulations, such as the Fair Debt Collection Practices Act (FDCPA) or CFPB guidelines on fair treatment.

Shift from “won’t be evil” (relying on model training) to “can’t be evil” by layering deterministic systems, such as hardcoded rules engines that override LLM suggestions, ensuring no prohibited actions like harassing language or unauthorized fees.

This structural approach not only mitigates fines but also builds audit trails for explainability. In the UK, where Consumer Duty mandates vulnerability detection, guardrails can enforce mandatory pauses for flagged cases, routing to humans if needed. Start by mapping regs to rules (e.g., “No contact outside 8 am – 9 pm”), then test via simulations, ensuring AI enhances customer outcomes without stifling innovation.

(Editor’s Note — C&R Software has extensive experience in this area and has written a helpful blog post on how automated decisioning systems can help enforce regulatory compliance.)

#4: Design Agentic Workflows Around Specialized AI Teams

Rather than relying on monolithic LLMs to handle everything, structure workflows as teams of specialized AI agents, each with a defined role, coordinated by an orchestration agent.

This modular design minimizes errors — individual agents focus narrowly, thereby reducing hallucination risks — and enhances explainability, as outputs are traceable to specific components for audits.

In collections, picture having an “Analyzer Agent” process borrower data (e.g., emails, payment history) to detect distress signals, such as tone shifts indicating job loss. A “Planner Agent” generates tailored options, such as forbearance plans, drawing from policy databases. An “Empathy Agent” refines language for compassion (“We’re here to help through this”). The “Orchestrator Agent” sequences them, starting with analysis, then planning, and finally drafting a response, while applying compliance checks. If needed, it loops in a “Human Escalator Agent” for overrides.

#5: Expand the Toolbox of Borrower Interventions

To capitalize on LLMs’ personalization at scale, equip agents (both human and AI) with a comprehensive suite of tools that extend beyond basics, such as repayment plans and forbearance. Include debt consolidation options, income-boosting referrals, budgeting apps, and links to government aid like SNAP or unemployment benefits. This holistic approach transforms collections into value-added experiences, enhancing satisfaction and recoveries by addressing the root causes.

From Scarcity to Abundance

For too long, loan servicing and debt management have been seen solely as operational burdens. Necessary, but not differentiating. This perception has created a scarcity mindset when it comes to investing in loan servicing and debt management technology.

However, with the emergence of LLMs and generative AI, the assumptions that underpinned that scarcity mindset are no longer valid. Customers want to work with lenders that treat them like human beings and that will work with them, with flexibility and empathy, when things get off track.

Generative AI capabilities, deployed within a well-designed decisioning system and an integrated system of record, can now deliver those outcomes efficiently and at scale. An abundance mindset in loan servicing and debt management is now feasible, and it will, faster than you might expect, become a competitive necessity.

ABOUT SPONSORED DEEP DIVES

Sponsored Deep Dives are essays sponsored by a very-carefully-curated list of companies (selected by me), in which I write about topics of mutual interest to me, the sponsoring company, and (most importantly) you, the audience. If you have any questions or feedback on these sponsored deep dives, please DM me on Twitter or LinkedIn.

Today’s Sponsored Deep Dive was brought to you by C&R Software.

C&R Software delivers advanced SaaS solutions for credit risk management, serving over 450 companies in more than sixty countries worldwide. Their comprehensive suite leverages automated workflows, AI-native insights, and data-driven decisioning engines to simply and humanize the entire customer lifecycle.