Editor’s Note — This article is sponsored by Marqeta. As with all sponsored content in Fintech Takes, this article was written, edited, and published by me, Alex Johnson. I hope you enjoy it!

The interesting thing about embedded finance is that not all aspects of embedded finance are created equal.

Take payments as an example.

Fundamentally, payments has two sides — acceptance and issuance. They are, quite literally, two sides of the same coin. And yet, they have evolved in radically different ways, and the competitive dynamics (and opportunities for competitive differentiation) within each could not be more different.

Let’s start with payment acceptance.

Payment Acceptance

Payment acceptance — the ability to accept various forms of payment (cash, debit and credit cards, etc.) from customers — is an embedded finance capability that all businesses have in common.

You literally cannot be in business if you can’t accept payments for your products or services!

As such, there has always been a robust market for helping small businesses figure out how to accept payments. That market is fairly stable, and the universe of providers and customers is well known (if large and dynamic).

It really only changes when the technology underpinning how businesses and consumers engage in commerce changes.

For example, the OGs in card payment acceptance are the ISOs (that’s Independent Sales Organizations for the acronym-curious); a one or two-person outfit driving around with a trunk full of countertop credit card terminals.

That’s how your long-standing neighborhood coffee shop first started taking cards. They called an ISO (or, more likely, an ISO called them), and they set up all the plumbing, left behind a machine with a roll of receipt paper, and disappeared until the next service call.

ISOs were the last-mile distribution channel that payment processors, merchant acquirers, and the card networks used to get to small businesses for decades.

But then came smartphones, which, when paired with an inexpensive magstripe card reader, suddenly made it much easier and cheaper to push card acceptance capabilities to a category of merchants (micro-merchants … think the flower seller at the local farmers’ market) that even the ISOs hadn’t bothered with. The company offering that smartphone dongle (Square) eventually moved upmarket, displacing those ISOs for the payment acceptance needs of larger neighborhood businesses.

The same thing happened in e-commerce. Selling products and services online used to be an enormously expensive endeavour for merchants. Amazon spent billions of dollars perfecting it in the 1990s and early 2000s.

Fast forward a decade, and technology had progressed sufficiently to allow a new generation of e-commerce enablement companies like Stripe (focused on developers) and Shopify (focused on more traditional small retailers) to democratize access to cutting-edge e-commerce capabilities for small businesses and micro-merchants.

However, just because every business needs to accept payments doesn’t mean that every business thinks the same way about payment acceptance.

Small businesses think about payment acceptance very little. This makes sense. Small business owners are incredibly busy people! And they aren’t experts in financial services. They just want something that works, and if that something is bundled with a bunch of other somethings (accounting, inventory management, payroll, etc.) that they need, all the better!

(This, incidentally, is the exact pitch for vertical B2B SaaS platforms, which have become a major distribution channel for a range of embedded finance capabilities, especially payments.)

However, as businesses get bigger, their needs regarding payment acceptance mature. Medium-sized businesses (roughly 100-500 employees) start hiring full-time CFOs and finance teams. They invest in risk management and operational efficiency.

And those investments manifest in a more rigorous approach to managing the various aspects of payment acceptance. Businesses in this size range will take a much keener interest in questions like, “How can we increase our chargeback win rate?” and “How does least-cost routing for debit card payment processing work?”

And for the businesses that reach the end of this maturity curve; the large enterprise companies like Walmart, which employs a staggering 2.1 million people, payment acceptance becomes an obsession. Hundreds of the smartest and most creative payments experts you’ve ever met, doing nothing but waking up every day trying to think of ways to shave a few basis points off of the company’s payment acceptance costs.

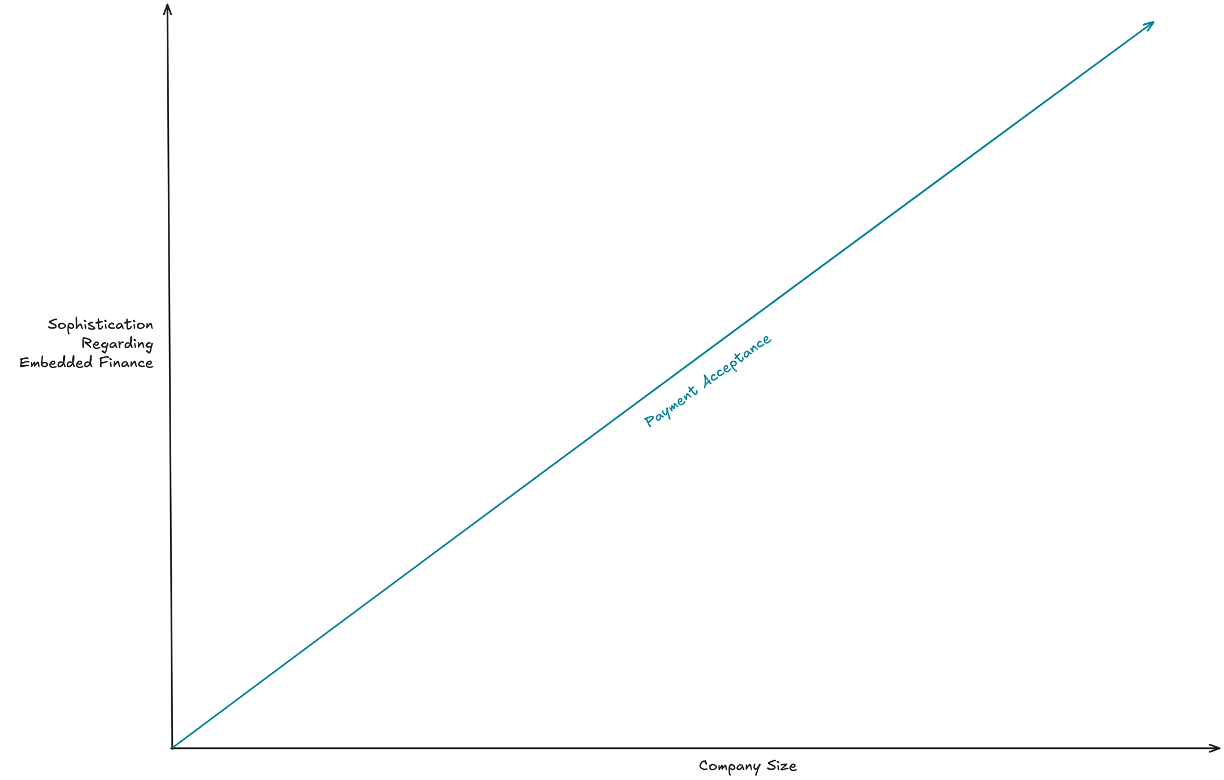

This is the payment acceptance maturity curve, and, as you can see, it’s a slow and generally predictable evolution:

Now, let’s flip things around and talk about payment issuance.

Payment Issuance

Like payment acceptance, payment issuance — the creation of payment instruments that a company’s customers can use to buy its products (and products from other companies) – can be enormously beneficial.

Not only can it lower a company’s payment acceptance costs (when a company provides the payment instrument that its customers use to pay it, it can cut out most if not all of the transactional payment acceptance costs … this is colloquially referred to as “closed-loop payments”) but it can also lead to increased sales (through customer incentives that produce more frequent sales and larger average order values), stickier customer relationships (thanks integrated loyalty and rewards programs), and new revenue streams (when customers use the payment mechanism with other merchants, the issuing company collects a portion of the transactional revenue).

The difference between payment acceptance and payment issuance is that companies don’t need to issue their own payment instruments to do business.

Unlike payment acceptance, payment issuance is ancillary to the business of running a business.

As such, it has historically only made sense for companies above a certain size threshold to explore payment issuance. If you didn’t have enough transaction volume to make the cost savings material, and the number of customers to make the revenue potential enticing, and the internal resources to make the operational burdens tolerable, it just wasn’t worth considering.

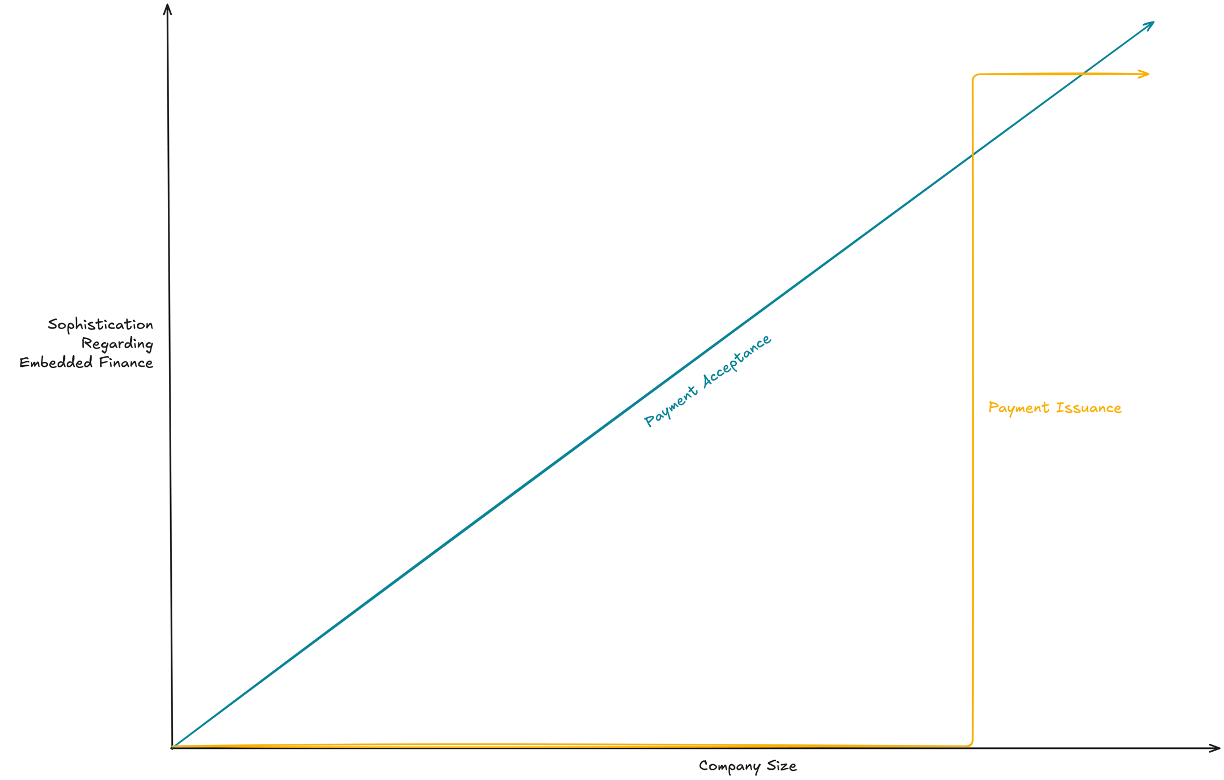

As a result, the maturity curve for businesses issuing payment instruments was less of a smooth and steady evolution and more of a late-stage, step-function leap:

Now, there have been plenty of successful case studies in the top right corner of this graphic, to be sure.

Co-brand credit cards are a great example. Most large retailers and consumer-facing brands have at least kicked the tires on offering their own credit cards. A few, like the big airlines, have been so successful that their co-brand credit cards (and attached loyalty programs) are now more profitable than their core businesses.

And there are a few notable, non-credit card examples as well. Starbucks, famously, offers a mobile payments and loyalty program, built on prepaid stored balance accounts, that has been enormously successful in simultaneously lowering the company’s payment acceptance costs, improving customers’ experiences, and generating a wealth of valuable first-party data.

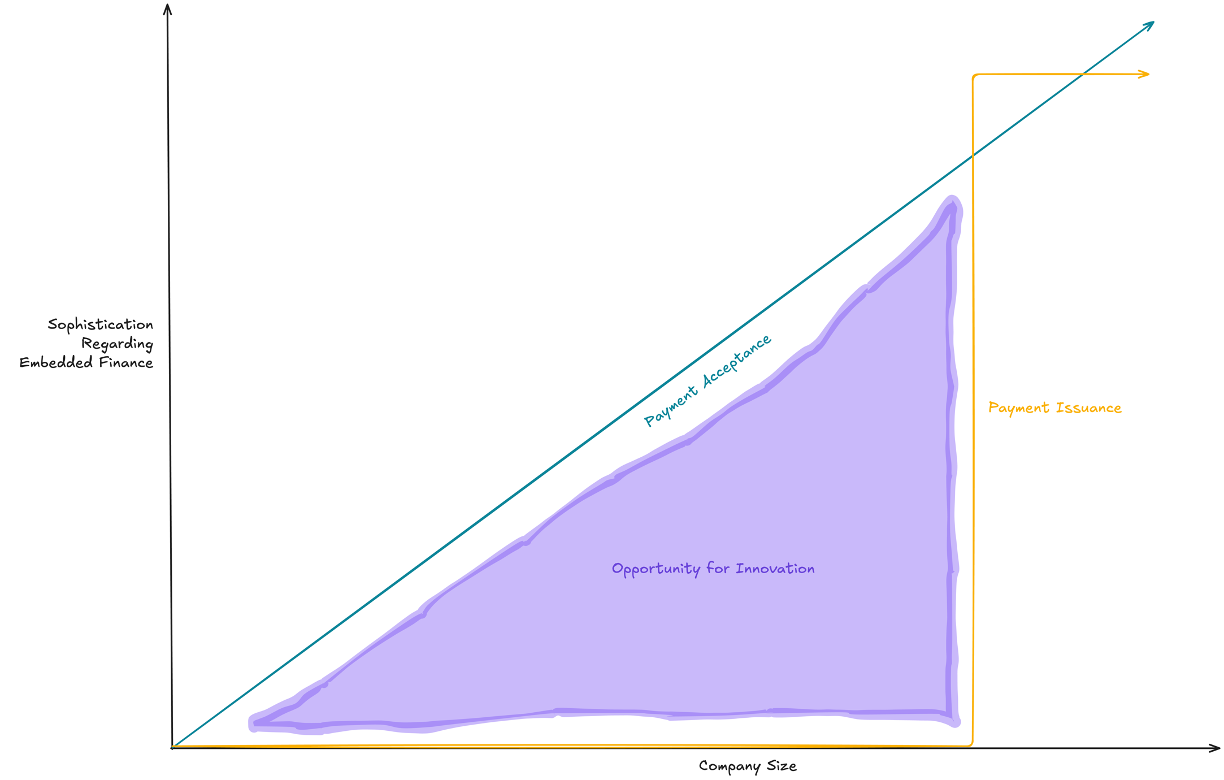

The question that I want to end with, however, is this: Is there an opportunity for smaller businesses to get involved on the payment issuance side of the equation?

The Opportunity

The short answer to our question is yes.

And the reason is that customers want it.

Marqeta was kind enough to give me a sneak peek of its upcoming 2025 State of Payments Report, and it is chock-full of interesting insights.

For example, according to the survey Marqeta fielded for the report, 31% of U.S. consumers (and 27% of UK consumers) say personalized rewards are a “need-to-have” in their payment experience.

Personalized.

Not “best” or “most generous”.

Personalized.

This is a critical insight for businesses considering a leap into embedded payment issuance because those companies control the environments in which their customers transact. This gives them the ability to create personalized rewards for their customers, rather than just trying to outbid Chase and American Express in raw cash back percentages.

Picture Starbucks, enabling users to order through the mobile app and skip the line. Or Delta, making its cardholders feel valued with early boarding and unexpected upgrades.

Or, my wife’s personal favorite example, Costco, which recently started offering early store entry for Executive Members (worth more than the annual 2% reward to folks who hate crowds, as my wife passionately does).

This isn’t a game just for the big boys. Smaller brands can run the same playbook: set your own rules, wrap rewards around the experiences you control, and make the payment product an extension of your brand.

When Behavior Outruns Infrastructure

Here’s the curious part: in many cases, the customer behavior shows up before the company infrastructure.

Your customers are already mixing and matching digital wallets, BNPL apps, co-brand credit cards, and loyalty programs to create the payment experience they want. They’re essentially building their own “super app” out of whatever’s available.

The opportunity is to notice this behavior early and ask:

- What would it look like if we became our customers’ default way to pay?

- How could we integrate payments so deeply that it changes their default habit?

- What unit economics (and customer loyalty) would that unlock for us?

The old answer: Wait until you’re Delta-sized and then launch a credit card.

The new answer: with modern issuing and embedded finance platforms lowering the technical and compliance barriers, it might already make sense to take the leap — and the real challenge becomes picking a partner who can de-risk the jump and scale with you.

Taking The Leap

Embedded payment acceptance is a linear market. Every part of it is well-understood and highly competitive.

Embedded payment issuance is different. Companies don’t have to issue their own payment instruments in order to survive.

However, I believe it will become increasingly necessary for companies to issue their own payment instruments if they want to thrive.

And they will need to do it earlier than they ever have before. Competition for customers has never been fiercer. Every company is trying to lock your best customers into their ecosystems. Payment issuance is a critical tool in this fight.

In payment acceptance, you evolve.

In payment issuance, you leap.

That leap can transform your unit economics, deepen loyalty, and put your brand at the center of your customers’ financial lives. But it only works if your infrastructure can support your vision.

Modern issuing and embedded finance platforms, such as Marqeta, can help.