The last time I wrote about pay by bank, I observed:

An easy way to spot emerging trends is to look for examples of market incumbents overreacting.

It’s not a common occurrence. Indeed, much of the modern theory of disruption is premised on the idea that market incumbents tend to underreact rather than overreact when confronted by some new (and potentially disruptive) technology or customer behavior.

So, when it does happen — usually in an area where a small number of incumbents have enjoyed an unusually long period of dominance — it’s worth sitting up and taking notice.

The example I cited in the essay — of an incumbent overreacting to the emergence of pay by bank — was JPMorgan Chase, which had been lobbying the CFPB to exclude payment initiation from its open banking rule.

As you certainly know if you’ve been reading this newsletter, JPMC has not let up at all in its efforts on this front. The pricing that the bank has been negotiating, for access to its open banking APIs, has consistently been higher for payments use cases than for non-payments use cases, which strongly suggests a strategic desire to disrupt the growth of pay by bank, as a competitor to debit cards and credit cards.

In today’s newsletter, I want to explore the current state of pay by bank in the U.S., its appeal to merchants, and the challenges that need to be solved in order to unlock pay by bank’s full potential.

What is Pay by Bank?

Before we get into the potential of pay by bank (and how we can unlock it), we should quickly define the term.

Put simply, pay by bank is any payment method that enables the transfer of funds directly between bank accounts.

Given the breadth of this definition, a lot of different payment solutions can be considered to be a form of pay by bank. Those solutions can be divided into two distinct layers: the payment rail (e.g., check clearing, ACH, FedNow, etc.) and the user interface (e.g., paper checks, online portals, merchant apps and mobile wallets, etc.)

The inherent characteristics of different payment rails (authorization processes, settlement speeds, dispute rules, transaction limits, processing costs, etc.) tend to be the determining factor for which use cases those rails are applied to. However, what we have seen in recent years is that the user interface that is layered on top of the payment rail can have a big impact on the success of different use cases as well.

This is where open banking comes in.

Open banking is a critical ingredient for modern pay by bank experiences because it streamlines the payment initiation process. Instead of requiring a customer to know (or look up) their routing and account numbers, you can, instead, simply ask them to log in to their digital banking portal, and the routing and account numbers are automatically retrieved and populated.

Thus, we can define modern pay by bank more narrowly by anchoring on a combination of electronic payment rails (ACH, RTP, FedNow, etc.) and convenient and intelligent user experiences, enabled and enriched by open banking.

Pay by Bank is a Sleeping Giant

We should start by admitting the obvious: very few consumers today use pay by bank.

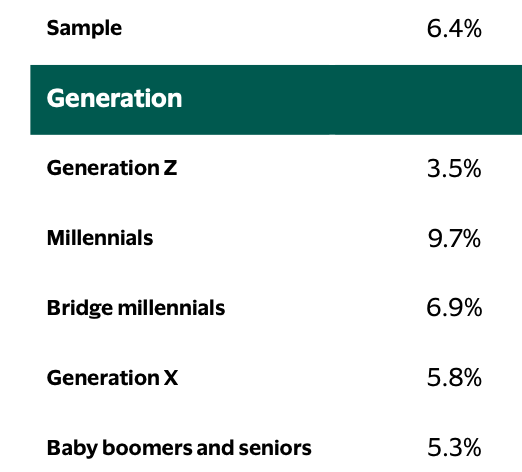

PYMNTS and Trustly surveyed 2,225 U.S. consumers in July of 2024. They found that only 6.4% of consumers reported that they were already using pay by bank. As you might expect, those percentages differed by generation, but even among the most active pay by bank generation (Millennials), less than 10% reported using it:

However, there are two reasons to believe that this limited level of adoption is a temporary phenomenon rather than a permanent state of affairs.

First, when asked why they have not used pay by bank, only a small percentage of consumers said that it was because they prefer to make payments from their checking accounts by way of a debit card (6.5%) or because they do not trust sharing their banking information over the internet (7.8%).

The biggest reason, by far, that consumers said they hadn’t used pay by bank was that they weren’t aware of it (56%).

This suggests that there is a very large Field of Dreams opportunity for merchants with pay by bank (if you build it, they will come). Additionally, it suggests a lack of familiarity with the term “pay by bank” itself, which makes me think that the 6.4% of consumers who self-reported using pay-by-bank already might be lower than the percentage who are actually using it.

(Editor’s Note — This is a very common challenge with consumer surveys in financial services. People frequently don’t understand the underlying mechanics of the financial products and services they are using, and we have a bad habit of using industry jargon like “pay by bank” in our survey questions.)

Second, and more importantly, once you tell consumers about pay by bank, they get interested.

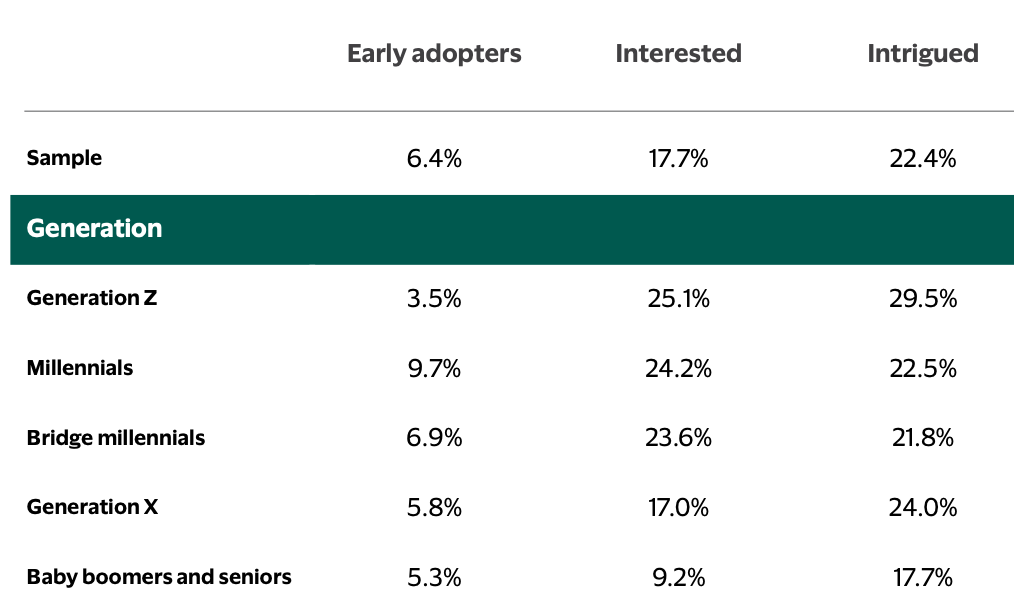

According to the PYMNTS survey, 40% of consumers said that they were either interested in or intrigued by pay by bank. That openness was most prominent among Gen Z consumers and Millennial consumers, but noticeable across all age ranges:

Interestingly, the consumers who said they were most resistant to the idea of using pay by bank (who were, as you might guess, more likely to be Gen Xers or Baby Boomers) were also the ones who were least familiar with it. This further reinforces the importance of consumer education and awareness in generating greater adoption.

Against the backdrop of this nascent (but promising!) consumer interest are some significant improvements to the infrastructure that underpins pay by bank.

While debit and credit cards continue to dominate non-cash consumer payments in the U.S. by transaction volume, ACH leads on payment value (i.e., it is used for larger transactions like rent and bill payments) and it has been growing at a faster rate for transaction volume (for both ACH debit and credit) than debit cards and credit cards over the last 5-7 years.

More importantly, bank-to-bank payment rails have seen meaningful upgrades in functionality over the last 10 years.

Same Day ACH, which launched in 2016, has seen significant growth. In Q1 of this year, volume of Same Day ACH payments climbed 19.1% year-over-year to reach 326 million, with the value of those payments increasing 24.8%. In Q2, it climbed another 15% in volume year-over-year (to 336.4 million) and 22% in value ($980.3 billion).

Instant payments — enabled through networks like Real-Time Payments (RTP) from The Clearing House and FedNow from the Federal Reserve — have seen similar traction. As of July, RTP averages 1.18 million payments each day, worth $481 billion, which was a 195% increase in value from the previous quarter. Since increasing the maximum transaction limit from $1 million to $10 million in February, the average RTP transaction has grown from $842 in January to more than $4,000 by June, a 376% increase. FedNow, while much newer, has seen promising growth as well, having brought on more than 1,400 participating financial institutions in just two years. The network facilitated 2.1 million transactions in Q2 of this year (a 63% increase over Q1).

Open banking infrastructure has also seen significant growth and improvements over this time period.

According to the CFPB, as of 2022, at least 100 million consumers had

authorized a third party to access account and transaction data regarding their financial

accounts. A growing percentage of that activity has happened through APIs (thanks, in large part, to the standard-setting work of the Financial Data Exchange) rather than screen scraping. And while the recent fight over fees for data providers has introduced some short-term uncertainty into the market, I believe two things will, over the long term, prove to be true:

- The combination of bank-to-bank payment rails and payment initiation through open banking will remain extremely competitive, from a cost perspective, with credit cards and, to a lesser extent, debit cards (especially Durbin-exempt debit).

- Banks will continue to invest in making open banking work better for their customers. A good example is app-to-app OAuth, which leverages on-device biometrics instead of usernames and passwords. Improvements like this will, in some cases, be motivated by commercial arrangements. And, in other cases, simply by a desire to create the best possible experience for customers.

So, to sum up, we have a robust and increasingly fast set of bank-to-bank payment rails, rapidly-maturing open banking infrastructure, and consumers who are accustomed to sharing their financial data and open to trying pay by bank.

And stepping into this promising environment, we have merchants.

What Do Merchants Want From Pay by Bank?

The obvious answer is lower payment processing costs.

This is a strong motivator for merchants, particularly when it comes to the costs they pay to accept credit cards. However, as I wrote about in my prior essay on pay by bank, replacing credit cards with pay by bank is a job that requires an appreciation for nuance.

The trick to understanding where pay by bank can add value is to distinguish between use cases where credit cards are the best answer and use cases where credit cards are simply the default answer.

For sporadic, highly considered purchases (clothes, electronics, vacations, etc.), credit cards or BNPL may be the best answer. These purchases are expensive, which means they generate more rewards for consumers, and they may require an extension of credit in order for the buyer to feel comfortable making the purchase.

For recurring transactions — bills and subscriptions — credit cards are usually the default choice; one that merchants can often influence or incentivize customers to change. Verizon, which offers a $10/line discount when you sign up for paperless billing and agree to pay with a debit card or bank transfer, is a great example.

For habitual, less-considered purchases (groceries, coffee, general retail, etc.), general-purpose credit cards may be the preferred payment method for some consumers, but sufficiently well-organized merchants with strong brand affinity and customer loyalty can move a significant number of their customers to less-expensive alternatives. Historically, the most popular alternative has been co-brand credit cards, offered directly by the merchant to their customers. However, over the last couple of decades, we’ve seen significant growth in pay by bank solutions offered by specific merchants, often integrated with the merchant’s proprietary mobile app and/or with a mobile wallet like Apple Pay or Google Wallet. Starbucks, Target, and Walmart are all good examples.

It’s important to note that while cost reduction is the most obvious (and often initial) motivator for merchants to explore pay by bank, it’s far from the only reason why merchants choose to make pay by bank a priority. In fact, in a lot of ways, it’s the least strategically important reason.

What’s more important to savvy merchants is using payments to learn more about their customers.

Credit cards and debit cards don’t tell merchants anything about the customer who is using them. All you know, as a merchant, is whether the transaction was approved or declined. That’s it.

Pay by bank, enabled by open banking, can tell you a lot more.

When a customer connects their bank account, they are, at minimum, sharing their routing number and account number with you. However, they also have the option of sharing months of historical bank transaction data with you as well. This data can give merchants a much richer level of insight into their customers’ financial lives, and that insight can power a multitude of compelling products and product features, including:

- Cash Flow Smoothing. Imagine if a grocery store knew, at the moment of the transaction, that a customer’s payment would cause them to overdraw their checking account and incur an overdraft fee, and the grocery store could offer that customer a fee-free microloan to cover the transaction while protecting their short-term cash flow by aligning repayment with their paycheck schedule. Imagine if a utility company knew that a scheduled auto-pay would fail and cause the customer’s account to be disconnected, and the utility company could proactively offer to shift that payment date to better align with the customer’s paycheck schedule. With open banking, these types of intelligent, contextually-aware pay by bank experiences are feasible.

- Personalized Offers. A debit card swipe can’t tell a merchant if the customer used that same card at their biggest competitor last week. Open banking-powered pay by bank can, which unlocks an entire world of personalized offers and incentives, delivered in real time at the point of sale. Imagine, as a merchant, being able to instantly identify when a customer switches from making a habitual purchase (like a daily coffee) with you to making it with your competitor across the street and being able to send them a timed offer for the next day to win back their business.

- Dynamic Risk Management. When implemented well, pay by bank often in results in more approved transactions (and thus more sales), compared to debit cards, because the insights into consumers’ cash flow patterns (enabled through open banking) can give merchants the confidence that customers will have the money to settle a transaction, even if they don’t in that moment (which is why a debit card would be declined). By contrast, merchants also need to know when their customers’ financial situations or behaviors have worsened and use that insight to adjust their risk management strategies (authorizations, payment holds, etc.) in real time. This insight is impossible to glean through debit cards, checks, or traditional ACH transactions. However, with open banking-powered pay by bank, it’s doable.

We’re constantly told that merchants hate paying interchange fees.

I think this is true, but I don’t think merchants’ dislike of the card networks is because of payment processing costs. I think it’s because of the opportunity costs.

For a merchant, every credit card and debit card transaction is a missed opportunity to gather data about their customers and to invest in giving those customers more personalized experiences that will strengthen their relationship with the merchant.

To put it bluntly, today, Visa and Mastercard (and their issuers) hoard the data and brand loyalty that should be accruing to merchants.

And that brings us to the final question that I want to answer in today’s essay …

How Can Merchants Unlock the Full Potential of Pay by Bank?

When it comes to making all of this theory that we’ve been discussing actually pencil out in the real world, merchants need to solve for two big challenges.

One lives in the minds of consumers, the other in the tech stacks of merchants.

#1: The Consumer Adoption Problem

Let’s start with consumers.

The PYMNTS survey made something very clear — awareness is the main obstacle. More than half of the respondents said they’d never even heard of pay by bank. It’s not that they hate it; they just don’t know it exists.

That’s the good news. Awareness problems are fixable. Education, branding, and incentives are how you fix them.

And when you do tell consumers what pay by bank actually is — fast, secure, direct payments from their bank account — about 40% say they’re interested. That’s roughly the same level of “openness” we saw when mobile wallets were first getting traction.

But interest only turns into adoption when the incentives line up.

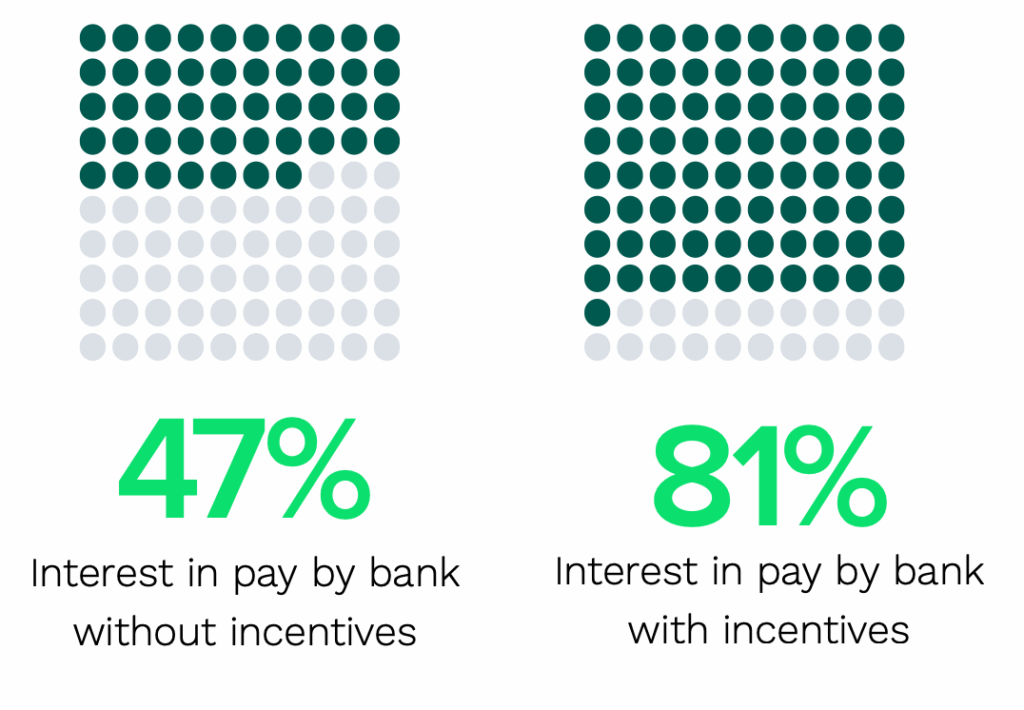

Rewards are the single biggest lever, by far, for driving interest and intrigue in pay by bank, as the PYMNTS survey data clearly tells us:

Consumers have been trained for decades to expect a kickback for how they pay. You can’t unteach that behavior, but you can redirect it. The smart play isn’t to copy Amex with travel points; it’s to reward behavior your customers already value.

Grocery stores can double fuel points for bank payments. Airlines can hand out early boarding or free snacks. Subscription merchants can tack on a “loyalty month” after a year of pay-by-bank autopay. These aren’t abstract ideas — they’re precisely the kinds of offers that shift tender share without killing margin.

UI matters too. The difference between bad, OK, and good adoption isn’t mystical — it’s literally where the button sits and what it says.

Here’s a (rough) hierarchy of what the adoption rate can look like, based on how pay by bank is implemented by the merchant:

- Bad: Your prototypical NASCAR checkout page with ten payment options, no explanation, and pay by bank lurking at the bottom. Expect ~1% adoption rate, with a lot of adverse selection.

- Good: Put pay by bank near the top of the checkout page, make it big, show bank logos, label it “Popular” or “Preferred,” and mention a benefit (“instant refunds” or “save 1–2%”). Just that, simple as it sounds, can get a merchant’s adoption rate up to 3–5%.

- Great: Make it the star of your wallet or app, tie it to loyalty and rewards, and market it like a product, not a feature. That’s where you see double-digit adoption, 8–10% or greater.

Consumers aren’t allergic to new payment methods, but they are lazy. Make it obvious, make it rewarding, and make it work every time.

#2: The Merchant Integration Problem

The other challenge isn’t psychological — it’s architectural.

For big merchants, especially those with franchisees, sub-merchants, or complex org charts, integration is a nightmare. Routing payments, settling to the right entity, reconciling funds across 10,000 stores — that’s not a weekend project.

Traditional pay by bank integrations require new backend flows, custom settlement files, and extra reconciliation logic. That’s a lot of plumbing work, even if you’ve assembled a strong business case.

This, ironically, is where I think payment cards can (and should) be used as a complement, rather than a competitor to, pay by bank.

Imagine authorizing a pay-by-bank transaction the same way you’d authorize a card payment — using a one-time virtual card that your existing processor already understands. The network handles authorization; the settlement happens later over a bank rail.

To your gateway, acquirer, and finance team, it still looks like a card transaction. But under the hood, it’s ACH, RTP, or FedNow doing the heavy lifting.

It’s basically a universal adapter for merchants — all the acceptance infrastructure stays intact while the economics flip in your favor.

This idea isn’t theoretical. We already have an example of the card networks playing this exact “authorization integration” role for a different, competitive payment product: BNPL.

Open-loop BNPL (i.e., BNPL delivered directly to consumers rather than through one-off merchant integrations) has used virtual cards for years to settle transactions through the card networks, even though its core product competes with cards. The same playbook can work for pay by bank.

For merchants with sprawling hierarchies or legacy POS systems, this hybrid approach can make pay by bank attainable. You don’t have to tear down your payments stack; you just add a new lane to the highway.

Pay by Bank: The Payment Router for Merchants

If pay by bank today is a new lane, the next step is a smart routing system that automatically chooses the best lane for every trip.

Right now, payments are dumb. A card swipe is a card swipe — the same process fires every time, no matter the context. But open banking gives merchants the intelligence to make that process dynamic.

Picture this: the merchant’s system looks at a transaction and decides, in milliseconds, whether to route it over a card, instant bank transfer, or even a pay-later option. That decision is based on cost, fraud risk, customer preference, liquidity, and speed.

If the customer’s checking account balance looks healthy, the system uses bank rails. If it’s low but payday is tomorrow, it might authorize now and settle later. If the transaction looks risky, it routes to a card with chargeback protections.

All of this happens invisibly — the customer just sees “Pay with your bank,” taps, and gets instant confirmation.

Think of it as programmable acceptance, the mirror image of Visa’s Flexible Credential capability on the issuer side. Issuers are getting smarter about which account to use for each purchase. Now, merchants are getting smarter about which rail to use for each sale.

In that world, “payment method” stops being a static choice and becomes a dynamic negotiation between the merchant and the consumer’s bank, powered by open banking data.

Card networks and pay by bank payment platforms like Trustly act as the glue holding it together — providing real-time authorization capabilities and fraud tooling, while settlement hops across whatever rails make the most sense.

When that happens, “pay by bank” won’t be a button on a checkout page. It’ll be the invisible router deciding how every dollar moves, quietly optimizing for cost, speed, and trust.

It’s not about replacing cards or banks or wallets. It’s about letting merchants — finally — program the one part of commerce that’s still running on muscle memory.

About Sponsored Deep Dives

Sponsored Deep Dives are essays sponsored by a very-carefully-curated list of companies (selected by me), in which I write about topics of mutual interest to me, the sponsoring company, and (most importantly) you, the audience. If you have any questions or feedback on these sponsored deep dives, please DM me on Twitter or LinkedIn.

Today’s Sponsored Deep Dive was brought to you by Trustly.

Trustly is the global leader in Pay by Bank solutions. With Open Banking at its core, Trustly gives consumers and merchants a smarter and safer way to pay.