3 Fintech News Stories

#1: PNC is Trying to Become JPMC

What happened?

Following in JPMorgan Chase’s footprints, PNC announced that it is planning to significantly invest in its branch network:

PNC Bank is to invest $1 billion in its coast-to-coast branch banking network in the US, overturning conventional wisdom about the value of brick and mortar assets.

Under the plans, PNC will open more than 100 new locations and renovate more than 1,200 existing locations through 2028.

“Our branch network is the heartbeat of our Retail business, offering friendly and convenient service to the millions of customers who step through our doors every single month,” said Alex Overstrom, head of PNC Retail Banking. “Whether to finance a home, deposit a check, or save for retirement, our customers count on our 15,000 branch team members to support their holistic financial needs. By investing in our network, we are supporting our customers, our team members, and the communities where we live and work.”

So what?

If you want to know what is motivating PNC CEO Bill Demchak to do this, read the transcript of PNC’s most recent earnings call, specifically Demchak’s back-and-forth with famously blunt bank analyst Mike Mayo.

If you don’t want to read the whole transcript, allow me to paraphrase it for you:

Mayo: In your last earnings call, you said that scale matters more than ever in banking. Why do you think this?

Demchak: We saw it during the spring banking crisis. When customers (especially corporate customers) are worried, money flows uphill. We benefited (barely) from that dynamic last time, but we need to be ready for next time. We need to be bigger.

Mayo: But how, specifically, are you going to get bigger? Are you going to double or triple your marketing spend? Are you going to advertise during the Super Bowl? Give us details man!

Demchak: There are 5,000 banks out there for me to take market share from. And when some of those banks get desperate and start looking for strong partners, we’re going to be opportunistic with M&A.

Mayo: I got several e-mails from people saying, well, I don’t know if I want to own PNC stock because I’m afraid of what kind of deal they might do. What do you say to that?

Demchak: Jesus Christ, Mike! Just look at our record. I’m not an idiot!

(Editor’s Note – Mike Mayo is the best. Big bank earnings calls would be so much more boring without him. That last question was, word for word, what he asked. I exaggerated Bill Demchak’s response, but I’m guessing it was close to what he was thinking.)

#2: The FICO of Open Banking

What happened?

Ark Invest’s venture fund invested in Pave, a fintech infrastructure company focused on cashflow underwriting:

Pave aims to operate as the analytics layer within the next-gen credit underwriting ecosystem, facilitating the analysis of financial data at scale, which requires significant capital and engineering talent. Customers can combine their own proprietary data with various alternative data streams across loan performance data, core banking data, aggregator data, and credit bureaus to keep their credit risk models up to date.

So what?

I’ll be honest – I didn’t even know that ARK had a venture fund. Looking over the list of private companies in its portfolio, I’m struck by A.) its size – there are only 23 companies total, and B.) its diversity – Pave is one of the few fintech companies, and there are some very big non-fintech companies including SpaceX, Anthropic, and Epic Games.

Sign up for Fintech Takes, your one-stop-shop for navigating the fintech universe.

Over 41,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

The terms of ARK’s investment in Pave weren’t disclosed, but based on the size and composition of ARK’s portfolio, I’m guessing ARK’s interest in Pave is more than a passing fancy.

Which I get!

I’ve gotten to know Ema and Raymond (the co-founders at Pave) over the last few years, and they’re very sharp. They are trying to make Pave the FICO of open banking.

And that is a very interesting target to aim at.

FICO came up at a time when the idea of applying statistical analysis techniques to risk management was considered asinine (read this essay for the full history). That was both a disadvantage (it took years to convince lenders to give them a shot) and an advantage (credit scoring was a blue ocean, with no competitors).

Conditions today are very different. There are many companies – Plaid, Mastercard, Nova Credit, Edge, Prism, and yes, FICO – that are trying to become the FICO of open banking. Most of them are significantly bigger and better resourced than Pave.

I’ll be interested to see how Pave carves out its own lane in what I expect to be a very crowded and competitive ecosystem.

#3: Can a Core Get There in Time?

What happened?

FIS announced an interesting partnership:

FIS … today announced it has entered a strategic partnership with Banked, a leading provider of open banking solutions, to drive new pay-by-bank offerings for both businesses and consumers.

Pay-by-bank solutions simplify payments by combining the benefits of real-time payment rails with the flexibility and efficiency of open banking, where third-party financial service providers have direct access to banking data to complete digital payments. As a result, business and consumers can make payments directly between business and consumer bank accounts without the need for card details, account numbers or sort codes. Businesses benefit from less fraud, reduced friction, faster settlement and lower processing fees, while consumers enjoy a smoother payment experience, easier verification and faster access to funds.

So what?

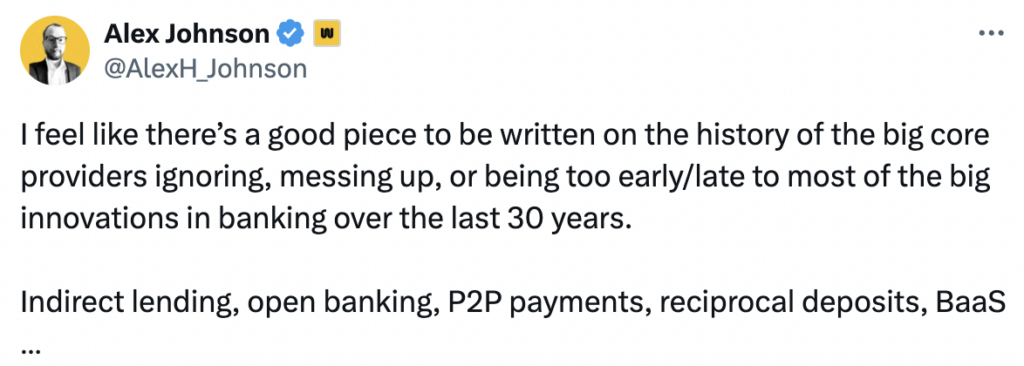

I recently shared this observation on Twitter:

Multiple people then proceeded to try to explain The Innovator’s Dilemma to me using very small words, which was … helpful.

Look, I get why the big core providers have mostly stayed away from the cutting edge of fintech innovation. That’s not the game they’re playing.

I just think it’s interesting to think about the counterfactual – what if, one of those times, one of them had actually gotten to the market on time? Not early. Just on time. With great execution. How would that have changed the trajectory of that company?

Well, FIS might be the core provider that answers this hypothetical.

Pay-by-bank is a perfect use case for them to chase. The vast majority of FIS’s customers don’t have big credit card franchises to protect. And enabling pay-by-bank will be a nice forcing function for pushing FIS forward on both faster payments and open banking, two trends that could have lots of nice knock-on benefits for the company’s customers.

I like this! And if FIS can make its acquisition of Bond work out (thus moving the ball forward on BaaS), it will be in a great position.

Of course, execution is always the question with the big core providers. We will have to wait and see how that part plays out.

2 Fintech Content Recommendations

#1: The Fintech OG Series (by Julie VerHage-Greenberg, TWIF)

I can’t tell you how excited I am for this series. Julie is a great interviewer, and the lineup for this series is beyond impressive. The first episode, featuring Matt Harris and Steve McLaughlin, is awesome. Bookmark this one. Trust me.

#2: The Fintech 50 (Jeff Kauflin & Janet Novack, Forbes)

People love lists like this. And I’m no exception. I’m a person. I love this list!

There were a few companies on here that surprised me.

1 Question to Ponder

What doesn’t make sense to you about insurance/insurtech?

I want to write about insurance and insurtech at some point, but it’s an industry that I am barely conversant in, and I need to find an angle to attack. I usually find the best angle for researching and writing about something is to find something simple that doesn’t make sense and that even the most authoritative expert in the space can’t adequately explain. What is that for insurance/insurtech?