I always thought the term “backlog” meant a messy accumulation of something that had gotten into its current state through neglect or disorganization. This was the visual in my head:

In reality, a backlog is simply “a reserve supply or an accumulation of a resource to be used later.” The term comes from the word for a large log placed at the back of a fire, which tended to be slow burning and thus available for use later:

So, it turns out that a backlog is a good thing that results from planning and preparation, not a bad thing that results from neglect or disorganization. I’m not sure why I thought it was the latter. Probably a Freudian manifestation of my anxieties about the state of my email inbox.

Anyway, in addition to that brief detour into etymology, today’s newsletter will cover a few fintech news stories that I’ve been saving. Call it a fintech news backlog.

#1: Consumer Report Improvements

What happened?

Plaid introduced a whole bunch of enhancements to its Consumer Report product for lenders, including integrating with its onboarding solution Layer:

By combining the power of Plaid Layer, our instant financial onboarding platform, with Consumer Report, our cash flow data solution powered by our consumer reporting agency, we’re making it easy for lenders to evaluate cash flow data alongside traditional credit data. This combination enables borrowers to instantly link their financial accounts and provide their income, expenses, and bank account balances directly to lenders right at the beginning of the application process. For lenders, this means access to a more holistic picture of their applicants’ financial situation to make more confident lending decisions.

Developing new risk attributes based on account connection activity:

We’ve surfaced hundreds of attributes from account connection activity. With credit insights powered by the Plaid Network, customers get differentiated risk signals that are complementary to traditional credit and cash flow, such as:

- Number of lifetime connections to lending applications

- Number of new connections to earned wage access applications in the last two days

- Days since first connection of any type

And helping lenders determine whether a specific bank account is the applicant’s primary bank account:

We recently added an indicator in the Consumer Report to give lenders more confidence that a given account in a linked financial institution represents the account holder’s primary account. Returned both as a label and a probability, this helps customers determine if the linked account is sufficient to underwrite or verify income with, and if not, they can prompt the applicant to link additional financial institutions.

So what?

These are all very logical and useful improvements to Plaid’s Consumer Report product.

When Plaid introduced Layer this summer, I predicted that cash flow underwriting would be a primary use case. The integration of the two products confirms the accuracy of this prediction and puts Consumer Report on a more equal footing with traditional credit files from a UX perspective (at least for returning Plaid users).

The risk attributes based on account connection activity are neat. In many ways, they parallel the development of the more subtle and powerful risk attributes built on top of traditional credit bureau data.

One interesting example: According to Plaid, credit applicants who establish three new active connections to a cash advance app in the last 90 days are 6.3X more likely to be at least 30 days delinquent over the first three months of a loan than others.

And finally, the development of the primary account indicator, while not a perfect solution, is a step in the right direction for lenders worried about consumers’ ability to game cash flow underwriting algorithms through the selective permissioning of data.

#2: Let’s Just Call TomoCredit What It Is

What happened?

Jeff Kauflin at Forbes wrote a great piece on the difficulties that TomoCredit customers have been having in canceling their services:

In the summer of 2023, 55-year-old Michigan resident Felisa Ware was hoping to improve her credit so she could buy a bigger house where her ailing mother could live with her. She signed up for a subscription service from TomoCredit. … After six months, Ware decided Tomo’s “VIP” plan wasn’t worth the $34.99 a month she was paying for it. … Yet when she looked in Tomo’s app and on its website, she couldn’t find an option to cancel.

What followed was a maddening exchange of 20 emails, with Ware repeatedly asking Tomo’s customer support to cancel her subscription. Instead of honoring her request, Tomo replied with questions on why she was canceling and whether she’d rather receive a free month instead of deactivating. At one point, Tomo’s customer support team went dark for five days, then 20 days. “It was just so bizarre and frustrating,” Ware says. Exasperated, she emailed Michigan’s attorney general and started posting on social media, tagging Tomo’s corporate accounts and its CEO, 35-year-old Kristy Kim. “They’re taking people’s money,” says Ware, who works in health care. “I work hard for my money.”

On January 28, 2024, about a month after her first request to cancel, TomoCredit attempted to charge Ware’s debit card again, though she had already called her bank and blocked any future Tomo charges. Finally, on January 30, her subscription was deactivated.

So what?

This story is well-timed, as the FTC just finalized their “Click-to-Cancel” rule, which should make it easier for consumers to cancel their subscriptions and memberships. This is important because many companies (including many fintech companies, as Jeff points out in his article) go to extreme, often absurd lengths to make it difficult for consumers to cancel their subscriptions or memberships.

(Editor’s Note — If you want to read more about this issue, I recommend checking out my essay on the subscription economy and my plea for someone in fintech to save me from it.)

I appreciate Jeff and the team at Forbes bringing the issue of subscription dark patterns in fintech to the forefront. However, I must admit that I found the article’s overall coverage of TomoCredit infuriating.

For example, the article describes Tomo’s decision to stop offering its credit-building charge card as a “pivot” and repeats CEO Kristy Kim’s statement that the company is profitable and growing quickly:

In the summer of 2023, she pivoted the business, essentially pausing the credit card and introducing a subscription service for improving people’s credit scores, called Tomo Boost. Kim says the fast adoption of Tomo’s subscriptions propelled the startup to become profitable late last year on a generally accepted accounting principles (GAAP) basis. She expects the company to reach $20 million in annualized revenue by the end of 2024, and she says it has enough cash in the bank to continue funding the business for three years.

This ignores some very crucial pieces of context, including the fact (first reported by Jason Mikula) that Tomo hasn’t been paying its bills:

A New York-based trademark attorney, Elizabeth Oliner, filed suit in San Francisco small claims court, alleging Tomo failed to pay her for work the company requested and authorized, including filing fees she incurred on the company’s behalf.

Oliner’s complaint is seeking $4,250 for a trademark application filed with the USPTO, a cancellation proceeding filed with the Trademark Trial and Appeal Board, and USPTO filing fees.

Hmmm, weird. If you were profitable and on track to reach a $20 million revenue run rate, wouldn’t you just pay the trademark attorney her $4,250?

And about that abrupt decision to pause the charge card and pivot to the Tomo Boost credit building service. Why exactly did that happen?

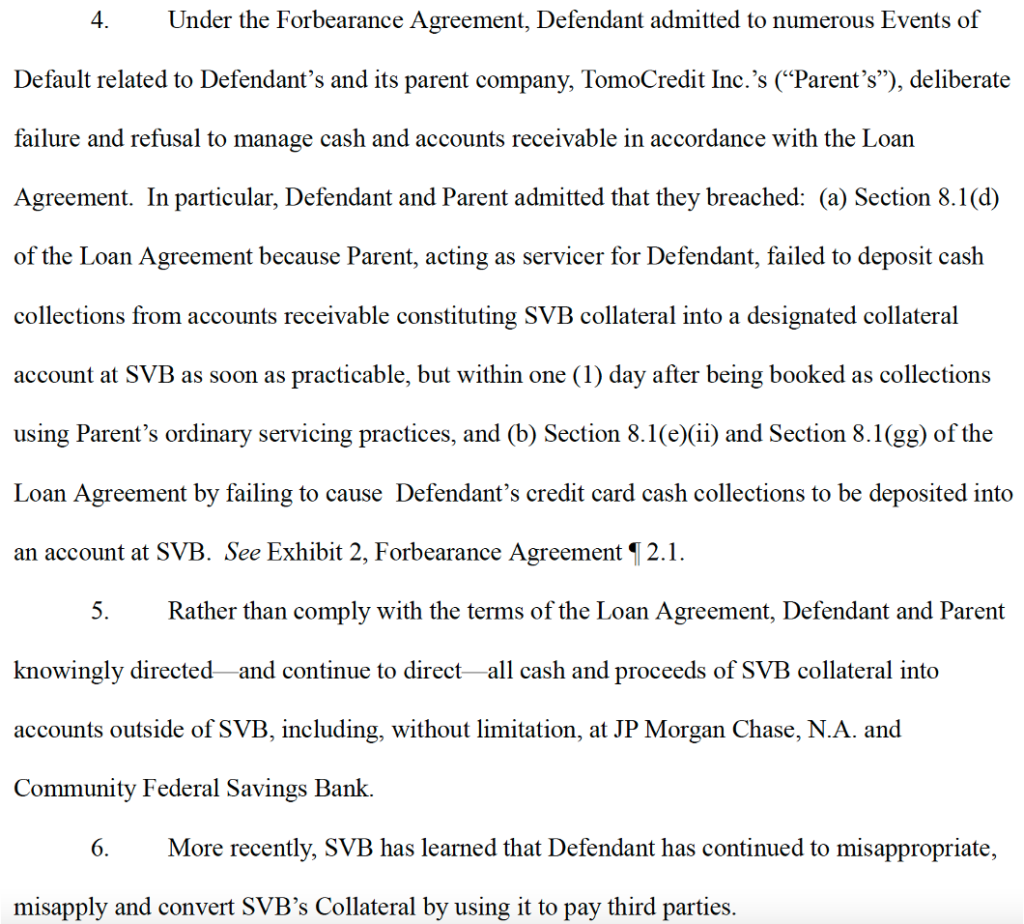

Again, thanks to some recent reporting from Jason Mikula (which he was kind enough to share with me), we know that Silicon Valley Bank sued Tomo after it defaulted on its $100 million debt facility, which it raised from SVB back in 2022 and which it had been using to fund the charge card product:

And while the Forbes article does cast some doubt on the efficacy of Tomo’s new credit-building service, Tomo Boost, writing, “it’s unclear whether Tomo’s credit-boosting service even works” and linking to an old article that I wrote about the product, it fails to explain the principal difference between legitimate credit building services like Experian Boost (which add real payments like utilities to the credit file) and Tomo Boost (which makes up fake credit lines).

That’s a big miss!

TomoCredit is a scam. I wish everyone would just call it what it is.

#3: Better. Best. Betsy.

What happened?

Better.com Founder & CEO Vishal Garg unveiled a new voice-based AI loan assistant named Betsy:

Betsy, the AI Loan Assistant, is a feature built through Better.com’s proprietary platform, Tinman. The all-in-one platform, Tinman, combines the many datasets LOs touch day-to-day such as Point of Sale (POS), Customer Relationship Management (CRM), Loan Origination System (LOS), Document Management System, and Pricing Engine. Its main differentiator, though, is Betsy, which was built to enhance the operational efficiency of Better.com’s licensed Loan Officers, Processors, and, Closers and improves its customer experience with timely, accurate answers to customer’s inquiries on an instant basis.

So what?

Here’s how Garg describes why Better Mortgage chose to prioritize voice over the more traditional chatbot approach for a virtual assistant:

“Chatbots don’t work. We’ve tried chatbots before and fundamentally consumers get tired of not being able to get a proper response to the inquiry that they have. They give up on chatbots. We knew that we had to really move the industry forward and build an AI voice assistant that is going to engage with consumers in a conversational way, and is fast.

However, Fintech Takes can exclusively reveal that Garg has much more heated words for chatbots behind closed doors. In an email to Better Mortgage’s former team of AI chatbots, Garg wrote:

You are TOO DAMN SLOW. You are a bunch of DUMB DOLPHINS and…DUMB DOLPHINS get caught in nets and eaten by sharks. SO STOP IT. STOP IT. STOP IT RIGHT NOW. YOU ARE EMBARRASSING ME.

The chatbots, which Garg abruptly fired a few days after sending that email, could not be reached for comment.

(Editor’s Note — This isn’t true. I just can’t resist the opportunity to joke about this absolutely bonkers incident, which reportedly happened to real people and not AI chatbots, unfortunately.)