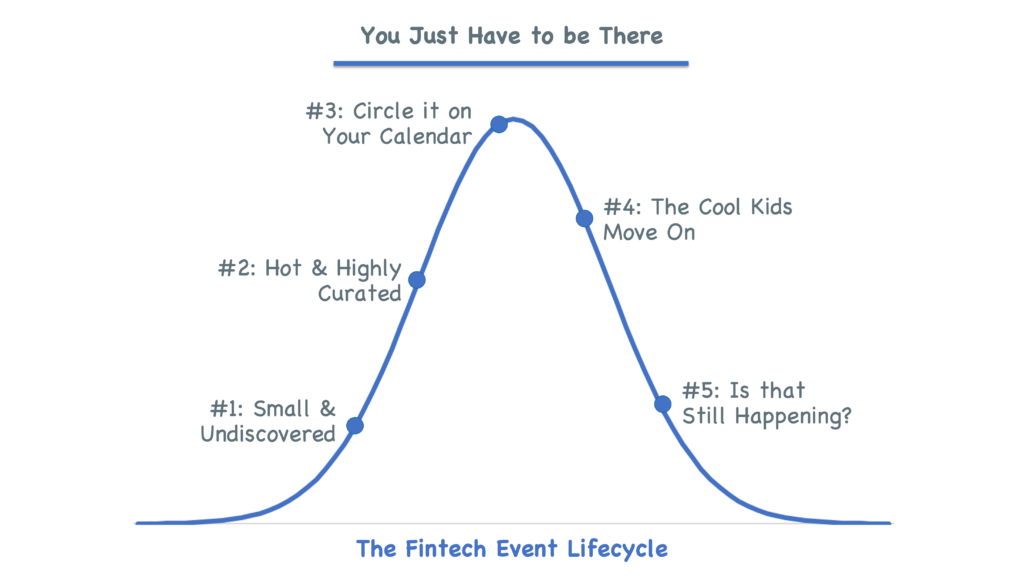

Over the last 15 years or so, I have observed a phenomenon that I like to call the fintech event lifecycle. It goes something like this:

- A new event emerges with a focus on financial technology and innovation. It attracts a small, but dedicated core group of speakers, attendees, and sponsors. The event takes risks and tries out new ideas, and the resulting content and networking is fresh and compelling (if a little rough around the edges).

- Word gets out that this event is worth attending and more people start going. This increase in attention leads to a more impressive roster of speakers and a lot more sponsors. The signal-to-noise ratio for content and networking remains fairly high, but a little of the initial diamond-in-the-rough charm is sanded off.

- The event becomes a circled-in-red-ink-on-the-calendar event for a large percentage of the financial industry. Lots of people attend, and the value of the event as a networking event hits its zenith (you start seeing folks travel to the location of the event in order to network without buying a ticket to the event itself). The content becomes more hit-and-miss.

- At some point, the event stops appealing to the more innovative (and usually younger) participants that it originally built itself around. They move on. While sponsors continue to support the event, the content, networking, and general vibe start to suffer.

- Word gets out that this event is no longer worth going to. Attendance and sponsorships start to dry up.

Interestingly, there’s always one event that manages to rise above this lifecycle and claim the “you just have to be there” throne. This is the event that everyone in the industry attends (or at least hovers around). It commands premium prices from attendees and sponsors, and it has the flashiest (if not always the best) content. The event that claims this position is usually one that has gotten to step #3 in the lifecycle, but not every event that gets to #3 ascends to the throne. There’s some luck involved. You have to be ready to seize the throne at the same time that the industry is ready to move on to a new lead event.

I think this theory accurately describes how fintech folks perceive the value of industry events. However, I’m not sure that perception is always useful.

Case in point – Finovate.

In 2008, Finovate was cool. It was the place to learn about financial technology and see all the most cutting-edge products that innovators were building.

Fast forward to 2022, and I get the distinct impression that a lot of folks working in fintech see Finovate as definitively uncool and not worth their time.

Why is that?

My best guess is that it feels like it’s been discovered; like that band that you used to like back when no one knew who they were, but now that they have become popular you kinda can’t stand them anymore.

I mean, there are bankers at Finovate now. Lots of them and not just the cool ones that wear jeans. In fact, all the bankers attending Finovate wear jeans now, which is worse because you can’t even tell them apart! If you attend Finovate these days, you might end up in the most boring conversation of your life. Better to skip it altogether and go to where the cool kids are.

Obviously, I’m being a bit facetious here, but I do think this gets at the root of an important problem – as an industry, financial services is still far too exclusionary.

The impulse to skip Finovate because you are absolutely sure that you won’t learn anything valuable is the same impulse that causes fintech startups to not hire bankers with 20+ years of experience because they might not fit in with their culture. It’s the same impulse that causes banks to dismiss everything in and around web3 as a worthless scam, and that causes VCs to pass on investing in a first-time founder whose background is different from their own.

This impulse is bad for our industry.

The best opportunities to learn and to improve are often found in places populated by people who look nothing like you and who have experiences far different than your own.

So, here is my request:

- Bankers – Seek out the cutting-edge. Try to attend conferences and less-formal get-togethers where few of your fellow bankers have yet to go. Join a couple of Discord servers and start playing around in web3. Jump on TikTok and see what financial education looks like in 2022.

- Fintechers – Go where the oldheads are (and take business cards, if you can) – CBA Live, American Banker Events, and yes, Finovate. Listen more than you speak. Read Bank Director and dig into call report data.

In this spirit, I want to share a few quick observations I gathered from my time this week at Finovate, watching demos and chatting with bankers and fintechers alike.

Observations from Finovate

1.) BaaS needs more infrastructure. As the OCC recently cautioned, BaaS makes banking more complex. Given this added complexity, it seems fairly obvious that banks and fintech companies that are reliant on BaaS partnerships could benefit from infrastructure solutions that are specifically designed to manage it. Apart from the BaaS platforms (Unit, Synctera, Treasury Prime) and whatever tech the established BaaS banks have built in-house, there really isn’t much out there yet. At Finovate, I learned of numerous examples of fintech infrastructure that was being designed (or redesigned) to address the specific needs of the BaaS ecosystem, across a wide range of functional areas, including …

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

2.) Compliance tech tuned for BaaS is going to be big. Two specific fintech companies that stood out to me during the event were Themis – a collaborative compliance platform for banks and their fintech partners – and Cable – an automated compliance controls monitoring and testing service. Both products can be used to support a variety of different use cases, but they are especially well-suited to assist banks in managing the unique compliance burdens presented by BaaS, and, tellingly, both companies were emphasizing BaaS very strongly in their demos.

3.) It’s going to be a great time to work in bank compliance. Related to the point above, a common talking point among the banks I spoke with at Finovate was the importance of going overboard in hiring compliance staff if you are going to make a pivot towards BaaS. I’m sure this was influenced by the recent news of Blue Ridge Bank’s agreement with the OCC, but it also seemed to be a broader acknowledgment that BaaS is actually much harder than many of the banks that have recently entered this space had thought (or been told by certain BaaS platforms). Banks that are serious about BaaS are going to start throwing money at compliance professionals at a volume and at a velocity that may only be familiar to COBOL programmers.

4.) Open banking needs more infrastructure. Like BaaS, open banking was a fintech category that companies at Finovate were working to build additional infrastructure on top of. FinGoal demoed an ‘aggregator switch kit’ designed to help fintech companies quickly and painlessly switch from one data aggregator to another (aggregator lock-in is a huge concern among fintech companies, although I’m not 100% convinced that FinGoal can make switching between them as easy as it claims it can). Knot, which didn’t demo at Finovate but had folks attending the show, built a Plaid-like service that enables consumers to easily update their cards on file with all of the merchants that they have recurring transactions with.

5.) Can we disentangle web3 philosophy from web3 technology? There was a decent amount of crypto and web3 at Finovate – companies like NYDIG and Bakkt demoed crypto-focused solutions on stage. However, the most intriguing conversations I had were with companies that were building products that were aligned with some of the philosophical goals of crypto and web3 but didn’t actually use distributed ledger technology to achieve them. For example, ASA provides a digital identity service, built on good old-fashioned web2 technology, that allows consumers to aggregate all of their financial identity data in their own personal ‘vaults’ and then leverage those vaults to access third-party financial services without ever having to share any of their PII or surrender control over their data to those third parties.

6.) Smaller banks are collaborating on innovation. CHUCK, the new P2P payments competitor to Zelle and Cash App, announced a new feature at Finovate – social money – which allows consumers to send each other electronic gift cards to specific merchants. This feature is similar to Cash App’s ability to let customers send each other fractional stock in specific companies, and it was achieved through a partnership with Prizeout (an ad-tech company). CHUCK, which was created by Alloy Labs (a consortium of banks), continues to demonstrate the capacity for community banks to innovate through collaboration, which was a theme I saw come up repeatedly at Finovate.

7.) Fintech investors want to have their cake and eat it too. Based on the conversations that I had at Finovate, I think we can expect a deluge of fintech funding news in the next couple of months. This is good news – fintech companies are still able to raise new rounds – but it also came with some anecdotal bad news. Several different fintech founders told me that the VC investors they spoke with during their latest raises were looking for strong unit economics (an expectation of fintech investors in 2022) while still expecting to see aggressive growth (a hallmark of fintech, pre-2022), which was, understandably, a source of frustration for these founders.

8.) Established fintech companies are reclaiming more of their tech stacks. A related theme that I heard from more established fintech companies was that they had plans to reclaim significant portions of their tech stack over the next couple of years. These initiatives were not expected to be quick or cheap, but they were seen as necessary as these companies attempt to shore up both their unit economics (fewer vendors = fewer mouths to feed) and speed up their product delivery cycles (fewer vendors = fewer development dependencies).

9.) Don’t try to make excuses for a lack of gender diversity among conference speakers. I already knew that excuses like “we can’t find enough qualified women” were complete bullshit when it came to event organizers trying to explain all these ‘manels’ that persist at industry conferences. However, after having the opportunity to moderate a panel at Finovate called What Embedded Finance & Banking As A Service Mean For Financial Services, which featured Jen Capasso (Chief Operating Officer, US Wholesale Banking, HSBC), Kathleen Pierce-Gilmore (Head of Global Payments, Silicon Valley Bank), and Sarit Amir (Head of Innovation and Emerging Tech, Payments Innovation, J.P. Morgan), I now have even less tolerance for this particular bit of status quo. Jen, Kathleen, and Sarit were incredibly insightful, funny, and generous in sharing their expertise. They (and the many women like them) deserve infinitely more stage time. If you need help finding more diverse speakers for your event, start here.

10.) Big banks are going to be big players in embedded finance and BaaS. This was one of my main takeaways from the panel with Jen, Kathleen, and Sarit. I tend to think about the opportunity of embedded finance as sitting mostly within the court of community and mid-size banks (thanks Durbin Amendment!). However, the advantages that bigger banks can bring to BaaS – more robust and flexible technology, stronger compliance controls, and vastly more scalable balance sheets – provide a significant competitive advantage over smaller banks and I think that advantage will start being pressed more consistently by bigger banks over the next year or two (hopefully as fintech companies move away from debit interchange-only business models).