3 Fintech News Stories

#1: Why Would Stablecoin Issuers Want to Become Regular Banks?

What happened?

A couple of interesting stablecoin things.

First, a bunch of stablecoin and stablecoin-adjacent crypto companies are considering acquiring bank charters or licenses, according to the Wall Street Journal (emphasis mine):

A host of crypto firms including Circle and BitGo plan to apply for bank charters or licenses, according to people familiar with the matter. Crypto exchange Coinbase Global and stablecoin company Paxos are considering similar moves, other people said.

That comes as the Trump administration moves to incorporate crypto into mainstream finance and Congress advances a pair of bills that would establish a regulatory framework for stablecoins, which let people easily trade in and out of more volatile cryptocurrencies. The legislation would require stablecoin issuers to have charters or licenses from regulators.

Some crypto firms are interested in national trust or industrial bank charters that would enable them to operate more like traditional lenders, such as by taking deposits and making loans. Others are after relatively narrow licenses that would allow them to issue a stablecoin. …

Any crypto firm that obtains a bank charter would become subject to stricter regulatory oversight.

And second, PayPal is going to launch “rewards” for holders of its stablecoin PYUSD:

PayPal Holdings will launch a rewards program this summer that will allow users to earn rewards on holdings of the PayPal USD (PYUSD) stablecoin in their PayPal or Venmo wallets.

The company expects to offer a 3.7% annual rewards rate upon the launch of the program, although it can change the rate at any time

Users will be able to immediately use the rewards to send to other PayPal or Venmo users, fund international transfers, exchange for fiat, convert to other cryptocurrencies or make purchases at merchants with PayPal Checkout

So what?

Fundamentally, there are two different paths for stablecoin issuers:

- Become narrow banks.

- Become regular banks.

The first path is what Congress is currently working on. Two bills are working their way through Congress — the STABLE Act in the House of Representatives and the GENIUS Act in the Senate — which are expected to be reconciled into a single bill that is passed by Congress and signed by the President sometime this summer. There are some slight differences between the two bills, but fundamentally, they both create a framework to regulate “payment stablecoins” that are backed 1:1 by cash and cash-equivalent assets, such as Treasuries, and are subject to bank-style federal and state regulatory supervision.

To put it mildly, these bills are concerning to banks, which don’t want to see the creation of a new category of bank-like companies that are blessed by regulators and can take deposits from consumers and businesses. Anything that makes stablecoins more competitive, as an alternative to a bank deposit account, is seen as problematic.

The tip of the spear, in this fight to create a new category of narrow banks, is yield.

The STABLE Act forbids regulated payment stablecoins from providing yield. The GENIUS Act leaves the door open to yield-bearing stablecoins but pushes the regulation of such coins to the SEC, which would likely view them as securities.

Stablecoin proponents are lobbying to push the door for yield-bearing stablecoins even further open. I highly doubt that PayPal wants its PYUSD rewards program to be regulated as a security (even though some other fintech/crypto companies like Figure have gone down this path), but if yield ends up being allowed for payment stablecoins under STABLE/GENIUS? I think it would be delighted. PayPal announcing its intention to offer rewards (i.e., yield) for holders of its stablecoin, in advance of STABLE/GENIUS being finalized, suggests to me that it is trying to put its thumb on the scale and encourage legislators to be more open to the idea of yield-bearing payment stablecoins.

The second path is for stablecoin issuers to just become regular, full-service banks. According to the Wall Street Journal, this is the path that at least some large crypto companies and stablecoin issuers are considering.

This makes no sense to me.

If I were a shareholder in a stablecoin issuer, I would want it to become just bank-like enough to make its core product competitive with bank deposit accounts, but no further! Beyond creating a safe and rewarding place for consumers and businesses to keep their money (which the STABLE/GENIUS Act will accomplish, especially if it loosens up a bit on yield restrictions), the benefits to stablecoin issuers in becoming regular banks wouldn’t (in my mind) outweigh the costs.

Lending is a really difficult and unfun business to be in. It comes with all kinds of strings (such as capital requirements) and very strict supervision (far stricter than what stablecoin issuers would be subject to under STABLE/GENIUS).

Banks lend money because we (society) require them to in order to lubricate investment and entrepreneurship (what Matt Levine referred to as “the alchemy of banking”). Non-bank lenders want to become banks because they are already doing this really unfun job, but without the benefit of the cheap funding.

Why on Earth would stablecoin issuers want to sign up for this when they are being offered a much more attractive (though arguably less socially useful) alternative?

#2: Can a Sustainability-Focused Neobank Work?

What happened?

GreenFi, a sustainability-focused neobank, has officially launched after raising $17M in funding:

Born from the 2024 acquisition of Aspiration’s consumer fintech division, GreenFi emerges as an independent brand backed by a $17 million seed round led by Mission Financial Partners (MFP). The company is led by CEO Tim Newell, former Tesla executive and head of Aspiration’s consumer fintech unit.

So what?

The history of this one is convoluted. Here’s the quick summary:

- Aspiration was a neobank focused on serving environmentally-conscious consumers. It started out, in 2015, offering a fossil fuel-free ESG fund and a debit card with a “Plant Your Change” spend roundup feature that promised to plant trees using the proceeds.

- In 2021, it announced a $2.3B SPAC merger. That year, it also signed a $300M sponsorship deal with the LA Clippers (2021 WOOHOOOO!!!!)

- Between 2022 and 2025, allegations began to surface about the company’s B2C and B2B sustainability initiatives not being on the level. The SPAC was quietly canceled, and Aspiration decided to focus entirely on its B2B carbon offsets business, selling the B2C business unit to Tim Newell (who had joined Aspiration as Chief Innovation Officer in 2022).

- In just the first four months of 2025, Aspiration has filed for bankruptcy, and one of the original two co-founders, Joseph Sanberg, has been arrested by the Department of Justice due to an alleged $145m investor fraud scheme. And Aspiration’s B2C business unit, now called GreenFi, has relaunched with $17M in fresh funding from Mission Financial Partners (which is the holding company that Newell launched to acquire the business from Aspiration).

Phew! Quite the history! And no wonder the B2C business is now called GreenFi. The sooner that everyone forgets the name “Aspiration,” the better.

The question is whether a sustainability-focused neobank can work. The recent history of niche neobanking in the U.S., especially for neobanks focused on affinity-led growth rather than product-led growth, isn’t very bullish.

That said, I admire Tim Newell’s attempt to salvage the original Aspiration mission, and I hope it succeeds.

#3: A New BaaS Warp Core is About to Come Online

What happened?

Darragh Buckley, Founder of Increase, has informed the Federal Reserve that he intends to acquire a controlling interest in the holding company of a small community bank:

Darragh Buckley, Bend, Oregon; to acquire voting shares of Twin City Bancorp, Inc., and thereby indirectly acquire voting shares of Twin City Bank, both of Longview, Washington.

So what?

Apologies for the dry quote. Change-in-Bank-Control Act (CIBCA) notices aren’t particularly compelling reads, and I don’t think any mainstream trade publications have picked up on this story yet (h/t to Bank Reg Blog for being the first to spot it!)

This is a big deal.

For those who are unaware of the history here, Buckley was the first employee at Stripe. He left in 2016 and founded Increase, a BaaS middleware platform, in 2020.

Increase isn’t as well-known as some of its middleware peers, but it’s generally considered to be one of the most modern, developer-centric BaaS Platforms in the market. This shouldn’t come as a surprise, given Buckley’s experience at Stripe, and it’s the primary reason Increase has been able to land several brand-name fintech clients, including Gusto and Ramp.

However, as strong as Increase’s technology is, it will always be at a disadvantage if it has to function as a middleware platform connecting fintech companies and other non-bank brands to regulated bank partners. BaaS middleware is just a tough place to make a living. It always has been, even before Synapse failed and federal regulators came down on “intermediate platforms” (as they refer to middleware providers) like a bag of hammers.

This is why Buckley attempted to acquire Washington Business Bank in 2022. He wanted to pursue the same path that Jackie Reses and William Hockey took when they acquired Lead Bank and Northern California National Bank, respectively.

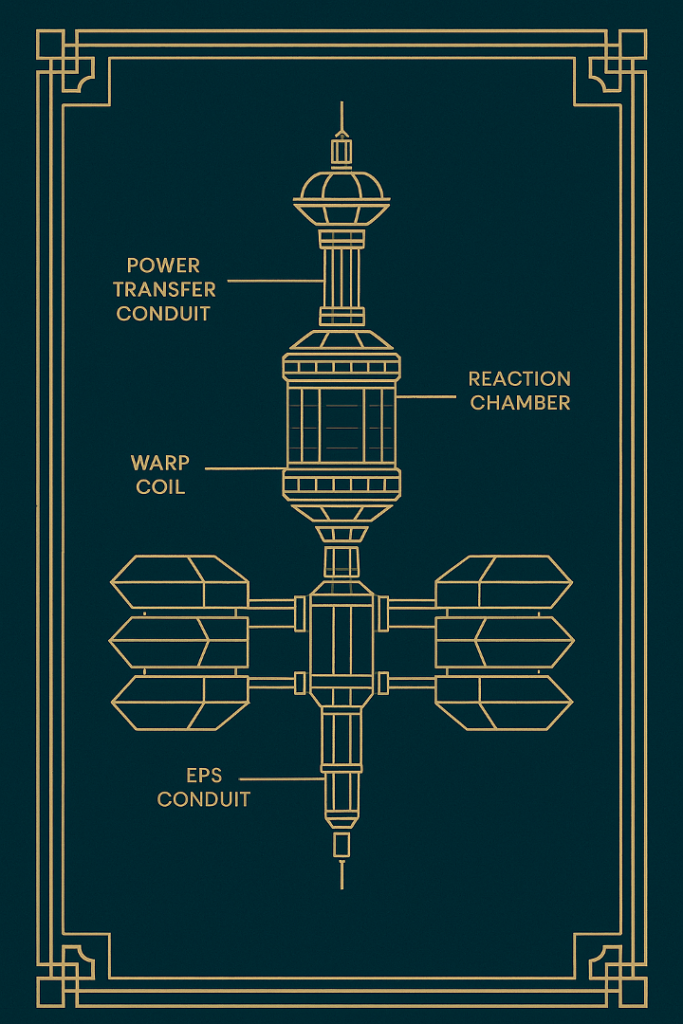

He wanted to build what I’ve previously termed a “BaaS Warp Core.”

A BaaS Warp Core is the best of both worlds — a world-class technology platform that delivers an exceptional developer experience, built directly on top of a community bank charter and balance sheet.

BaaS Warp Cores are appealing because, like the engines of the USS Enterprise, they allow fintech companies to move fast.

This is especially appealing to the largest and most sophisticated fintech companies in the market. At these companies, the decision on which BaaS providers to work is made by the engineering teams. These teams want to work with BaaS providers that can match their engineering velocity, and that will expend the necessary resources to implement exactly what they want (these fintech companies don’t pick off of a menu, they expect custom implementations). They look for technical credibility, above all else, which is an advantage that these well-known executives from Stripe, Plaid, and Square lean on heavily to help their companies win business.

The challenge with BaaS Warp Cores is that you have to maintain the precise right balance between your technology, regulatory compliance, and balance sheet, or, much like on the USS Enterprise, the matter–antimatter reaction can become unstable and result in a massive explosion.

Buckley’s attempt to acquire Washington Business Bank failed, likely because federal bank regulators did not believe he had the banking experience needed to keep that matter-antimatter reaction stable.

However, since the failed acquisition, Buckley has been serving on the board of Washington Business Bank, and federal banking regulators under the Trump Administration have indicated that they are much more open to bank acquisitions (including those made by fintech companies and founders). By making this move to acquire Twin City Bank now, Buckley is clearly signalling his confidence that the second time will be the charm.

My best guess is that this acquisition will be successful. Buckley will likely infuse Twin City Bank with significantly more capital (the bank is tiny, with less than $70M in assets) and will start moving it into the world of BaaS and embedded finance (using the beachhead he has already established with Increase). This will be a slow process, subject to regulators’ comfort. However, Twin City Bank already has a bit of a head start in high-risk banking activities, having served recreational cannabis dispensaries for more than a decade.

2 Fintech Content Recommendations

#1: Making Redlining Great Again (by Jonathan Joshua) 📚

Really good analysis here from Jonathan on a wild new Executive Order from the Trump Administration, which is attempting to eliminate the disparate impact theory of liability in consumer lending.

#2: Crypto casino takings top $80bn as gamblers bypass blocks (by Marianna Giusti, Financial Times) 📚

If you will excuse me, I’m gonna go slam my face into my desk a few times.

1 Question to Ponder

What new products can we build to ensure that banks benefit from the shift to open banking?

Among data aggregators, this is often described as getting banks to switch from playing defense to playing offense.

I have a few ideas, but I’d love to hear yours!