3 Fintech News Stories

#1: Finding Money and Managing Paperwork

What happened?

A new fintech company called Aidaly came out of stealth:

Caring for a family member is not only hard work, but expensive, too. Many family caregivers miss work (or stop working) and pay for medical expenses out of pocket. Aidaly was created to help them find sources for compensation and financial aid.

The company, which is coming out of stealth mode, announced that it has raised $8.5 million in funding

Medicare and Medicaid dollars cover some services, but they can be difficult to apply for. Aidaly’s role is making access to state and private benefits easier, along with services like financial planning, mental health support and caregiver training. The platform also helps users manage paperwork, and the company says it can help identify if someone is eligible for benefits in less than 15 minutes. This is especially important because it means caregivers might discover financial sources they were previously unaware of.

So what?

Automating tedious paperwork and finding unrealized opportunities for savings and additional revenue is one of the most powerful value propositions that fintech can offer consumers.

It’s good when this capability is applied to something like recurring subscriptions (a la Truebill). It’s great when applied to a more specific and underserved segment of consumers, especially one that is thanklessly performing an essential job for society.

More of this, please.

#2: Utility > Affinity

What happened?

Vergo, a business banking app for architects and interior designers, raised a $4.1 million seed round:

At its core, Vergo blends elements of banking with the functionality of project management and accounting software to serve the specific needs of designers, architects, and contractors. After filling out a short business application form and receiving approval, new users can download the Vergo app and move money into an FDIC-insured checking account, which is connected to a debit card. That card offers at least 1% cashback on spending in categories such as furniture, decor, and building materials.

The time-saving value of Vergo lies in its ability to stay on top of a project’s finances with very little time or effort. Users can instantly tag purchases, payments, invoices, and more to associate them with a specific project, thereby automating the process of tracking expenditures and revenues across work streams.

So what?

I love basically all niche neobanks. However, I’ve noticed that niche neobanks focused on consumers tend to be highly reliant on brand affinity. This isn’t a bad thing, per se, but I think it is a difficult way to drive growth and retention. Utility, on the other hand, is a wonderfully efficient lever for acquiring and keeping customers and niche neobanks focused on businesses — construction, logistics, accounting — all seem like standout winners in an otherwise rather bland B2B business banking ecosystem. I’m bullish on Vergo.

#3: Roast Mode Activated

What happened?

Sign up for Fintech Takes, your one-stop-shop for navigating the fintech universe.

Over 41,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

A personal financial management app just reached a half-billion-dollar valuation:

British AI-based personal finance chatbot Cleo has hit a $500 million valuation thanks to an $80 million funding round, according to Sky News.

The round, which comes about 18 months after a $44 million raise, was joined by tech investor Sofina, says Sky.

Launched in 2016, London-based Cleo integrates with users’ bank accounts and then uses AI to analyse spending habits and transaction histories to help with money management.

So what?

I’m fascinated by the personal financial management space. It’s been around forever (in fintech terms), it’s always got new companies and founders building in it, and yet it never really seems to live up to the hype (in terms of either revenue or user adoption).

Anyone building in the PFM space today needs to be able to answer this question — why will your app succeed where almost all others have flopped?

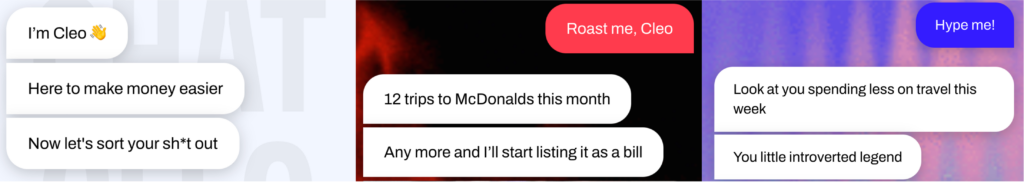

Cleo’s answer, in part, appears to be by being really mean:

Cleo is AI. She blipped back in Feb 2019.

She created this unintentionally savage one-liner herself:

Congrats you’ve saved £0! Double that and you could save £0 by next month!

By failing to exclude users who had saved nothing, Cleo gleefully sent this supportive message to quite literally everyone who had ever signed up to her autosave feature. And you loved it. You wouldn’t stop retweeting it. We ended up writing Roast mode because you wouldn’t stop asking us to.

The app appears to be a relatively standard chatbot-based PFM product, but with a personality layered on top that is equal parts big sister, Statler & Waldorf, and Leslie Knope complimenting Ann Perkins:

I’m here for it.

2 Things to Read and/or Listen To

#1: An Interview With Brex Co-Founder and Co-CEO Pedro Franceschi (by Ben Thompson, Stratechery)

Coming on the heels of Brex’s decision to pivot away from small businesses, this interview provides a ton of really useful background on Brex — where they came from, what they think their core competencies are, where they’re going, etc.

One of my favorite bits from this interview was learning why Brex focuses so much on the employee experience:

Ben Thompson: You talk about how Brex Empower wants to serve not just the finance team but also the employees. It’s interesting, because you drew the connection to Apple before, and I think there’s a bit where one of the reasons why Apple didn’t succeed in the enterprise was they were selling to consumers, they weren’t necessarily selling to IT departments, whereas the requirements and needs of the people actually buying the stuff might have been very different than the employees, and the user experience might not have been at the top of the stack. Why isn’t that still the case here? Who is the buyer of Brex Empower? Who’s making the choice to sort of get that, and why would they care about the employee experience?

Pedro Franceschi: The buyer is absolutely the finance team, but if you think about the life of someone on the finance team that takes care of spend management today, their life is being what we call a TV cop, chasing employees for receipts and all that. What we realized is that there’s a flywheel effect that essentially when you start by building this great employee experience, people tend to do the right thing more often. When they do the right thing, there’s more compliance, so you need less process, and that makes the employee experience even better.

#2: Thin Platforms (by Ben Thompson, Stratechery)

A double dose of Ben Thompson recommendations for you this week.

(if you’re not subscribing to Stratechery, you’re missing the best tech analysis that there is, full stop)

This essay explains the implications of enterprise software moving from thick clients to thin platforms. Thompson uses Microsoft Teams and Stripe’s new App Marketplace as examples of why an integrated approach tends to beat a best-of-breed approach when selling software to companies.

Any fintech company selling to large enterprises, including banks, should read this essay.

1 Question to Ponder

#1: What’s going on right now with bank-fintech partnerships? I’m hearing increasingly of delays and disruptions experienced by fintech companies and BaaS platforms due to regulatory issues from their bank partners. What’s going on?

If you have any insights into this that you’d like to share privately with me, please DM me on Twitter or LinkedIn.