Everyone who writes about the financial services ecosystem does it in their own way.

Some people rely on on-the-record interviews with subject matter experts. Some lean on their own personal experiences. Some cultivate private sources and use them to break news stories.

I do some of that, but most of my work is based on my analysis of publicly available information (press releases, company websites, developer docs, legal filings, etc.)

In practice, what that means is that I read a lot of words written by marketers and reviewed (and sanded down) by lawyers.

Now, to be clear, I have a lot of empathy for these folks. I started my career in marketing. I have spent many hours translating the blunt and unartful input of product leaders and C-suite executives into beautiful prose, only to watch as all the art is cut back out of it by overly cautious in-house counsel.

Perhaps because of that experience, I feel like I have a pretty good sense for the frustrations that often hide behind the words that companies publish.

What they want to say is stuff like, “Our competitors couldn’t copy our product if we drew them a fucking map.” But what they end up saying is, “Our product roadmap and velocity consistently outpace our competitors.”

They’re both saying, roughly, the same thing. One is just a lot funnier and more honest than the other.

So, in that spirit, the plan for today’s newsletter is to write some honest taglines.

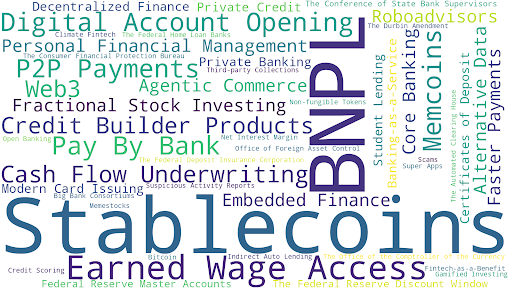

I have selected fifty different things in financial services (products, trends, laws, regulatory bodies, etc.) and written brutally honest taglines for them. These taglines don’t represent the totality of my feelings about the subjects (which are usually nuanced and multi-faceted), but they do poke at the things that we often think but don’t say out loud.

Where relevant, I have also included some brief commentary and links to previous stuff that I have written or said.

As with my logo rankings/re-rankings and NBA/WNBA player comps, this is just for fun. Please don’t take any of this too seriously!

Stablecoins: Because everybody wants to be an American.

(There’s something very American about using technology to circumvent the monetary controls of other countries in order to sell their citizens U.S. dollars.)

Fractional Stock Investing: Democratizing the ability to show how bad most people are at stock picking.

Memcoins: If it’s funny (or you don’t understand it), it’s a good investment.

Agentic Commerce: Shopping minus the humans.

(Simon Taylor and I talked about this a lot in the most recent episode of Not Fintech Investment Advice.)

Faster Payments: Coming soon, we promise!

P2P Payments: Sounds fancier than ‘giving your friend money.’

BNPL: It’s better than credit cards, so stop whinging.

(I’ve noticed that BNPL providers tend to conflate “our product is financially healthier than credit cards” with “our product is financially healthy”. I explored this in a lot more detail in this essay.)

Credit Scoring: Your financial life and future prospects, reduced to a three-digit number.

Cash Flow Underwriting: Judge them not by their character, but by the contents of their bank accounts.

Digital Account Opening: Why community banks think fintech companies are beating them.

(If you’ve been reading Cornerstone Advisors’ What’s Going on in Banking report for the last five years, you’ll understand this one.)

Core Banking: You can check out, but you can never leave.

Credit Builder Products: The GLP-1s of personal finance.

(You don’t have to change your lifestyle to change your life!)

The Federal Reserve Discount Window: Cheap money for losers.

(Policymakers are well aware of the stigma problem. However, I have not seen many proposals for how to fix it.)

The Consumer Financial Protection Bureau: We’re not locked in here with you. You’re locked in here with us.

(I’m channeling the Chopra-era CFPB with this tagline, obviously. The Vought-era tagline would be something more like, “Actually, you’re right. We suck.”)

Super Apps: Great at nothing, but mediocre at everything!

Climate Fintech: Offset your guilt — one payment at a time.

Web3: Can we convince LPs to just redo the dot-com bubble?

Roboadvisors: Wealthtech, pre-ChatGPT.

(Today, we call it agentic AI, but back in the day, we used terms like self-driving money.)

Private Banking: If you have to ask how much it costs, you can’t afford it.

Pay By Bank: ACH, only sexier.

(For an in-depth primer on pay by bank, read this.)

Modern Card Issuing: We’re much cooler than TSYS.

The Automated Clearing House: We move trillions of dollars without screwing up and all you guys do is complain.

Earned Wage Access: You deserve to get paid instantly (and we deserve to get paid to help you get paid instantly).

(The irony of EWA is that if we just moved, en masse, to real-time or even end-of-day pay, instead of the traditional two-week pay cycle, there would be no more need for it!)

Alternative Data: Like regular data, but it dates skateboarders and has several tattoos that its parents don’t know about.

(Inspired by an old tweet from Tom Hadley. More here.)

Embedded Finance: Never step foot in a branch again.

(This is my favorite thing I’ve ever written about embedded finance.)

Personal Financial Management: The advice hasn’t changed, but maybe this time you’ll listen?

(There’s something admirable about fintech founders’ refusal to stop building PFM tools, despite the overwhelming history of failure in this space. I wrote about the PFM space here and here.)

The Conference of State Bank Supervisors: Keep your hands off our assessment fees!

The Office of the Comptroller of the Currency: Keep your hands off our assessment fees!

(A little context on the CSBS, OCC, and the fights they’ve had over charters can be found in this essay.)

The Federal Deposit Insurance Corporation: Please stop misusing our logo!

(I actually have a solution to this problem for the FDIC, in case they’re interested!)

Fintech-as-a-Benefit: Maybe if employers give away our product, investors will like us better.

(Chime talks about its new Enterprise line of business in almost these exact terms in its S-1. More on that here.)

Decentralized Finance: Because everybody is dying to be their own bank.

Memestocks: We can transform Millennial nostalgia into positive expected value investments through the power of collective belief.

Gamified Investing: Because you weren’t losing enough money without confetti.

Private Credit: The stuff we wouldn’t let banks invest in after they crashed the global economy.

(I wrote about this space, in some depth, here.)

Student Lending: We’re from the government, and we’re here to help.

(And yet often it’s not that helpful! Here’s a recent example.)

Third-party Collections: We’ll be mean to your customers so you don’t have to.

Banking-as-a-Service: Because starting a de novo bank is literally insane.

(The boom in BaaS and the trickle of de novo bank charters in the wake of the Great Recession seem connected to me. Kiah Haslett and I talked with Mike Hsu about this earlier this year.)

Office of Foreign Asset Control: No, we didn’t mean Lebanon, Ohio.

Suspicious Activity Reports: Just file them. Don’t worry, they probably won’t read them.

Federal Reserve Master Accounts: We won’t tell you why you can’t have one!

(We did a great Bank Nerd Corner episode on this last year, if you want to learn more about the history here.)

Bitcoin: Money for those with a persecution complex.

Certificates of Deposit: You know you’re too lazy to optimize your deposit yield.

Non-fungible Tokens: Remember 2021? How much fun was that?

(I’m going to sound so dumb trying to explain what NFTs were to my kids in 10 years.)

Indirect Auto Lending: If you think you can disrupt us, you’ve never tangled with the National Auto Dealers Association.

(I wrote about the auto lending space a few years ago. Probably due for a refresh, even though it is a remarkably difficult ecosystem to disrupt.)

Open Banking: We’re gonna convince your customers to give us your data, and there’s nothing you can do to stop us.

(The statement “the data belongs to the customer” is the fintech policy equivalent of a blue shell from Mario Kart. It works every time.)

The Federal Home Loan Banks: Come for the promise of home lending. Stay for the super-lien position.

Net Interest Margin: Sounds better than “ripping off our customers is literally our business model.”

(This model is slowly being strangled, and banks and credit unions are going to have to adjust. I wrote about this here.)

The Durbin Amendment: Boy, that backfired!

Scams: Fraud, but it’s your fucking fault and we bear no liability.

(The distinction that banks draw between fraud and scams is ridiculous and infuriating, as I wrote about here.)

Big Bank Consortiums: Lower your shields and surrender your ships. We will add your biological and technological distinctiveness to our own. Your culture will adapt to service us. Resistance is futile.

(P2P payments, faster payments, open banking, digital wallets, stablecoins … it doesn’t seem to matter. When the collective attacks something, it wins every time.)